LensCrafters 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 74 | ANNUAL REPORT 2009

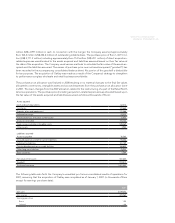

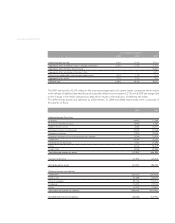

Year ended December 31,

2009 2008 2007

Italian statutory tax rate 31.4% 31.4% 37.3%

Aggregate effect of different rates in foreign jurisdictions (0.3)% (1.7)% (1.7)%

Aggregate effect of Italian restructuring (5.3)%

Aggregate effect of change in tax law in Italy 2.1%

Effect of non-deductible stock-based compensation 0.1% 1.1% 1.1%

Aggregate other effects 2.7% 2.2% 1.5%

Effective rate 33.9% 33.0% 35.0%

The 2007 tax benefi t of 5.3% relates to the business reorganization of certain Italian companies which results

in the release of deferred tax liabilities and is partially offset by the increase of 2.1% in the 2007 tax charge due

to the change in the Italian statutory tax rates which results in the reduction of deferred tax assets.

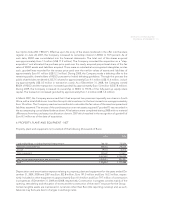

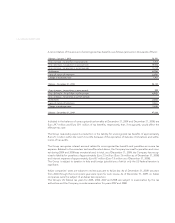

The deferred tax assets and liabilities as of December 31, 2009 and 2008, respectively, were comprised of

(thousands of Euro):

2009 2008

Deferred Income Tax Assets

Inventory 54,932 71,660

Insurance and other reserves 14,393 8,580

Right of return reserve 8,085 14,471

Net operating loss carryforwards 43,499 50,565

Occupancy reserves 17,979 19,630

Employee-related reserves (including pension liability) 73,748 72,974

Tradename 92,284 76,525

Deferred tax on derivatives 17,334 21,685

Other 34,134 54,819

Fixed assets 16,568 29,684

Total deferred income tax assets 372,957 420,593

Valuation Allowance (21,500) (24,048)

Net deferred tax assets 351,457 396,545

Deferred income tax liabilities

Tradename (224,221) (241,409)

Fixed assets (51,489) (32,919)

Other intangibles (99,128) (115,031)

Dividends (10,813) (13,316)

Other (4,412) (12,067)

Total deferred income tax liabilities (390,062) (414,742)

Net deferred income tax liabilities (38,605) (18,197)