LensCrafters 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 76 | ANNUAL REPORT 2009

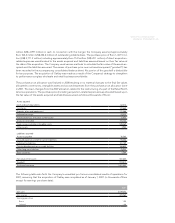

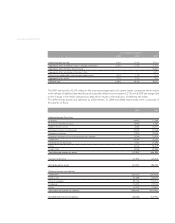

A reconciliation of the amount of unrecognized tax benefi ts is as follows (amounts in thousands of Euro):

Balance - January 1, 2008 56,591

Gross increase - tax positions in prior periods 4,910

Gross decrease - tax positions in prior periods (9,356)

Gross increase - tax position in current periods 13,139

Settlements (6,756)

Lapse of statute of limitations (2,296)

Change in exchange rates 1,901

Balance - December 31, 2008 58,133

Gross increase - tax positions in prior periods 999

Gross decrease - tax positions in prior periods (6,692)

Gross increase - tax position in current periods

Settlements (2,685)

Lapse of statute of limitations (1,261)

Change in exchange rates (1,426)

Balance - December 31, 2009 47,068

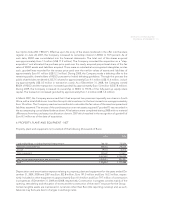

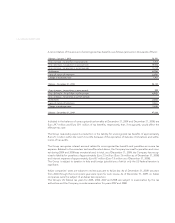

Included in the balance of unrecognized tax benefi ts at December 31, 2009 and December 31, 2008, are

Euro 29.7 million and Euro 39.1 million of tax benefi ts, respectively, that, if recognized, would affect the

effective tax rate.

The Group reasonably expects a reduction in the liability for unrecognized tax benefi ts of approximately

Euro 25.1 million within the next 12 months because of the expiration of statutes of limitations and settle-

ments of tax audits.

The Group recognizes interest accrued related to unrecognized tax benefi ts and penalties as income tax

expense. Related to the uncertain tax benefi ts noted above, the Company’s accrual for penalties and inter-

est during 2009 and 2008 was immaterial and, in total, as of December 31, 2009, the Company has recog-

nized a liability for penalties of approximately Euro 2.5 million (Euro 3.6 million as of December 31, 2008)

and interest expense of approximately Euro 8.7 million (Euro 7.5 million as of December 31, 2008).

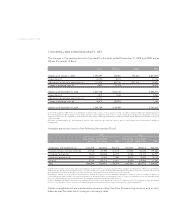

The Group is subject to taxation in Italy and foreign jurisdictions of which only the US federal taxation is

signifi cant.

Italian companies’ taxes are subject to review pursuant to Italian law. As of December 31, 2009, tax years

from 2004 through the most recent year were open for such review. As of December 31, 2009, no Italian

companies were the subject of an Italian tax inspection.

The Group’s US federal tax years for 2005, 2006, 2007 and 2008 are subject to examination by the tax

authorities and the Company is under examination for years 2007 and 2008.