LensCrafters 2009 Annual Report Download - page 99

Download and view the complete annual report

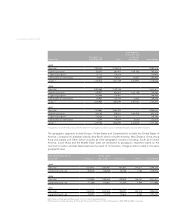

Please find page 99 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 97 <

14. FINANCIAL INSTRUMENTS

Concentration of Credit Risk

Financial instruments which potentially expose the Company to concentration of credit risk consist prima-

rily of cash, investments and accounts receivable. The Company attempts to limit its credit risk associated

with cash equivalents by placing the Company’s cash balances and investments with highly rated banks and

fi nancial institutions. However, at any time amounts invested at these banks may be in excess of the amount

of insurance provided on such deposits. With respect to accounts receivable, the Company limits its credit

risk by performing ongoing credit evaluations and certain customers may be required to post security in

the form of letters of credit. As of December 31, 2009 and 2008, no single customer balances comprised

10 percent or more of the overall accounts receivable balance. However, included in accounts receivable

as of December 31, 2009 and 2008, was approximately Euro 13.0 million and Euro 12.3 million, respectively,

due from the host stores of the Company's licensed brands retail division. These receivables represent cash

proceeds from sales deposited into the host stores, bank accounts, which are subsequently forwarded to

the Company on a weekly or monthly basis depending on the Company’s contract with the particular host

store and are based on contract arrangements that are short term in length.

Concentration of Supplier Risk

As a result of the OPSM and Cole acquisitions, Essilor S.A. has become one of the largest suppliers to the

Company’s Retail Division. For the 2009, 2008 and 2007 fi scal years, Essilor S.A. accounted for approxi-

mately 9 percent, 12.0 percent and 15.0 percent of the Company’s total merchandise purchases, respec-

tively. Management believes that the loss of this vendor would not have a signifi cant impact on the future

operations of the Company as it could replace this vendor quickly with other third-party suppliers.

15. COMMITMENTS AND CONTINGENCIES

Royalty Agreements

Luxottica Group has entered into license agreements to manufacture, design and distribute prescription

frames and sunglasses with selected fashion brands.

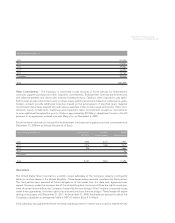

Under these license agreements, which typically have terms ranging from three to ten years, Luxottica

Group is required to pay a royalty which generally ranges from 5 percent to 14 percent of the net sales.

Some of these agreements provide also for annual guaranteed minimum payments and for a mandatory

marketing contribution (that generally amounts to between fi ve and ten percent of net sales). These license

agreements may be terminated early by either party for a variety of reasons including, among others,

non-payment of royalties, failure to meet minimum sales thresholds, product alteration and, under certain

agreements, a change in control of Luxottica Group S.p.A.

On January 28, 2009, Luxottica Group announced the signing of a license agreement for the design, manu-

facture and global distribution of sun and prescription eyewear under the Tory Burch and TT brands. The

agreement runs for six years starting in January 2009 and is renewable for an additional four years.

On January 30, 2009, Luxottica Group announced a three-year extension of the license agreement for the

design, production and worldwide distribution of prescription frames and sunglasses under the Salvatore

Ferragamo brand. The new agreement will run through December 2011, with an option for a further two-

year extension under the same terms.

On April 9, 2009, Luxottica Group announced a fi ve-year extension of the license agreement for the design,