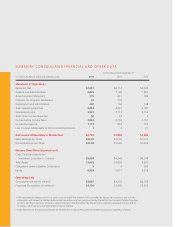

MasterCard 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The primary general purpose card brands include MasterCard, Visa®, American Express®,JCB

®,Diners

Club®, UnionPay®and Discover®. These brands, including MasterCard, have come to be associated with a variety

of forms of payment in the United States and other markets around the world, including (depending on the brand)

credit, charge, debit and prepaid cards. Regional and domestic/local debit brands that require a personal

identification number (“PIN”) for verification represent alternative, and sometimes primary, brands within many

countries. In these markets, issuers have historically relied on the Maestro and Cirrus brands (and other brands) to

enable cross-border transactions, which typically constitute a small portion of the overall number of transactions.

In addition to general purpose cards, private label cards comprise a portion of all card-based forms of

payment. Typically, private label cards are credit cards issued by, or on behalf of, a merchant (such as a

department store or gasoline retailer) and can be used only at that merchant’s locations.

Payment Services and Solutions

We provide transaction processing and other payment-related services as well as a wide range of payment

solutions to enable our customers to design, package and implement products and programs targeted to the

specific needs of their customers. We work with customers to provide customized solutions, as well as more

general solutions. Our payment solutions are built upon our expertise in payment programs, product

development, payment processing technology, loyalty and rewards solutions, payment security, consulting and

information services and marketing. We also manage and promote our brands for the benefit of all customers

through advertising, promotional and interactive programs and sponsorship initiatives.

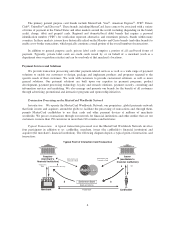

Transaction Processing on the MasterCard Worldwide Network

Introduction. We operate the MasterCard Worldwide Network, our proprietary, global payments network

that links issuers and acquirers around the globe to facilitate the processing of transactions and, through them,

permits MasterCard cardholders to use their cards and other payment devices at millions of merchants

worldwide. We process transactions through our network for financial institutions and other entities that are our

customers, in more than 150 currencies in more than 210 countries and territories.

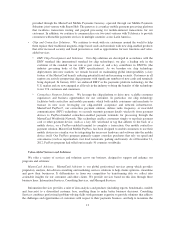

Typical Transaction. A typical transaction processed over the MasterCard Worldwide Network involves

four participants in addition to us: cardholder, merchant, issuer (the cardholder’s financial institution) and

acquirer (the merchant’s financial institution). The following diagram depicts a typical point-of-interaction card

transaction:

$

(less merchant discount)

Typical Point of Interaction Card Transaction

Authorization and

Transaction Data

Authorization and

Transaction Data

Acquirer

(merchant’s

financial institution)

Transaction

Data Bill

$

Issuer

(cardholder’s

financial institution)

$

Merchant Cardholder

Present Card

Goods and Services

Settlement Bank

$

6