MasterCard 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

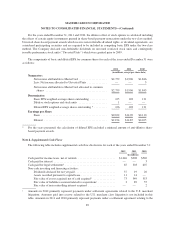

U.S. federal antitrust litigation between MasterCard and American Express Company. Under the terms of

the American Express Settlement, MasterCard made 12 quarterly payments of $150 million beginning in the

third quarter of 2008. The Company made its final quarterly payment of $150 million in June 2011.

2See Note 2 (Acquisitions) for further details.

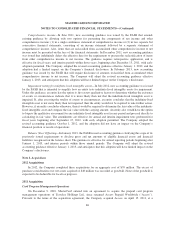

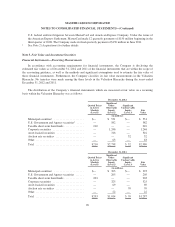

Note 5. Fair Value and Investment Securities

Financial Instruments—Recurring Measurements

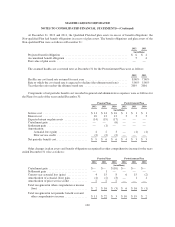

In accordance with accounting requirements for financial instruments, the Company is disclosing the

estimated fair values as of December 31, 2012 and 2011 of the financial instruments that are within the scope of

the accounting guidance, as well as the methods and significant assumptions used to estimate the fair value of

those financial instruments. Furthermore, the Company classifies its fair value measurements in the Valuation

Hierarchy. No transfers were made among the three levels in the Valuation Hierarchy during the years ended

December 31, 2012 and 2011.

The distribution of the Company’s financial instruments which are measured at fair value on a recurring

basis within the Valuation Hierarchy was as follows:

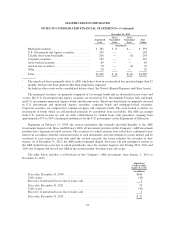

December 31, 2012

Quoted Prices

in Active

Markets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Fair

Value

(in millions)

Municipal securities1..................... $— $ 531 $— $ 531

U.S. Government and Agency securities2..... — 582 — 582

Taxable short-term bond funds .............. 210 — — 210

Corporate securities ...................... — 1,246 — 1,246

Asset-backed securities ................... — 316 — 316

Auction rate securities .................... — — 32 32

Other .................................. — 63 — 63

Total .................................. $210 $2,738 $ 32 $2,980

December 31, 2011

Quoted Prices

in Active

Markets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Fair

Value

(in millions)

Municipal securities1..................... $— $ 393 $— $ 393

U.S. Government and Agency securities ...... — 205 — 205

Taxable short-term bond funds .............. 203 — — 203

Corporate securities ...................... — 325 — 325

Asset-backed securities ................... — 69 — 69

Auction rate securities .................... — — 70 70

Other .................................. — 22 — 22

Total .................................. $203 $1,014 $ 70 $1,287

90