MasterCard 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

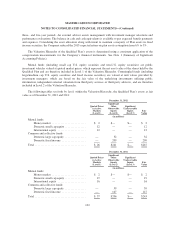

Note 12. Debt

On November 16, 2012, the Company entered into a committed five-year unsecured $3 billion revolving

credit facility (the “Credit Facility”), which expires on November 16, 2017. The Credit Facility replaced the

Company’s prior credit facility. Borrowings under the Credit Facility are available to provide liquidity for

general corporate purposes, including providing liquidity in the event of one or more settlement failures by the

Company’s customers. In addition, for business continuity planning and related purposes, we may borrow and

repay amounts under the Credit Facility from time to time. The facility fee and borrowing cost under the Credit

Facility are contingent upon the Company’s credit rating. At December 31, 2012, the applicable facility fee was

10 basis points on the average daily commitment (whether or not utilized). In addition to the facility fee, interest

on borrowings under the Credit Facility would be charged at the London Interbank Offered Rate (LIBOR) plus

an applicable margin of 90 basis points, or an alternative base rate. MasterCard had no borrowings under the

Credit Facility or prior credit facility at December 31, 2012 and 2011.

The Credit Facility contains customary representations, warranties, events of default and affirmative and

negative covenants, including a financial covenant limiting the maximum level of consolidated debt to earnings

before interest, taxes, depreciation and amortization. MasterCard was in compliance in all material respects with

the covenants of the Credit Facility and prior credit facility at December 31, 2012 and 2011. The majority of

Credit Facility lenders are customers or affiliates of customers of MasterCard.

On August 2, 2012, the Company filed a universal shelf registration statement to provide additional access

to capital, if needed. Pursuant to the shelf registration statement, the Company may from time to time offer to sell

debt securities, preferred stock, Class A common stock, depository shares, purchase contracts, units or warrants

in one or more offerings.

Note 13. Stockholders’ Equity

Classes of Capital Stock

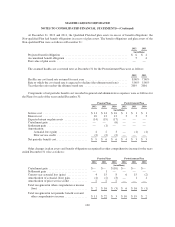

MasterCard’s amended and restated certificate of incorporation authorizes the following classes of capital

stock:

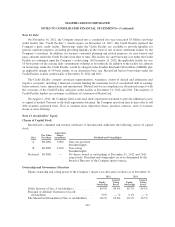

Class

Par Value

Per Share

Authorized

Shares

(in millions) Dividend and Voting Rights

A $0.0001 3,000 One vote per share

Dividend rights

B $0.0001 1,200 Non-voting

Dividend rights

Preferred $0.0001 — No shares issued or outstanding at December 31, 2012 and 2011,

respectively. Dividend and voting rights are to be determined by the

Board of Directors of the Company upon issuance.

Ownership and Governance Structure

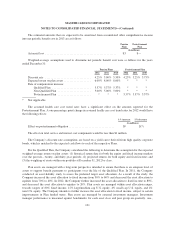

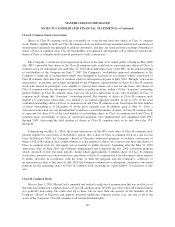

Equity ownership and voting power of the Company’s shares were allocated as follows as of December 31:

2012 2011

Equity

Ownership

General

Voting

Power

Equity

Ownership

General

Voting

Power

Public Investors (Class A stockholders) ............. 85.9% 89.4% 85.7% 89.3%

Principal or Affiliate Customers (Class B

stockholders) ................................ 3.9% — % 4.1% — %

The MasterCard Foundation (Class A stockholders) . . . 10.2% 10.6% 10.2% 10.7%

104