LensCrafters 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

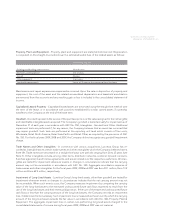

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 71 <

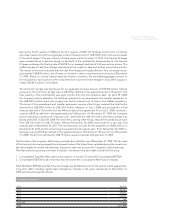

Sun Optics India LTD ("RBSO"). Effective upon the entry of the shares tendered in the offer into the share

register on June 26, 2007, the Company increased its ownership interest in RBSO to 70.5 percent. As of

such date, RBSO was consolidated into the fi nancial statements. The total cost of the shares acquired

was approximately Euro 13 million (US$ 17.2 million). The Company recorded the acquisition as a "step-

acquisition" and allocated the purchase price paid over the newly acquired proportional share of the fair

value of RBSO assets and liabilities acquired. There were no substantial unrecognized intangibles, and as

such, goodwill was recorded for the excess price paid over the net fair values of assets and liabilities of

approximately Euro 9.1 million (US$ 12.3 million). During 2008, the Company made a delisting offer to the

remaining public shareholders of RBSO pursuant to India’s delisting guidelines. Through this process the

public shareholders tendered 4,335,713 shares for approximately Euro 9.1 million (US$ 13.4 million, includ-

ing approximately US$ 0.5 million in transaction costs). As of December 31, 2008, the Company owned

88.2% of RBSO and the transaction increased goodwill by approximately Euro 5.0 million (US$ 7.8 million).

During 2009, the Company increased its ownership in RBSO to 93.3% of the fully paid up equity share

capital. The transaction increased goodwill by approximately Euro 1.2 million (US$ 1.6 million).

In March 2007, the Company announced that it had acquired two prominent specialty sun chains in South

Africa, with a total of 65 stores. Luxottica Group’s total investment in the two transactions was approximately

Euro 10 million. The Company used various methods to calculate the fair value of the assets acquired and

liabilities assumed. The excess of the purchase price over net assets acquired ("goodwill") was recorded in

the accompanying consolidated balance sheet. All valuations were completed during 2008 with no material

differences from the purchase price allocation done in 2007 which resulted in the recognition of goodwill of

Euro 8.3 million as of the date of acquisition.

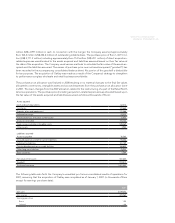

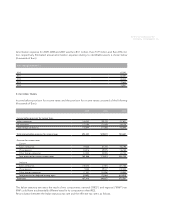

6. PROPERTY, PLANT AND EQUIPMENT - NET

Property, plant and equipment-net consisted of the following (thousands of Euro):

2009 2008

Land and buildings, including leasehold improvements 766,150 755,254

Machinery and equipment 880,851 795,126

Aircraft 39,814 40,018

Other equipment 554,642 513,631

2,241,457 2,104,029

Less: accumulated depreciation and amortization 1,092,541 933,331

Total 1,148,916 1,170,698

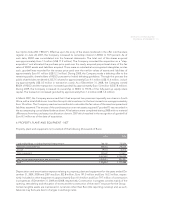

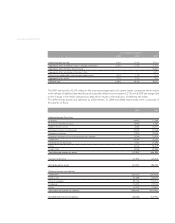

Depreciation and amortization expense relating to property, plant and equipment for the years ended De-

cember 31, 2009, 2008 and 2007 was Euro 202.8 million, Euro 191.0 million and Euro 163.3 million, respec-

tively. Included in other equipment is approximately Euro 41.4 million and Euro 79.7 million of construction

in progress as of December 31, 2009 and 2008, respectively. Construction in progress consists mainly of the

opening, remodeling and relocation of stores and the construction of the new IT structure for the Group.

Certain tangible assets are maintained in currencies other than Euro (the reporting currency) and, as such,

balances may fl uctuate due to changes in exchange rates.