LensCrafters 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 95 <

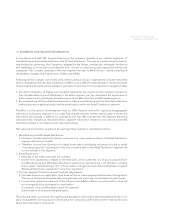

13. SEGMENTS AND RELATED INFORMATION

In accordance with ASC 280, Segment Reporting, the Company operates in two industry segments: (1)

manufacturing and wholesale distribution and (2) retail distribution. Through its manufacturing and whole-

sale distribution operations, the Company is engaged in the design, manufacture, wholesale distribution

and marketing of house brand and designer lines of mid- to premium-priced prescription frames and

sunglasses. The Company operates in the retail segment through its Retail Division, mainly consisting of

LensCrafters, Sunglass Hut, Pearle Vision, Oakley and OPSM.

Following several changes over recent years within Luxottica Group’s organizational structure described

below, management has decided, beginning in 2009, to use a different methodology to review the results

of each segment for performance evaluation purposes. In particular, the most signifi cant changes included:

• the recent integration of Oakley has increased significantly the volume of inter-company transactions

from the Manufacturing and Wholesale to the Retail segment, but has diminished the significance of

those transactions for evaluating the performance of the Manufacturing and Wholesale segment;

• the increased use of full profitability measures (i.e. adding manufacturing profit to the retail profit) when

making decisions regarding product and brand allocation within the Retail Distribution segment.

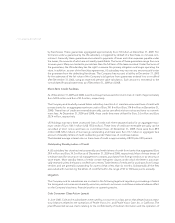

Therefore it is the opinion of management that, for 2009, the prior method for reporting disaggregated

information by business segment is no longer fully aligned with the current method used to review the

information. Accordingly, in 2009 and in compliance with ASC 280 requirements, the Segment Reporting

information has changed as described below. Segment information related to prior periods presented

have been restated in accordance to the new methodology.

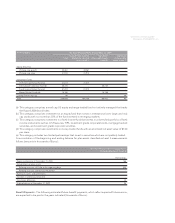

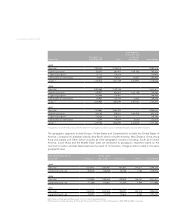

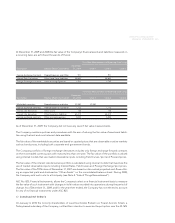

Net sales and income from operations for each reporting segment is calculated as follows:

1. Manufacturing and Wholesale Distribution:

• Net Sales includes sales to third-party customers only; inter-company sales to the Retail Distribution

segment will not be included;

• Therefore, Income from Operations is related to net sales to third-party customers only; the so-called

"manufacturing profit" generated on the inter-company sales to the Retail Distribution segment will

not be included in this segment;

2. Retail Distribution:

• Net sales to the retail consumers are included;

• Income from Operations is related to the retail sales, and includes the cost of goods acquired from

the Manufacturing and Wholesale Distribution segment at manufacturing cost, therefore including

the so-called "manufacturing profit" of those sales, no longer reported under the Manufacturing and

Wholesale Distribution segment’s income from operations;

3. The Inter-Segment Transactions and Corporate Adjustments:

• Net sales become not applicable, since there will be no inter-company sales between the segments.

The sum of third-party wholesale sales and retail sales will match the consolidated net sales figures;

• Income from operations is the sum of the following two different effects, since the profit-in-stock will

not be required to be eliminated in consolidation:

a) corporate costs not allocated to a specific segment;

b) amortization of acquired intangible assets.

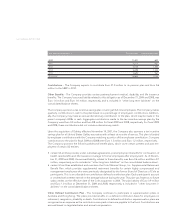

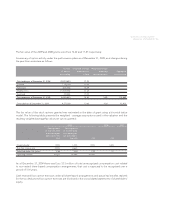

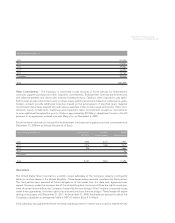

The following tables summarize the segment and geographic information deemed essential by the Com-

pany’s management for the purpose of evaluating the Company’s performance and for making decisions

about future allocations of resources.