LensCrafters 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.> 70 | ANNUAL REPORT 2009

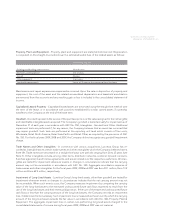

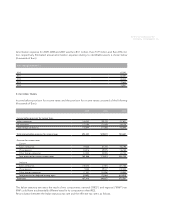

Pro forma data may not be indicative of the results that would have been obtained had these events actu-

ally occurred at the beginning of the periods presented, nor does it intend to be a projection of future

results.

b) Other acquisitions

The following is a description of other acquisitions and investments. No pro forma fi nancial information is

presented, as these acquisitions were not material, individually or in aggregate, to the Company's consoli-

dated fi nancial statements.

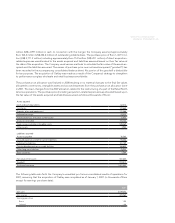

On July 16, 2009, the Company closed an agreement with Multiopticas Internacional S.L. (MOI), a company

that owns over 390 eyewear stores operating under the GMO, Econoptics and SunPlanet retail brands in

Chile, Peru, Ecuador and Colombia, pursuant to which Luxottica acquired a 40 percent participation in

MOI. The total consideration paid for the acquisition of MOI was Euro 41.4 million. The purchase price

was paid in two installments, each of them equal to 50 percent of the purchase price. The fi rst installment

was paid on the closing date on July 16, 2009, the second installment was paid in January 2010. Under the

terms of the agreement, the Company has a call option for the remaining 60 percent of MOI. The call op-

tion will be exercisable by the Company between 2012 and 2014 at a price to be determined on the basis

of MOI’s sales and EBITDA values at the time of the exercise. The difference between the carrying amount

and the amount of underlying equity in net assets was Euro 32.5 million as of acquisition date and was

mainly allocated to goodwill. There were no signifi cant intangibles realized or other fair value adjustments

associated with the acquisition.

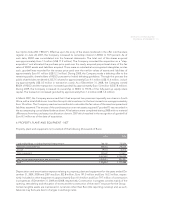

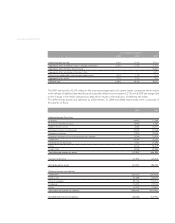

On July 31, 2008, Sunglass Hut UK Ltd. ("SGH"), an indirect wholly-owned subsidiary of the Company,

issued new shares of common stock and paid an aggregate of GBP 600,000 to the shareholders of Optika

Holdings Limited ("OHL") for all the outstanding shares of OHL. OHL through its subsidiaries operated a

chain of ophthalmic retail locations throughout the UK and Ireland under the brand name "David Clulow".

The total consideration exchanged for the OHL acquisition was Euro 22.1 million (approximately GBP 17.5

million). OHL was a joint venture owned 50% by the Company and 50% by a third party. Upon the comple-

tion of this transaction the Company owns, directly and indirectly, approximately 66% of SGH and OHL (the

"combined entity"). As a result of the acquisition the former shareholders of OHL received a minority stake

of the combined entity of 34% and a put option to sell the shares to the Company, while the Company was

granted a call option on the minority stake. The acquisition of the Company’s additional interest in OHL

was accounted for as a business combination. The Company used various methods to calculate the fair

value of the assets acquired and the liabilities assumed. The goodwill recorded in the consolidated fi nan-

cial statements as of December 31, 2008 totaled Euro 18.1 million. There were no signifi cant intangibles

realized or other fair value adjustments associated with the business combination.

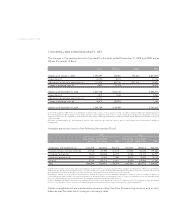

In February 2007, the Company completed the acquisition of certain assets and assumed certain liabilities

of D.O.C Optics Corporation and its affi liates, an optical retail business with approximately 100 stores

located primarily in the Midwest United States of America for approximately Euro 83.7 million (US$ 110.2

million) in cash. The purchase price, including direct acquisition-related expenses, was allocated to the

assets acquired and liabilities assumed based on their fair value at the date of the acquisition. The goodwill

recorded in the consolidated fi nancial statements as of December 31, 2007 totaled Euro 70.4 million, of

which Euro 64.9 million was deductible for tax purposes. The Company used various methods to calculate

the fair value of the assets acquired and liabilities assumed. The fi nal allocation of the purchase price among

the assets and liabilities acquired and the amount of the goodwill was completed in 2008 resulting in no

material differences from the purchase price allocation done in 2007. The acquisition was made as a result

of the Company’s strategy to continue expansion of its retail business in the United States of America.

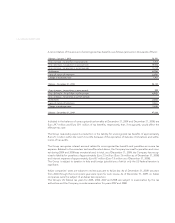

During 2007, in compliance with the 2006 decision of the Supreme Court of India, the Company launched

a public offering to acquire an additional 31 percent of the outstanding equity share capital of RayBan