MasterCard 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A WORLD BEYOND CASH: OUR JOURNEY CONTINUES

ANNUAL

REPORT

2012

Table of contents

-

Page 1

A W OR LD B EY O N D C A SH : OUR J OURNEY CONTINUES A N N U A L R E P O R T 2 0 1 2 -

Page 2

... 1 GDV generated by Maestro and Cirrus cards is not included. The data for GDV is provided by MasterCard customers and includes information with respect to MasterCard-branded transactions that are not processed by MasterCard and for which MasterCard does not earn signiï¬cant revenues. All data is... -

Page 3

... driving preference for electronic payments and our brands. We achieved solid ï¬nancial results in 2012, including net revenue and earnings per share growth. We delivered operational performance with healthy growth in annual gross dollar volume, cross-border volume and processed transactions. As we... -

Page 4

... for a population with limited or no access to banks. And last year, MasterCard became the ï¬rst international payments network to issue a license to a domestic bank in Myanmar and the ï¬rst to be accepted at an ATM in the city of Yangon, helping a country to integrate further with the global... -

Page 5

... Number) 2000 Purchase Street Purchase, NY (Address of principal executive offices) 10577 (Zip Code) (914) 249-2000 (Registrant's telephone number, including area code) Title of each Class Name of each exchange on which registered Class A common stock, par value $0.0001 per share New York Stock... -

Page 6

... Corporate Governance ...Item 11. Executive Compensation ...Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...Item 13. Certain Relationships and Related Transactions, and Director Independence ...Item 14. Principal Accounting Fees and Services... -

Page 7

... include, without limitation, statements relating to: • • the Company's focus on growing its credit, debit, prepaid, commercial and payment transaction processing offerings; the Company's focus on diversifying its business (including seeking new areas of growth, expanding acceptance points and... -

Page 8

... companies and other businesses. We manage a family of well-known, widelyaccepted payment brands, including MasterCard®, Maestro® and Cirrus®, which our customers use in their payment programs and solutions. We process payment transactions over the MasterCard Worldwide Network and provide support... -

Page 9

... cards, charge cards, debit and deferred debit cards (including cash access or Automated Teller Machine ("ATM") cards), prepaid cards and other types of cards; Contactless, mobile and web-based payments-contactless payments, electronic payments through mobile phones and other handheld devices using... -

Page 10

...and rewards solutions, payment security, consulting and information services and marketing. We also manage and promote our brands for the benefit of all customers through advertising, promotional and interactive programs and sponsorship initiatives. Transaction Processing on the MasterCard Worldwide... -

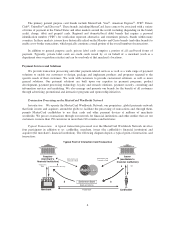

Page 11

... typical transaction, a cardholder purchases goods or services from a merchant using a card or other payment device. After the transaction is authorized by the issuer using our network, the issuer pays the acquirer an amount equal to the value of the transaction, minus the interchange fee (described... -

Page 12

... that require value-added processing, such as real-time access to transaction data for fraud scoring or rewards at the point-of-sale, or customization of transaction data for unique consumer-spending controls, use the network's centralized processing structure, ensuring advanced processing services... -

Page 13

...) transaction processing services to customers in every region of the world, which allow customers to facilitate payment transactions between cardholders and merchants within a particular country. We process most of the cross-border transactions using MasterCard, Maestro and Cirrus-branded cards and... -

Page 14

... be obtained. Information on ATM and manual cash access locations is reported by our customers and is partly based on publicly available reports of payments industry associations, government agencies and independent market analysts. Cards bearing the Maestro or Cirrus logos are accepted at many of... -

Page 15

... Maestro-branded debit products may be used to make purchases and, in some cases, to obtain cash back at the point of sale. • MasterCard-branded Debit Card. MasterCard-branded debit programs provide functionality for both signature-based and PIN-based authenticated transactions. For the year ended... -

Page 16

... large corporations, mid-sized companies, small businesses and government entities to streamline their procurement and payment processes, manage information and expenses and reduce administrative costs. For the year ended December 31, 2012, our commercial credit and charge programs generated $287... -

Page 17

... to provide consumers with mobile payments services in multiple countries across Latin America. • Chip and Contactless Solutions. We continue to work with our customers around the world to help them replace their traditional magnetic-stripe based cards and terminals with new chip-enabled products... -

Page 18

... platform featuring an array of advanced authorization, transaction routing and alert controls and virtual card number capabilities that uses the functionality of the MasterCard Worldwide Network and is designed to assist financial institutions in creating new and enhanced payment offerings. Fraud... -

