LensCrafters 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 63 <

customer at such time. The products are not subject to formal customer acceptance provisions. In some

countries, the customer has the right to return products for a limited period of time after the sale. However,

such right of return does not impact the timing of revenue recognition as all conditions of ASC No. 605,

Revenue Recognition, are satisfi ed at the date of sale. Accordingly, the Company has recorded an accrual

for the estimated amounts to be returned. This estimate is based on the Company’s right of return policies

and practices along with historical data and sales trends. There are no other post-shipment obligations.

Revenues received for the shipping and handling of goods are included in sales and the costs associated

with shipments to customers are included in operating expenses.

Retail distribution segment revenues are recognized upon receipt by the customer at the retail location

or, for internet and catalogue sales, when goods are shipped directly to the customer. In some countries,

the Company allows retail customers to return goods for a period of time and, as such, the Company

has recorded an accrual for the estimated amounts to be returned. This accrual is based on the historical

return rate as a percentage of net sales and the timing of the returns from the original transaction date.

There are no other post-shipment obligations. As such, the right of return does not impact the timing of

revenue recognition as all conditions of ASC No. 605, are satisfi ed at the date of sale. Additionally, the

Retail Division enters into discount programs and similar relationships with third parties that have terms of

twelve or more months. Revenues under these arrangements are likewise recognized as transactions occur

in the Company’s retail locations and customers take receipt of products and services. Advance payments

and deposits from customers are not recorded as revenues until the product is delivered. At December 31,

2009 and 2008 customer advances included in the consolidated balance sheet in "Accrued Expenses and

Other" were Euro 31.1 million and Euro 23.0 million, respectively. Retail Division revenues also includes

managed vision care revenues consisting of both fi xed fee and fee for service managed vision care plans.

For fi xed fee plans, the plan sponsor pays the Company a monthly premium for each enrolled subscriber.

Premium revenue is recognized as earned during the benefi t coverage period. Premiums are generally

billed in the month of benefi t coverage. Any unearned premium revenue is deferred and recorded within

accrued liabilities on the balance sheet. For fee for service plans, the plan sponsor pays the Company a fee

to process its claims. Revenue is recognized as the services are rendered. This revenue is presented as third

party administrative services revenue. For these programs, the plan sponsor is responsible for funding the

cost of claims. Accruals are established for amounts due under these relationships based on an estimate

of uncollectible.

The Company licenses to third parties the rights to certain intellectual property and other proprietary

information and recognizes royalty revenues when earned.

Franchise revenues based on sales by franchisees (such as royalties) are accrued and recognized as earned.

Initial franchise fees are recorded as revenue when all material services or conditions relating to the sale of

the franchise have been substantially performed or satisfi ed by the Company and when the related store

begins operations. Allowances are established for amounts due under these relationships when they are

determined to be uncollectible. Sales of ophthalmic products and other materials are recorded when the

goods are shipped directly to franchisees net of appropriate allowances.

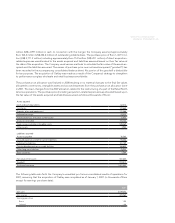

Revenues associated with our third-party franchisees and licensors at December 31, 2009, 2008 and 2007,

consist of the following (in thousand of Euros):

2009 2008 2007

Initiation fees 2,384 754 456

Royalties 14,652 14,712 16,949

Sales of frames and other materials 25,145 27,102 32,999

Other revenue 2,606 455 750

Total 44,787 43,023 51,154