LensCrafters 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 91 <

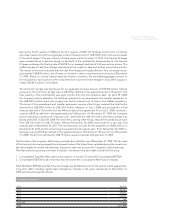

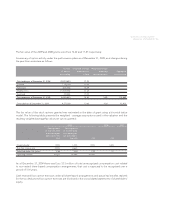

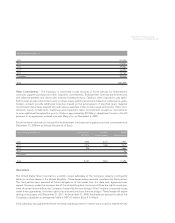

Number

of options

outstanding

Weighted average

exercise price

in Euro

Weighted average

remaining

contractual term

Aggregate

intrinsic value

Outstanding as of December 31, 2008 10,161,000 13.89

Granted 3,935,000 14.04

Forfeitures (279,200) 17.75

Modifi cations (2,885,000) 23.12

Exercised (943,150) 11.41

Outstanding as of December 31, 2009 9,988,650 14.99 5.80 32,852

Exercisable as of December 31, 2009 4,015,650 14.15 2.84 16,725

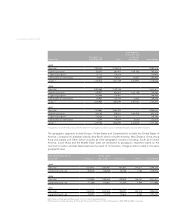

The weighted-average fair value of grant-date fair value options granted during the years 2009, 2008 and

2007 was Euro 5.01, Euro 5.02 and Euro 6.03, respectively.

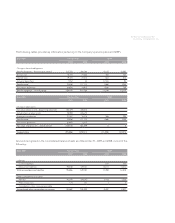

The fair value of the stock options granted was estimated at the date of grant using a binomial lattice

model. The following table presents the weighted-average assumptions used in the valuation and the

resulting weighted average fair value per option granted:

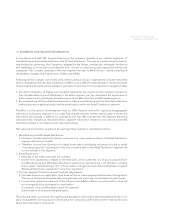

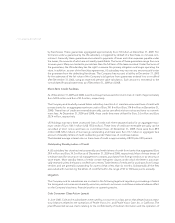

2009 2009 2009 2009 2008 2007

Ordinary plan

for employees

not domiciled

in the USA

Ordinary plan

for employees

domiciled

in the USA

Reassignment

of the 2006/2007

ordinary plans

for employees

domiciled

in the USA

Reassignment of

the 2006/2007

ordinary plans

for employees

not domiciled

in the USA

Ordinary

plan

Ordinary

plan

Dividend yield 1.43% 1.43% 1.43% 1.43% 1.65% 1.43%

Risk-free interest rate 2.66% 2.66% 2.90% 2.66% 3.63% 3.91%

Expected option life (years) 5.65 5.65 5.25 5.65 6.27 5.70

Expected volatility 35.59% 35.59% 36.14% 35.59% 26.93% 23.70%

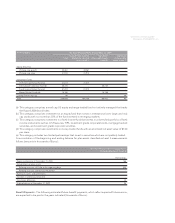

Expected volatilities are based on implied volatilities from traded share options on the Company's stock,

historical volatility of the Company's share price, and other factors. The expected option life is based

on the historical exercise experience for the Company based upon the date of grant and represents the

period of time that options granted are expected to be outstanding. The risk-free rate for periods within

the contractual life of the option is based on the US Federal Treasury or European government bond yield

curve, as appropriate, in effect at the time of grant.

As of December 31, 2009 there was Euro 13.6 million of total unrecognized compensation cost related

to non-vested share-based compensation arrangements; that cost is expected to be recognized over a

period of 1.95 years.

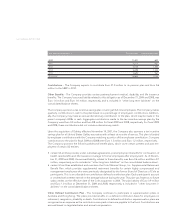

Stock Performance Plans

In October 2004, under a Company performance plan, the Company granted options to acquire an ag-

gregate of 1,000,000 shares of the Company to certain employees of the North American Luxottica Retail

Division which vested and became exercisable on January 31, 2007 as certain fi nancial performance meas-