Page 19

... to support our brand by using digital, mobile and social channels to allow us to engage more directly with our stakeholders and allow consumers and customers to engage directly in programs, promotions and merchant offers, as well as provide relevant information on MasterCard products, services and... -

Page 20

... other social benefit cards (including cards to aid victims of natural disasters) and products and solutions that enable mobile commerce payments. MasterCard Revenue Sources We generate revenues by charging fees to our customers for providing transaction processing and other payment-related services... -

Page 21

... and rebate agreements. Revenues from processing cross-border transactions fluctuate with cross-border activities. See our risk factor in "Risk Factors-Business Risks" in Part I, Item 1A of this Report related to crossborder travel. In 2012, net revenues from our five largest customers accounted for... -

Page 22

... for all MasterCard-branded cards (excluding Cirrus and Maestro) and for both MasterCard credit and charge programs and MasterCard debit and prepaid programs in all of our regions for the years ended December 31, 2012 and 2011. Growth rates are provided on both a U.S. dollar and local currency basis... -

Page 23

..., design and features of cards and card programs; the use of our trademarks; merchant acquiring activities (including acceptance standards applicable to merchants); and guaranteed settlement and customer failures. Customer Risk Management We guarantee the settlement of many of the transactions... -

Page 24

... and processing of illegal transactions) and security compliance (including our MasterCard Site Data Protection Service®, which assists customers, merchants and third-party service providers in protecting commercial sites from hacker intrusions and subsequent account data compromises) by requiring... -

Page 25

... within MasterCard. Our integrated risk management structure balances risk and return by having business units and central functions (such as finance and law) identify, own and manage risks, our executive officers set policy and accountability and our Board of Directors and its committees provide... -

Page 26

... programs. In addition, a number of our customers issue American Express and/or Discover-branded payment cards in a manner consistent with a four-party system. We also compete for new business partners with whom we seek to work, such as merchants, government agencies and telecommunication companies... -

Page 27

... are seeking to enhance their networks that link issuers directly with point-of-sale devices for payment transaction authorization and processing services. Certain of these transaction processors could potentially displace us as the provider of these payment processing services. New Entrants and... -

Page 28

... and merchants; the acceptance base, reputation and brand recognition of payment cards; pricing; the success and scope of marketing and promotional campaigns; the quality, security and integrity of transaction processing; the relative value of services and products offered; and the impact of new... -

Page 29

... activities of our internet payments gateway and prepaid card program management services are also subject to U.S. and other countries' AML laws and regulations. We have an AML compliance program to address these legal and regulatory requirements and assist in managing money laundering and terrorist... -

Page 30

... the attractiveness of debit card programs to our customers and adversely affect transaction volumes and revenues. Additionally, regulation of issuer practices around the world include regulation of the issuance of prepaid cards. In Germany, additional consumer information is required in connection... -

Page 31

... New requirements and developments may affect our customers' ability to extend credit through the use of payment cards, which could decrease our transaction volumes. In some circumstances, new regulations could have the effect of limiting our customers' ability to offer new types of payment programs... -

Page 32

... the costs consumers and merchants pay in a four-party payments system. They are also a factor on which we compete with other payment providers and therefore an important determinant of the volume of transactions we process over our network. We do not earn revenues from interchange fees. We have... -

Page 33

... on payments, and specifically the cost of acceptance, which includes interchange fees. In 2010, the Canadian Department of Finance implemented a voluntary "Code of Conduct" on related issues for payment card industry participants in Canada, by which MasterCard voluntarily agreed to abide. In 2011... -

Page 34

... filed against MasterCard, Visa and a number of large Canadian banks relating to MasterCard and Visa interchange fees and rules related to interchange fees, including "honor all cards" and "no surcharge" rules. In the United Kingdom, since May 2012, a number of retailers have filed claims against... -

Page 35

... information could be used by the Federal Reserve to reexamine and potentially re-set the interchange cap. With respect to network arrangements and transaction routing, the regulations require debit and prepaid cards to be enabled with two unaffiliated payments networks. The regulations also provide... -

Page 36

... payment services in certain countries. As a result, the risks created by any one new law or regulation are magnified by the potential they have to be replicated, affecting our business in another place or involving another product. These include matters like interchange rates, network standards... -

Page 37

...addressing any overdraft fees imposed in connection with ATM and debit card transactions, the CFPB's investigation into bank overdraft practices (and any further potential litigation on this) and regulations instituted in Germany requiring the provision of certain consumer identification information... -

