MasterCard 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

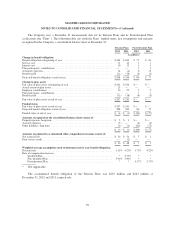

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

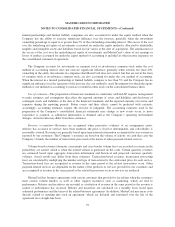

For the years ended December 31, 2011 and 2010, the dilutive effect of stock options is calculated including

the effects of certain equity instruments granted in share-based payment transactions under the two-class method.

Unvested share-based payment awards which receive non-forfeitable dividend rights, or dividend equivalents, are

considered participating securities and are required to be included in computing basic EPS under the two-class

method. The Company declared non-forfeitable dividends on unvested restricted stock units and contingently

issuable performance stock units (“Unvested Units”) which were granted prior to 2009.

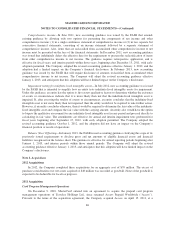

The components of basic and diluted EPS for common shares for each of the years ended December 31 were

as follows:

2012 2011 2010

(in millions, except per share data)

Numerator:

Net income attributable to MasterCard .................... $2,759 $1,906 $1,846

Less: Net income allocated to Unvested Units .............. — — 3

Net income attributable to MasterCard allocated to common

shares ........................................... $2,759 $1,906 $1,843

Denominator:

Basic EPS weighted-average shares outstanding ............ 125 128 131

Dilutive stock options and stock units .................... 1 — —

Diluted EPS weighted-average shares outstanding * ......... 126 128 131

Earnings per Share

Basic .............................................. $22.02 $14.90 $14.10

Diluted ............................................ $21.94 $14.85 $14.05

* For the years presented, the calculation of diluted EPS excluded a minimal amount of anti-dilutive share-

based payment awards.

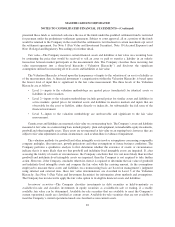

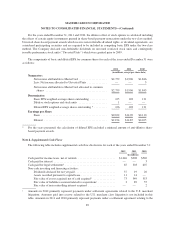

Note 4. Supplemental Cash Flows

The following table includes supplemental cash flow disclosures for each of the years ended December 31:

2012 2011 2010

(in millions)

Cash paid for income taxes, net of refunds .......................... $1,046 $908 $520

Cash paid for interest ........................................... — — 3

Cash paid for legal settlements1................................... 65 303 607

Non-cash investing and financing activities:

Dividends declared but not yet paid ............................ 37 19 20

Assets recorded pursuant to capital lease ........................ 11 14 —

Fair value of assets acquired, net of cash acquired2............... 73 549 553

Fair value of liabilities assumed related to acquisitions2............ 3 89 55

Fair value of non-controlling interest acquired ................... — — 2

1Amounts in 2012 primarily represent payments under settlement agreements related to the U.S. merchant

litigations. Amounts paid into escrow related to the U.S. merchant class litigation is not included in this

table. Amounts in 2011 and 2010 primarily represent payments under a settlement agreement relating to the

89