LensCrafters 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 65 <

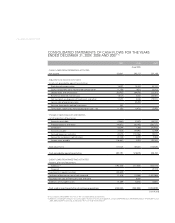

2009 2008 2007

Weighted average shares outstanding - basic 457,270,491 456,563,502 455,184,797

Effect of dilutive stock options 672,127 1,153,542 3,345,812

Weighted average shares outstanding - dilutive 457,942,618 457,717,044 458,530,609

Options not included in calculation of dilutive shares as the

exercise price was greater than the average price during the

respective period or performance measures related to the

awards have not yet been met 17,456,736 18,529,635 4,947,775

Stock-Based Compensation - Stock-based compensation represents the cost related to stock-based awards

granted to employees. Stock-based compensation cost is measured at grant date based on the estimated

fair value of the award and recognizes the cost on a straight-line basis (net of estimated forfeitures) over

the employee requisite service period. The fair value of stock options is estimated using a binomial lattice

valuation technique. Deferred tax assets are recorded for awards that result in deductions on income tax

returns, based on the amount of compensation cost recognized and the statutory tax rate in the jurisdic-

tion in which the deduction will be received. Differences between the deferred tax assets recognized for

fi nancial reporting purposes and the actual tax deduction reported on the income tax return are recorded

in Additional Paid-In Capital (if the tax deduction exceeds the deferred tax asset) or in the consolidated

statements of income (if the deferred tax asset exceeds the tax deduction and no additional paid-in capital

exists from previous awards).

Derivative Financial Instruments - Derivative fi nancial instruments are accounted for in accordance with

ASC No. 815, Derivatives and Hedging.

ASC No. 815 requires that all derivatives, whether or not designed in hedging relationships, be recorded

on the balance sheet at fair value regardless of the purpose or intent for holding them. If a derivative is

designated as a fair-value hedge, changes in the fair value of the derivative and the related change in the

hedge item are recognized in operations. If a derivative is designated as a cash-fl ow hedge, changes in the

fair value of the derivative are recorded in other comprehensive income/(loss) ("OCI") in the consolidated

statements of shareholders’ equity and are recognized in the consolidated statements of income when the

hedged item affects operations. The Company records hedge ineffectiveness as gains or losses in the con-

solidated statements of income in their respective measurement periods. The effect of these derivatives

in the consolidated statements of income depends on the item hedged (for example, interest rate hedges

are recorded in interest expense). For a derivative that does not qualify as a hedge, changes in fair value

are recognized in the consolidated statements of income, under the caption "Other - net".

Designated hedging instruments and hedged items qualify for hedge accounting only if there is a formal

documentation of the hedging relationship at the inception of the hedge, the hedging relationship is

expected to be highly effective and effectiveness is tested at the inception date and at least every three

months.

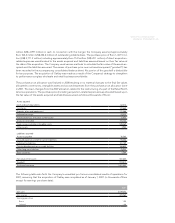

Certain transactions and other future events, such as (i) the derivative no longer effectively offsetting

changes to the cash fl ow of the hedged instrument, (ii) the expiration, termination or sale of the derivative,

or (iii) any other reason of which the Company becomes aware that the derivative no longer qualifi es as a

cash fl ow hedge, would cause the balance remaining in other comprehensive income to be realized into

earnings prospectively. Based on current interest rates and market conditions, the estimated aggregate

amount to be recognized into earnings as additional expense from other comprehensive income relating

to these cash fl ow hedges in fi scal 2010 is approximately Euro 23.2 million, net of taxes.

Luxottica Group uses derivative fi nancial instruments, principally interest rate and currency swap agree-

ments, as part of its risk management policy to reduce its exposure to market risks from changes in interest