Page 38

... areas of consumer privacy, data use and/or security could decrease the number of payment cards and devices issued and could increase our costs. We are subject to regulations related to privacy and data protection and information security in the jurisdictions in which we do business, and we could be... -

Page 39

... all forms of payment, including paper-based transactions (principally cash and checks); card-based or other electronic payment programs or systems, including credit, charge, debit, prepaid, private-label and other types of general purpose and limited use programs; contactless, mobile and web-based... -

Page 40

...operations. We generate revenue from the fees that we charge our customers for providing transaction processing and other payment-related services and from assessments on the dollar volume of activity on cards and other devices carrying our brands. In order to increase transaction volumes, enter new... -

Page 41

... billion, or 24%, of total revenue. Loss of business from any of our large customers could have a material adverse impact on our overall business and results of operations. Merchants continue to be focused on the costs of accepting electronic forms of payment, which may lead to additional litigation... -

Page 42

... to cross-border) transactions conducted using MasterCard, Maestro and Cirrus cards are authorized, cleared and settled by our customers or other processors. Because we do not provide domestic processing services in these countries and do not, as described above, have direct relationships with... -

Page 43

... transaction integrity or introduce value-added programs and services that are dependent upon us processing the underlying transactions. We rely on the continuing expansion of merchant acceptance of our products and programs. Although our business strategy is to invest in strengthening our brands... -

Page 44

... transactions using MasterCard, Maestro and Cirrus-branded cards and generate a significant amount of revenue from cross-border volume fees and transaction processing fees. Revenue from processing cross-border and currency conversion transactions for our customers fluctuates with cross-border travel... -

Page 45

... and networks. Our customers and other parties in the payments value chain, as well as our cardholders, rely on our digital technologies, computer and email systems, software and networks to conduct their operations. In addition, to access our products and services, our customers and cardholders... -

Page 46

... security breaches of the networks, systems or devices that our customers use to access our products and services which could result in the unauthorized disclosure, release, gathering, monitoring, misuse, loss or destruction of confidential, proprietary and other information (including account data... -

Page 47

...) third-party processors to process transactions generated by cards carrying our brands and merchants may use third parties to provide services related to card use. A breach of the systems on which sensitive cardholder data and account information are processed, transmitted or stored could lead... -

Page 48

...currency or valued based on a currency other than the functional currency of the entity generating the revenues. Resulting exchange gains and losses are included in our net income. Our risk management activities provide protection with respect to adverse changes in the value of only a limited number... -

Page 49

... by securities analysts or our failure to achieve analysts' earnings estimates; the announcement of new products or service enhancements by us or our competitors; announcements related to litigation, regulation or legislative activity; potential acquisitions by us of other companies; and... -

Page 50

...of December 31, 2012, MasterCard and its subsidiaries owned or leased 126 commercial properties. We own our corporate headquarters, a 472,600 square foot building located in Purchase, New York. There is no outstanding debt on this building. Our principal technology and operations center is a 528,000... -

Page 51

... and adequate for the business that we currently conduct. However, we periodically review our space requirements and may acquire or lease new space to meet the needs of our business, or consolidate and dispose of facilities that are no longer required. Item 3. Legal Proceedings Refer to Notes 10... -

Page 52

... Purchases of Equity Securities Price Range of Common Stock Our Class A common stock trades on the New York Stock Exchange under the symbol "MA". The following table sets forth the intra-day high and low sale prices for our Class A common stock for the four quarterly periods in each of 2012 and 2011... -

Page 53

... Company's repurchase activity during the fourth quarter of 2012 consisted of open market share repurchases and is summarized in the following table: Average Price Paid per Share (including commission cost) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs Dollar Value... -

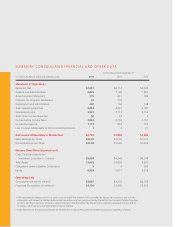

Page 54

... in Part II, Item 8 of this Report. 2012 Years Ended December 31, 2011 2010 2009 (in millions, except per share data) 2008 Statement of Operations Data: Revenues, net ...Total operating expenses ...Operating income (loss) ...Net income (loss) attributable to MasterCard ...Basic earnings (loss... -

Page 55

... transactions. We generate revenues from the fees that we charge our customers for providing transaction processing and other payment-related services and by assessing our customers based primarily on the dollar volume of activity on the cards and other devices that carry our brands. In 2012, volume... -

Page 56

...the years ended December 31, 2012 and 2011, respectively, due to the MDL Provision. Business Environment We process transactions from more than 210 countries and territories and in more than 150 currencies. Net revenue generated in the United States was 39%, 40% and 42% of total net revenue in 2012... -

Page 57

...in Part I, Item 1A of this Report for further discussion. Further, information security risks for global payments and technology companies such as MasterCard have significantly increased in recent years. Although to date we have not experienced any material impacts relating to cyber-attacks or other... -

Page 58

... our brands, the number of transactions we process for our customers or the nature of other payment-related services we provide to our customers. Our revenues are based upon transactional information accumulated by our systems or reported by our customers. Our primary revenue billing currencies are... -

Page 59

... merchant relationships and promoting acceptance at the point of sale. Market development fees are charged primarily to issuers and acquirers based on components of volume, and support our focus on building brand awareness and card activation, increasing purchase volumes, cross-border card usage... -

Page 60

... acquirers for listing invalid or fraudulent accounts either electronically or in paper form and for distributing this listing to merchants. Cardholder services fees are for benefits provided with MasterCard-branded cards, such as insurance, telecommunications assistance for lost cards and locating... -

Page 61

... agreements with customers. These agreements can be terminated in a variety of circumstances. See our risk factor in "Risk Factor-Business Risks" in Part I, Item 1A of this Report for further discussion. The significant components of our net revenues for the years ended December 31, 2012, 2011 and... -

Page 62

... points in 2012 and 13 percentage points in 2011) and increased consulting fees, fraud service fees and other payment-related services in 2012 and 2011. Rebates and incentives, other includes the impact from new and renewed agreements and reductions from terminated and expired agreements. Operating... -

Page 63

...introduce new service offerings and access new markets globally. Our advertising and marketing strategy is to increase global MasterCard brand visibility, usage and overall preference among cardholders globally through brand advertising, promotions, sponsorships, and digital, mobile and social media... -

Page 64

... interest accretion on litigation settlements and an adjustment to the earnout related to the Company's acquisition of Access, partially offset by expenses from equity method investments. Income Taxes The effective income tax rates for the years ended December 31, 2012, 2011 and 2010 were 29.9%, 30... -

Page 65

..., as well as the cash, cash equivalents and investment securities balances and credit available to the Company at December 31: Years Ended December 31, 2012 2011 2010 (in millions, except per share data) Net cash provided by operating activities ...Cash, cash equivalents and available-for-sale... -

Page 66

... by litigation settlement payments of $303 million. Net cash used in investing activities for the year ended December 31, 2012 was primarily related to purchases of investment securities and the payment related to U.S. merchant class litigations into escrow, partially offset by net proceeds from... -

Page 67

... our global payments network, partially offset by net proceeds from sales and maturities of investment securities. Net cash used in financing activities for the years ended December 31, 2012 and 2011 primarily related to the repurchase of the Company's Class A common stock and dividend payments to... -

Page 68

... Company's share repurchase authorizations of its Class A common stock through December 31, 2012, as well as historical purchases: Authorization Dates June 2012 April 20111 Total (in millions, except average price data) Board authorization ...Remaining authorization at December 31, 2011 ...Dollar... -

Page 69

... the MasterCard brand and amounts due in accordance with merchant agreements that are fixed and non-cancelable. Future cash payments that will become due to our customers under agreements which provide pricing rebates on our standard fees and other incentives in exchange for transaction volumes are... -

Page 70

... customer performance was 10% higher, net revenue would have been reduced by approximately $25 million in 2012. Loss Contingencies The Company is currently involved in various claims and legal proceedings. The Company regularly reviews the status of each significant matter and assesses its potential... -

Page 71

...on the Company's financial position or results of operations. Foreign Exchange Risk We enter into forward contracts to manage foreign exchange risk associated with anticipated receipts and disbursements which are either transacted in a non-functional currency or valued based on a currency other than... -

Page 72

... sell foreign currency had been entered into with customers of MasterCard. MasterCard's derivative contracts are summarized below: December 31, 2012 December 31, 2011 Estimated Fair Estimated Fair Notional Value Notional Value (in millions) Commitments to purchase foreign currency ...Commitments to... -

Page 73

... financial statements in Part II, Item 8 of this Report for additional information on the Company's current and prior credit facilities. We had no borrowings under the current or prior credit facilities at December 31, 2012 or 2011. Equity Price Risk The Company did not have significant equity price... -

Page 74

... FINANCIAL STATEMENTS Page MasterCard Incorporated As of December 31, 2012 and 2011 and for the years ended December 31, 2012, 2011 and 2010 Management's Report on Internal Control Over Financial Reporting ...Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheet... -

Page 75

... its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. As required by Section 404 of the Sarbanes-Oxley Act of 2002, management has assessed the effectiveness of MasterCard's internal control over financial reporting as of December 31, 2012. In... -

