LensCrafters 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 75 <

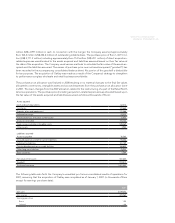

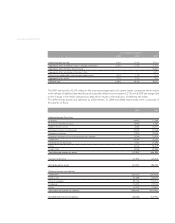

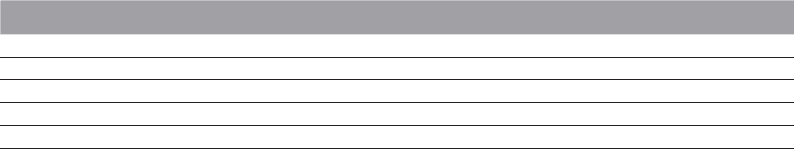

Deferred income tax assets and liabilities have been classifi ed in the consolidated fi nancial statements as

follows:

(Euro 000) 2009 2008

Deferred income tax assets - current 110,910 131,907

Deferred income tax assets - non current 97,437 83,447

Deferred income tax liabilities - current (10,813) -

Deferred income tax liabilities - non current (236,140) (233,551)

Net deferred income tax liabilities (38,605) (18,197)

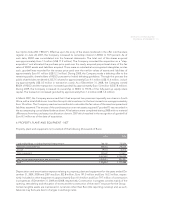

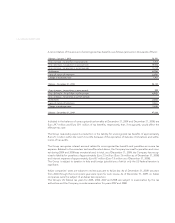

On December 24, 2007, the Italian Government issued the Italian Finance Bill of 2008 (the "2008 Bill"). The

2008 Bill decreases the national tax rate (referred to as "IRES") from 33% to 27.5%, and the regional tax rate

(referred to as "IRAP") from 4.25% to 3.9%. The effect of this change created an additional Euro 8 million

of deferred tax expense in 2007.

The Company does not provide for an accrual for income taxes on undistributed earnings of its non Italian

operations to the related Italian parent company that are intended to be permanently invested. It is not

practicable to determine the amount of income tax liability that would result had such earnings actually

been distributed. In connection with the 2009 earnings of certain subsidiaries, the Company has provided

for an accrual for income taxes related to declared dividends of earnings.

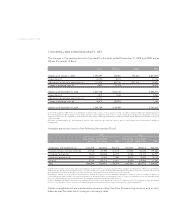

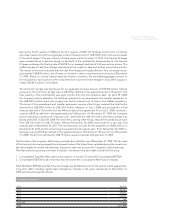

At December 31, 2009, a US subsidiary of the Company had federal net operating loss carry-forwards

(NOLs) of approximately Euro 94.2 million which may be used against income generated by certain subsidi-

ary groups. Substantially all of the NOLs begin expiring in 2019. Approximately Euro 235.8 thousand and

Euro 231.1 thousand of these NOLs were used in each of 2009 and 2008, respectively. The use of the NOL

is limited due to restrictions imposed by US tax rules governing utilization of loss carry-forwards following

changes in ownership. Approximately Euro 341.2 thousand of the net operating losses expired in 2009 and

none expired in 2008. As of December 31, 2009, a US subsidiary of the Company had various state net

operating loss carry-forwards (SNOLs), associated with individual states within the United States of America

totaling approximately Euro 3.1 million. In 2009, approximately Euro 895.9 thousand of the SNOLs expired.

The remaining SNOLs as of December 31, 2009, begin expiring in 2012. Due to the foreign operations of

the US subsidiary, as of December 31, 2009, such US subsidiary of the Company has approximately Euro

4.8 million of non-US net operating losses and foreign tax credit carry-forwards, respectively. These foreign

NOLs will begin to expire in 2012.

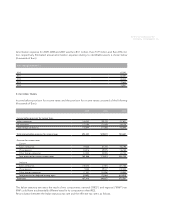

At December 31, 2009 other foreign subsidiaries of the Company located outside the US had NOLs of

approximately Euro 66.8 million. These NOLs expires in different years between 2010 and 2014.

As of December 31, 2009 and 2008, the Company has recorded an aggregate valuation allowance of Euro

21.5 million and Euro 24.1 million, respectively, against deferred tax assets as it is more likely than not that

the above deferred income tax assets will not be fully utilized in future periods. The amount of valuation

allowance that would be allocated directly to capital in future periods, if reversed, is not material.