LensCrafters 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 30

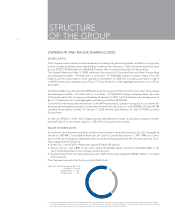

STRUCTURE

OF THE GROUP

Delfin S.àr.l. (Del Vecchio Family)

Free float (1)

Giorgio Armani

Treasury shares

67.7%

26.0%

4.9%

1.4%

OWNERSHIP AND MAJOR SHAREHOLDERS

SHARE CAPITAL

The Company’s share capital consists exclusively of ordinary fully paid voting shares, entitled to voting rights

both at ordinary and extraordinary shareholders’ meetings. As of January 31, 2010, the share capital was equal

to Euro 27,877,129.98 divided into 464,618,833 shares, with a nominal value of Euro 0.06 per share.

The General Meeting of May 13, 2008, authorised, for a period of 18 months from such date, the purchase

and subsequent transfer - the latter with no time limits - of 18,500,000 ordinary Company shares. From the

beginning of this authorisation, which expired on November 13, 2009, the Company purchased a total of

1,325,916 shares at an average price of Euro 17.13 per share, for a total aggregate purchase price of Euro

22,714,251.

The General Meeting of October 29, 2009 authorised, for a period of 18 months from such date, the purchase

and subsequent transfer - the latter with no time limits - of 18,500,000 ordinary Company shares. By virtue

of this authorisation the Company purchased as of January 31, 2010, 1,614,154 shares at an average price of

Euro 17.37 per share, for a total aggregate purchase price of Euro 28,035,169.

Concurrently with the purchase transactions on the MTA carried out by Luxottica Group S.p.A. pursuant to the

aforementioned buyback programs, its subsidiary Arnette Optic Illusions, Inc. sold 3,099,824 of the 6,434,786

Luxottica Group shares it owned. On January 31, 2010, Arnette Optic Illusions, Inc. held 3,334,962 Luxottica

Group shares.

In total, as of March 1, 2010, the Company directly, and indirectly through its subsidiary company Arnette,

held 6,275,032 of its own shares, equal to 1.35% of the Company’s share capital.

MAJOR SHAREHOLDERS

According to the information available and the communications received pursuant to art. 120 of Legislative

Decree no. 58/1998 ("Consolidated Financial Law") and to Consob Resolution no. 11971/1999, as of Janu-

ary 31, 2010, the Company’s shareholders with an equity holding greater than 2% of Luxottica Group S.p.A.

share capital are the following:

• Delfin S.àr.l., with 67.67% of the share capital (314,403,339 shares);

• Giorgio Armani, with 4.89% of the share capital (22,724,000 shares, of which 13,514,000 ADRs in the

name of Deutsche Bank Trust Company Americas); and

• Deutsche Bank Trust Company Americas, with 7.42% of the share capital (34,489,857 ADRs )(1) on behalf

of third parties.

The Chairman Leonardo Del Vecchio controls Delfi n S.àr.l.

(1) The shares held by Deutsche Bank Trust Company Americas represent ordinary shares that are traded in the US fi nancial market through issuance by the Bank of

a corresponding number of American Depositary Shares; such ordinary shares are deposited at Deutsche Bank S.p.A., which in turn issues the certifi cates entitling

the holders to participate and vote at the meetings, and are to be considered public shares held by non-affi liates.