Page 76

...is to express opinions on these financial statements, and on the Company's internal control over financial reporting based on our integrated audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that... -

Page 77

MASTERCARD INCORPORATED CONSOLIDATED BALANCE SHEET December 31, 2012 2011 (in millions, except share data) ASSETS Cash and cash equivalents ...Restricted cash for litigation settlement ...Investment securities available-for-sale, at fair value ...Accounts receivable ...Settlement due from customers... -

Page 78

MASTERCARD INCORPORATED CONSOLIDATED STATEMENT OF OPERATIONS For the Years Ended December 31, 2012 2011 2010 (in millions, except per share data) Revenues, net ...Operating Expenses General and administrative ...Advertising and marketing ...Provision for litigation settlement ...Depreciation and ... -

Page 79

MASTERCARD INCORPORATED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME For the Years Ended December 31, 2012 2011 2010 (in millions) Net Income ...Other comprehensive income (loss): Foreign currency translation adjustments ...Defined benefit pension and postretirement plans ...Income tax effect ...... -

Page 80

... CONSOLIDATED STATEMENT OF CHANGES IN EQUITY Accumulated Retained Other Earnings Comprehensive Common Stock Additional Class A Non(Accumulated Income (Loss), Paid-In Treasury Controlling Total Deficit) Net of Tax Class A Class B Capital Stock Interests (in millions, except per share data) Balance at... -

Page 81

MASTERCARD INCORPORATED CONSOLIDATED STATEMENT OF CASH FLOWS For the Years Ended December 31, 2012 2011 2010 (in millions) Operating Activities Net income ...Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization ...Share based payments ...... -

Page 82

...; (2) manages a family of well-known, widely-accepted payment brands, including MasterCard®, Maestro® and Cirrus®, which it licenses to its customers for use in their payment programs and solutions; (3) processes payment transactions over the MasterCard Worldwide Network; and (4) provides support... -

Page 83

... upon transactional information accumulated by our systems or reported by our customers. The Company's revenues are based on the volume of activity on cards that carry the Company's brands, the number of transactions processed or the nature of other payment-related services. Volume-based revenues... -

Page 84

... assets with finite useful lives are amortized over their estimated useful lives, which range from one to ten years, under the straight-line method. Capitalized software includes internal costs incurred for payroll and payroll related expenses directly related to the design, development and testing... -

Page 85

... provide a framework for managing the Company's settlement exposure. Settlement risk is the legal exposure due to the difference in timing between the payment transaction date and subsequent settlement. MasterCard's rules guarantee the settlement of many of the MasterCard, Cirrus and Maestro-branded... -

Page 86

...on management's judgment using internal and external data, these fair value determinations are classified in Level 3 of the Valuation Hierarchy. See Note 5 (Fair Value and Investment Securities) for information about methods and assumptions. The Company has not elected to apply the fair value option... -

Page 87

... under hedge accounting as of December 31, 2012 and 2011. Settlement due from/due to customers-The Company operates systems for clearing and settling payment transactions among MasterCard customers. Net settlements are generally cleared daily among customers through settlement cash accounts by wire... -

Page 88

... on buildings is calculated using the straight-line method over an estimated useful life of 30 years. Amortization of leasehold improvements and capital leases is included in depreciation expense. Leases-The Company enters into operating and capital leases for the use of premises, software and... -

Page 89

... by dividing net income attributable to MasterCard by the weighted-average number of common shares outstanding during the year, adjusted for the potentially dilutive effect of stock options and unvested stock units using the treasury stock method. For the years ended December 31, 2011 and 2010... -

Page 90

...On December 9, 2010, MasterCard entered into an agreement to acquire the prepaid card program management operations of Travelex Holdings Ltd., since renamed Access Prepaid Worldwide ("Access"). Pursuant to the terms of the acquisition agreement, the Company acquired Access on April 15, 2011, at a 86 -

Page 91

.... The full year revenues for 2011 did not meet the requirements for payment of the earn-out and therefore the liability was eliminated and the Company recorded other income of $9 million in 2011. Access manages and delivers consumer and corporate prepaid travel cards through business partners around... -

Page 92

...Company's consolidated results of operations was not considered to be material. Note 3. Earnings Per Share Basic earnings per share ("EPS") for the year ended December 31, 2012 is calculated by dividing net income attributable to MasterCard by the weighted-average number of common shares outstanding... -

Page 93

...the years ended December 31, 2011 and 2010, the dilutive effect of stock options is calculated including the effects of certain equity instruments granted in share-based payment transactions under the two-class method. Unvested share-based payment awards which receive non-forfeitable dividend rights... -

