LensCrafters 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

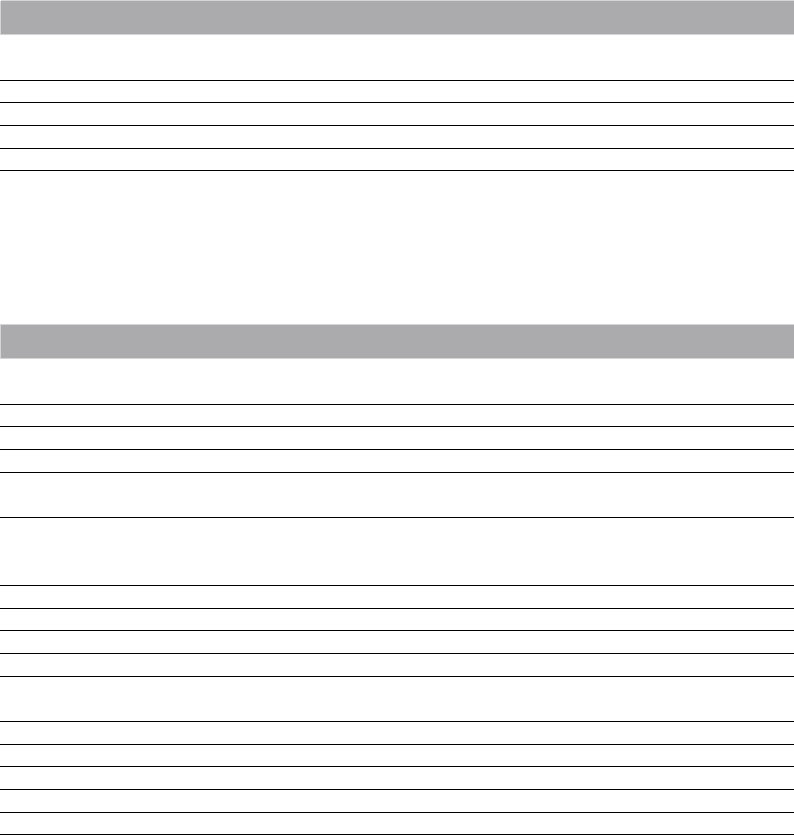

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 73 <

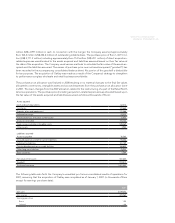

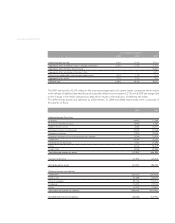

Amortization expense for 2009, 2008 and 2007 was Euro 83.1 million, Euro 73.9 million and Euro 69.6 mil-

lion, respectively. Estimated annual amortization expense relating to identifiable assets is shown below

(thousands of Euro):

Years ending December 31,

2010 83,593

2011 82,457

2012 80,445

2013 79,640

2014 74,907

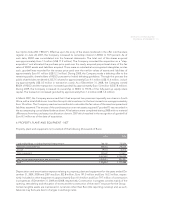

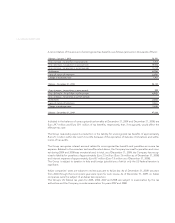

8. INCOME TAXES

Income before provision for income taxes and the provision for income taxes consisted of the following

(thousands of Euro):

2009 2008 2007

Income before provision for income taxes

Italian companies 185,243 199,793 317,637

US companies 153,396 172,609 319,154

Other foreign companies 155,644 217,468 143,890

Total income before provision for income taxes 494,283 589,870 780,681

Provision for income taxes

Current

Italian companies 79,465 87,333 156,198

US companies 48,016 29,975 116,785

Other foreign companies 42,404 55,985 61,742

Total provision for current income taxes 169,886 173,293 334,725

Deferred

Italian companies (10,570) (7,757) (47,736)

US companies 9,288 39,517 (10,592)

Other foreign companies (1,187) (10,396) (2,896)

Total provision for deferred income taxes (2,469) 21,364 (61,224)

Total taxes 167,416 194,657 273,501

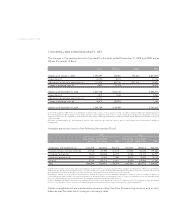

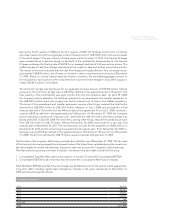

The Italian statutory tax rate is the result of two components: national ("IRES") and regional ("IRAP") tax.

IRAP could have a substantially different base for its computation than IRES.

Reconciliation between the Italian statutory tax rate and the effective tax rate is as follows: