LensCrafters 2009 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23 <

DISTRIBUTION

Luxottica operates in all the world’s major eyewear markets and continues to expand in emerging markets,

where it has made substantial investments in the last few years and intends to expand and strengthen its

distribution platform.

Direct distribution makes it possible to maintain close contact with clients and maximize the image and

visibility of Luxottica brands. Further, the Group’s experience in direct operation of stores in certain of its

more important countries has given it a unique understanding of the world’s eyewear markets. All this

makes it possible, among other things, to achieve tight control and strategic optimization of brand diffu-

sion, both house and license.

Luxottica’s distribution structure is one of the Group’s main strengths. It is global, embracing retail stores

and serving a wholesale distribution network of third party stores and chains.

WHOLESALE

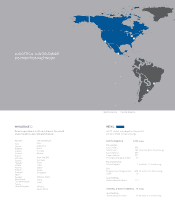

The distribution structure covers more than 130 countries, with over 40 direct operations in the major mar-

kets and approximately 100 independent distributors in other markets. Each wholesale subsidiary operates

its own network of sales representatives who are normally retained on a commission basis. Relationships

with large international, national and regional accounts are generally managed by employees.

Customers of the wholesale business are mostly retailers of mid- to premium-priced eyewear, such as

independent opticians, optical retail chains, specialty sun retailers and duty-free shops. In North America

and some other areas, the main customers also include independent optometrists, ophthalmologists and

premium department stores.

Certain brands including Oakley are distributed also to sporting goods stores and specialty sports stores,

including bike, surf, snow, skate, golf and motor sports stores.

In addition to making some of the best brands, with a broad array of models tailored to the needs of each

market, Luxottica also seeks to provide its wholesale customers with pre- and post-sale services to enhance

their business. These services are designed to provide customers with the best product and in a time frame

and manner that best serve the Group's customers’ needs.