LensCrafters 2009 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNEXES | 121 <

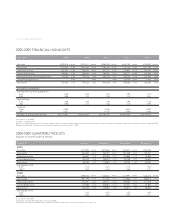

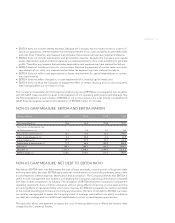

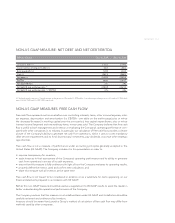

NON-US GAAP MEASURE: NET DEBT AND NET DEBT/EBITDA

(Millions of Euro) Dec. 31, 2009 Dec. 31, 2008

Long-term debt (+) 2,404.2 2,519.3

Current portion of long-term debt (+) 166.3 286.2

Bank overdrafts (+) 149.0 432.5

Cash (-) (380.1) (288.5)

Net debt (=) 2,339.3 2,949.5

EBITDA 869.1 1,014.7

Net debt/EBITDA 2.7x 2.9x

Net debt @ avg. exchange rates (1) 2,383.9 2,821.2

Net debt @ avg. exchange rates (1) / EBITDA 2.7x 2.8x

(1) Calculated using the respective 12-month average exchange rate as of December 31, 2009 and the 12-month average exchange rate as of December 31, 2008, which

were €1 =US$ 1.3947 and €1 = US$ 1.4707, respectively.

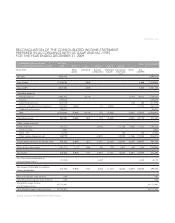

NON-US GAAP MEASURES: FREE CASH FLOW

Free cash fl ow represents net income before non-controlling interests, taxes, other income/expense, inter-

est expense, depreciation and amortization (i.e. EBITDA - see table on the earlier page) plus or minus

the decrease/(increase) in working capital over the prior period, less capital expenditures, plus or minus

interest income/(expense) and extraordinary items, minus taxes paid. The Company believes that free cash

fl ow is useful to both management and investors in evaluating the Company’s operating performance com-

pared with other companies in its industry. In particular, our calculation of free cash fl ow provides a clearer

picture of the Company’s ability to generate net cash from operations, which it uses to cover mandatory

debt service requirements and to fund discretionary investments, pay dividends or pursue other strategic

opportunities.

Free cash fl ow is not a measure of performance under accounting principles generally accepted in the

United States (US GAAP). The Company includes it in this presentation in order to:

• improve transparency for investors;

• assist investors in their assessment of the Company’s operating performance and its ability to generate

cash from operations in excess of its cash expenses;

• ensure that this measure is fully understood in light of how the Company evaluates its operating results;

• properly defi ne the metrics used and confi rm their calculation; and

• share this measure with all investors at the same time.

Free cash fl ow is not meant to be considered in isolation or as a substitute for items appearing on our

fi nancial statements prepared in accordance with US GAAP.

Rather, this non-GAAP measure should be used as a supplement to US GAAP results to assist the reader in

better understanding the operational performance of the Company.

The Company cautions that this measure is not a defi ned term under US GAAP and its defi nition should be

carefully reviewed and understood by investors.

Investors should be aware that Luxottica Group’s method of calculation of free cash fl ow may differ from

methods used by other companies.