Page 94

...of the American Express Settlement, MasterCard made 12 quarterly payments of $150 million beginning in the third quarter of 2008. The Company made its final quarterly payment of $150 million in June 2011. See Note 2 (Acquisitions) for further details. 2 Note 5. Fair Value and Investment Securities... -

Page 95

... Other category of the Valuation Hierarchy, as the fair value is based on broker quotes for the same or similar derivative instruments. See Note 20 (Foreign Exchange Risk Management) for further details. The Company's auction rate securities ("ARS") investments have been classified within Level 3 of... -

Page 96

... lease obligation related to the Company's global technology and operations center located in O'Fallon, Missouri. The Company has netted the refunding revenue bonds and the corresponding capital lease obligation in the consolidated balance sheet and estimates that the carrying value approximates the... -

Page 97

MASTERCARD INCORPORATED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) December 31, 2011 Gross Gross Unrealized Unrealized Gain Loss1 (in millions) Amortized Cost Fair Value Municipal securities ...U.S. Government and Agency securities ...Taxable short-term bond funds ...Corporate ... -

Page 98

...impairment included in accumulated other comprehensive income related to the Company's ARS was $3 million and $8 million as of December 31, 2012 and 2011, respectively. A hypothetical increase of 100 basis points in the discount rate used in the discounted cash flow analysis would have increased the... -

Page 99

... 36 77 163 183 $681 $190 - 35 35 144 $404 2012 2011 (in millions) Customer and merchant incentives ...Nonmarketable equity investments ...Auction rate securities available-for-sale, at fair value ...Investment securities held-to-maturity ...Income taxes receivable ...Other ...Total other assets... -

Page 100

...-year lease between MasterCard, as tenant, and the Missouri Development Finance Board ("MDFB"), as landlord, for MasterCard's global technology and operations center located in O'Fallon, Missouri. This lease includes a bargain purchase option and is thus classified as a capital lease. The building... -

Page 101

... 2012, the Company acquired three businesses and recognized $48 million of related goodwill. On April 15, 2011, MasterCard acquired Access. The Company recognized $354 million of related goodwill as part of the acquisition of Access. See Note 2 (Acquisitions) for further details. The Company had... -

Page 102

...the second quarter of 2012 to $790 million (on a pre-tax basis). On October 31, 2012, MasterCard made a $64 million payment for the individual merchant plaintiffs settlement. In December 2012, the Company made a $726 million payment into a qualified settlement fund related to the U.S. merchant class... -

Page 103

... of: Prepaid expenses, long term ...Accrued expenses ...Other liabilities, long term ...Amounts recognized in accumulated other comprehensive income consist of: Net actuarial loss ...Prior service credit ...Weighted-average assumptions used to determine end of year benefit obligations Discount rate... -

Page 104

... were as follows: 2012 2011 Health care cost trend rate assumed for next year ...Rate to which the cost trend rate is expected to decline (the ultimate trend rate) ...Year that the rate reaches the ultimate trend rate ... 8.00% 7.00% 5.00% 5.00% 2019 2016 Components of net periodic benefit cost... -

Page 105

...loss ... $3 $- Weighted-average assumptions used to determine net periodic benefit cost were as follows for the years ended December 31: 2012 Pension Plans 2011 2010 Postretirement Plan 2012 2011 2010 Discount rate ...Expected return on plan assets ...Rate of compensation increase: Qualified Plan... -

Page 106

...the Company's financial instruments. See Note 1 (Summary of Significant Accounting Policies). Mutual funds (including small cap U.S. equity securities and non-U.S. equity securities) are public investment vehicles valued at quoted market prices, which represent the net asset value of the shares held... -

Page 107

... million and $33 million for 2012, 2011 and 2010, respectively. Severance Plan The Company provides limited postemployment benefits to eligible former U.S. employees, primarily severance under a formal severance plan (the "Severance Plan"). The Company accounts for severance expense by accruing the... -

Page 108

...of customers of MasterCard. On August 2, 2012, the Company filed a universal shelf registration statement to provide additional access to capital, if needed. Pursuant to the shelf registration statement, the Company may from time to time offer to sell debt securities, preferred stock, Class A common... -

Page 109

... February 2010, the Company's Board of Directors authorized programs to facilitate conversions of shares of Class B common stock (without limits as to the number of shares) on a one-for-one basis into shares of Class A common stock for subsequent sale or transfer to public investors, beginning after... -

