MasterCard 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

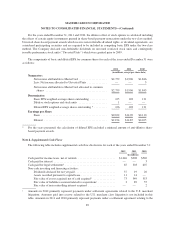

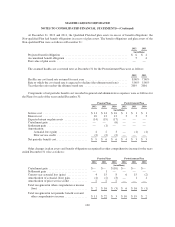

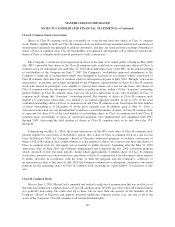

Note 10. Accrued Expenses

Accrued expenses consisted of the following at December 31:

2012 2011

(in millions)

Customer and merchant incentives ...................................... $1,058 $ 889

Personnel costs ..................................................... 354 345

Advertising ........................................................ 122 144

Income and other taxes ............................................... 94 82

Other ............................................................. 120 150

Total accrued expenses ............................................... $1,748 $1,610

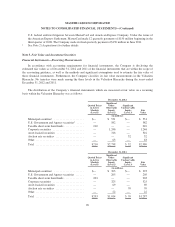

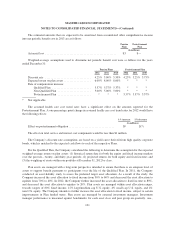

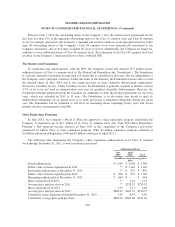

As of December 31, 2012 and 2011, the Company’s provision related to the U.S. merchant litigations was

$726 million and $770 million, respectively. These amounts are not included in the accrued expense table above

and are separately reported as accrued litigation on the consolidated balance sheet. On July 13, 2012, MasterCard

entered into a memorandum of understanding to settle the merchant class litigation, and separately agreed in

principle to settle all claims brought by the individual merchant plaintiffs. MasterCard’s financial portion of the

settlements was increased by $20 million in the second quarter of 2012 to $790 million (on a pre-tax basis). On

October 31, 2012, MasterCard made a $64 million payment for the individual merchant plaintiffs settlement.

In December 2012, the Company made a $726 million payment into a qualified settlement fund related to

the U.S. merchant class litigation. The Company has presented these funds as restricted cash for litigation

settlement since the use of the funds under the qualified settlement fund is restricted for payment under the

preliminary settlement agreement. Subject to court approval, all or a portion of the funds would be returned to the

Company in the event that the settlement is not finalized or certain merchants opt out of the settlement

agreement. See Note 18 (Legal and Regulatory Proceedings) for further discussion.

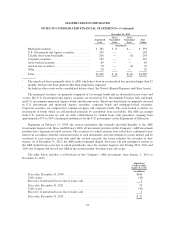

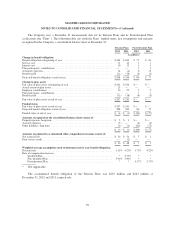

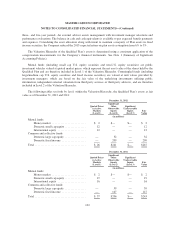

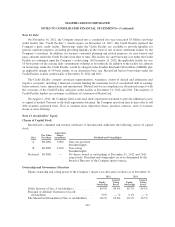

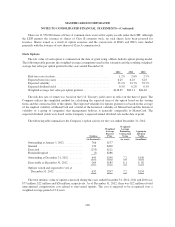

Note 11. Pension Plans, Postretirement Plan, Savings Plan and Other Benefits

The Company maintains a non-contributory, qualified, defined benefit pension plan (the “Qualified Plan”)

with a cash balance feature covering substantially all of its U.S. employees hired before July 1, 2007. In

September 2010, the Company amended the Qualified Plan to phase out participant pay credit percentages in the

years 2011 and 2012 and eliminate the pay credit effective January 1, 2013. Plan participants continue to earn

interest credits. As a result of the amendment to the Qualified Plan, the Company recognized a curtailment gain

of $6 million in the third quarter of 2010 and a reduction in pension liability of $17 million at December 31,

2010. The Company also recognized corresponding effects in accumulated other comprehensive income and

deferred taxes.

The Company also has an unfunded non-qualified supplemental executive retirement plan (the “Non-

qualified Plan”) that provides certain key employees with supplemental retirement benefits in excess of limits

imposed on qualified plans by U.S. tax laws. The Non-qualified Plan had settlement gains in 2011 resulting from

payments to participants. The term “Pension Plans” includes both the Qualified Plan and the Non-qualified Plan.

The Company maintains a postretirement plan (the “Postretirement Plan”) providing health coverage and

life insurance benefits for substantially all of its U.S. employees hired before July 1, 2007.

98