Page 110

...summarizes the Company's share repurchase authorizations of its Class A common stock through December 31, 2012, as well as historical purchases: Authorization Dates June April 2012 20111 Total (in millions, except average price data) Board authorization ...Dollar-value of shares repurchased in 2011... -

Page 111

...at the completion of the Company's June 2012 Share Repurchase Program. Note 14. Accumulated Other Comprehensive Income (Loss) The changes in the balances of each component of accumulated other comprehensive income (loss) for the years ended December 31, 2012 and 2011 were as follows: Defined Benefit... -

Page 112

... management believes is generally comparable to MasterCard. The expected dividend yields were based on the Company's expected annual dividend rate on the date of grant. The following table summarizes the Company's option activity for the year ended December 31, 2012: WeightedAverage Exercise Price... -

Page 113

... $300 1.2 1.3 $268 $259 The fair value of each RSU is the closing stock price on the New York Stock Exchange of the Company's Class A common stock on the date of grant. The weighted-average grant-date fair value of RSUs granted during the years ended December 31, 2012, 2011 and 2010 was $422, $257... -

Page 114

... calculated using the number of PSUs expected to vest, multiplied by the period ending price of a share of MasterCard's Class A common stock on the New York Stock Exchange, less previously recorded compensation expense. With regard to the PSUs issued in 2009, the Company awarded 143% of the original... -

Page 115

... of the DSUs was based on the closing stock price on the New York Stock Exchange of the Company's Class A common stock on the date of grant. The weighted-average grant-date fair value of DSUs granted during the years ended December 31, 2012, 2011 and 2010 was $408, $274 and $217, respectively. The... -

Page 116

... of income before income taxes for the years ended December 31 are as follows: 2012 2011 (in millions) 2010 United States ...Foreign ...Total income before income taxes ... $2,508 1,424 $3,932 $1,415 1,331 $2,746 $2,198 559 $2,757 MasterCard has not provided for U.S. federal income and foreign... -

Page 117

... STATEMENTS-(Continued) Effective Income Tax Rate The effective income tax rates for the years ended December 31, 2012, 2011 and 2010 were 29.9%, 30.6% and 33.0%, respectively. The effective tax rate for 2012 was lower than the effective tax rate for 2011 primarily due to discrete benefits related... -

Page 118

...is the Company's policy to account for interest expense related to income tax matters as interest expense in its statement of operations, and to include penalties related to income tax matters in the income tax provision. For the years ended December 31, 2012, 2011 and 2010, the Company recorded tax... -

Page 119

... rule), which required merchants who accept MasterCard cards to accept for payment every validly presented MasterCard card, constituted an illegal tying arrangement in violation of Section 1 of the Sherman Act. In June 2003, MasterCard International signed a settlement agreement to settle the claims... -

Page 120

...and Visa (the "ATM Operators Complaint"). Plaintiffs seek to represent a class of non-bank operators of ATM terminals that operate ATM terminals in the United States with the discretion to determine the price of the ATM access fee for the terminals they operate. Plaintiffs allege that MasterCard and... -

Page 121

... are styled as class actions, although a few complaints are filed on behalf of individual merchant plaintiffs) against MasterCard International Incorporated, Visa U.S.A., Inc., Visa International Service Association and a number of customer financial institutions. Taken together, the claims in the... -

Page 122

... credit interchange fees paid by acquirers to issuers. MasterCard would also be required to modify its No Surcharge Rule to permit U.S. merchants to surcharge MasterCard credit cards, subject to certain limitations set forth in the class settlement agreement. On October 19, 2012, the parties entered... -

Page 123

... interchange fee for credit card transactions does not exceed 30 basis points and for debit card transactions does not exceed 20 basis points; (4) introducing a new rule prohibiting its acquirers from requiring merchants to process all of their MasterCard and Maestro transactions with the acquirer... -

Page 124

..., because a balancing mechanism like default cross-border interchange fees constitutes an essential element of MasterCard Europe's operations, the December 2007 decision could also significantly impact MasterCard International's European customers' and MasterCard Europe's business. The European... -

Page 125

... the revenues of MasterCard's Italian customers and on MasterCard's overall business in Italy. Poland. In January 2007, the Polish Office for Protection of Competition and Consumers (the "PCA") issued a decision that MasterCard's (and Visa Europe's) domestic credit and debit default interchange fees... -

Page 126

... using the average daily card volume during the quarter multiplied by the estimated number of days to settle. The Company has global risk management policies and procedures, which include risk standards, to provide a framework for managing the Company's settlement risk. Customer-reported transaction... -

Page 127

... Exchange Risk Management The Company enters into foreign currency forward contracts to manage risk associated with anticipated receipts and disbursements which are either transacted in a non-functional currency or valued based on a currency other than its functional currencies. The Company also... -

Page 128

... significant operating decisions are based upon analysis of MasterCard at the consolidated level. Revenue by geographic market is based on the location of the Company's customer that issued the card, as well as the location of the merchant acquirer where the card is being used. Revenue generated in... -

Page 129

.... No individual country, other than the U.S., generated more than 10% of total revenues in those periods. MasterCard did not have any one customer that generated greater than 10% of net revenues in 2012, 2011 or 2010. The following table reflects the geographical location of the Company's property... -

Page 130

... OF QUARTERLY DATA (Unaudited) March 31 2012 Quarter Ended June 30 September 30 December 31 (in millions, except per share amounts) 2012 Total Revenues, net ...Operating income (loss) ...Net income attributable to MasterCard ...Basic earnings per share ...Basic weighted-average shares outstanding... -

Page 131

... in the Securities and Exchange Commission's rules and forms and (ii) ensuring that information required to be disclosed in such reports is accumulated and communicated to MasterCard Incorporated's management, including its President and Chief Executive Officer and Chief Financial Officer, as... -

Page 132

...security ownership of certain beneficial owners and management equity and compensation plans will appear in the Proxy Statement and is incorporated by reference into this Report. Item 13. Certain Relationships and Related Transactions, and Director Independence The information required by this Item... -

Page 133

SIGNATURES Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this Annual Report on Form 10-K to be signed on its behalf by the undersigned, thereunto duly authorized. MASTERCARD INCORPORATED (Registrant) Date: February 14, ... -

Page 134

...14, 2013 By: /S/ JOSÉ OCTAVIO REYES LAGUNES José Octavio Reyes Lagunes Director Date: February 14, 2013 By: /S/ MARK SCHWARTZ Mark Schwartz Director Date: February 14, 2013 By: /S/ JACKSON TAI Jackson Tai Director Date: February 14, 2013 By: /S/ EDWARD SUNING TIAN Edward Suning Tian... -

Page 135

... Ann Cairns and MasterCard International Incorporated, dated June 15, 2011 (incorporated by reference to Exhibit 10.8 to the Company's Annual Report on Form 10-K filed February 16, 2012 (File No. 001-32877)). Contract of Employment between MasterCard UK Management Services Limited and Ann Cairns... -

Page 136

... Restated MasterCard International Incorporated Change in Control Severance Plan, amended and restated as of June 5, 2012 (incorporated by reference to Exhibit 10.6 to the Company's Quarterly Report on Form 10-Q filed August 1, 2012 (File No. 001-32877)). Schedule of Non-Employee Directors' Annual... -

Page 137

... Visa U.S.A. Inc. and Visa International Service Association (incorporated by reference to Exhibit 10.3 to the Company's Quarterly Report on Form 10-Q filed August 1, 2008. (File No. 001-32877)). Release and Settlement Agreement dated as of October 27, 2008 by and among MasterCard, Discover and Visa... -

Page 138

... Inc., Visa U.S.A. Inc., Visa International Service Association and MasterCard's customer banks that are parties thereto (incorporated by reference to Exhibit 10.33 to Amendment No.1 to the Company's Annual Report on Form 10-K/A filed on November 23, 2011). MasterCard Settlement and Judgment Sharing... -

Page 139

.... Exhibit omits certain information that has been filed separately with the U.S. Securities and Exchange Commission and has been granted confidential treatment. The agreements and other documents filed as exhibits to this report are not intended to provide factual information or other disclosure... -

Page 140

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 141

... Board MasterCard Incorporated; President, PSI UK Ltd MASTERCARD EXECUTIVE MANAGEMENT Ajay Banga President and Chief Executive Ofï¬cer Ann Cairns President, International Markets Ajay Banga President and Chief Executive Ofï¬cer MasterCard Incorporated Gary J. Flood President, Global Products... -

Page 142

... company's Annual Report on Form 10-K as well as other periodic ï¬lings by the Company with the U.S. Securities and Exchange Commission (SEC) are available on the Investor Relations section of our website at www.mastercard.com. Visit our website, www.mastercard.com, for updated news releases, stock... -

Page 143

...those set forth in MasterCard Incorporated's ï¬lings with the Securities and Exchange Commission (SEC), including its Annual Report on Form 10-K for the year ended December 31, 2012 (which is included in this annual report), Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that it has... -

Page 144

Our Company Website mastercard.com Our Cashless Conversations Blog 2013 Proxy Statement © 2013 MasterCard