LensCrafters 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.> 66 | ANNUAL REPORT 2009

and foreign exchange rates. Although it has not done so in the past, the Company may enter into other

derivative fi nancial instruments when it assesses that the risk can be hedged effectively.

Defi ned Benefi t Pension Plans - The funded status of the Company’s defi ned benefi t pension plans is

recognized in the consolidated statements of income. The funded status is measured as the difference

between the fair value of plan assets and the benefi t obligation at December 31, the measurement date.

For defi ned benefi t pension plans, the benefi t obligation is the projected benefi t obligation ("PBO"),

which represents the actuarial present value of benefi ts expected to be paid upon retirement based on

estimated future compensation levels. The fair value of plan assets represents the current market value

of cumulative company and participant contributions made to an irrevocable trust fund, held for the sole

benefi t of participants, which are invested by the trust fund. Overfunded plans, with the fair value of plan

assets exceeding the benefi t obligation, are aggregated and recorded as a prepaid pension asset equal

to this excess. Underfunded plans, with the benefi t obligation exceeding the fair value of plan assets, are

aggregated and recorded as a retirement benefi t obligation equal to this excess. The current portion of

the retirement benefi t obligations represents the actuarial present value of benefi ts payable in the next 12

months exceeding the fair value of plan assets, measured on a plan-by-plan basis.

Net periodic pension benefi t cost/(income) is recorded in the consolidated statements of income and

includes service cost, interest cost, expected return on plan assets, amortization of prior service costs/

(credits) and (gains)/losses previously recognized as a component of gains and (losses) not affecting re-

tained earnings and amortization of the net transition asset remaining in accumulated gains and (losses)

not affecting retained earnings. Service cost represents the actuarial present value of participant benefi ts

earned in the current year. Interest cost represents the time value of money associated with the passage

of time. Certain events, such as changes in employee base, plan amendments and changes in actuarial

assumptions, result in a change in the benefi t obligation and the corresponding change in the gains and

(losses) not affecting retained earnings. The result of these events is amortized as a component of net

periodic cost/(income) over the service lives of the participants.

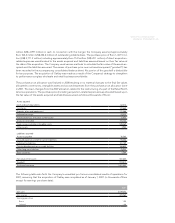

Fair Value - Effective January 1, 2008, the Company adopted ASC No. 820, Fair Value Measurements and

Disclosures, and ASC No. 825, Financial Instruments. ASC No. 820 does not require new fair value measure-

ments but clarifi es the defi nition, method, and disclosure requirements of previously issued standards that

address fair value measurements. ASC No. 820 establishes a defi nition of fair value (based on an exit price

model), establishes a framework for measuring fair value, defi nes disclosures about fair value measurements

and defi nes exceptions to the fair value model (for example, leases and lease transactions). The Company

adopted ASC No. 820 (previously referred to as FASB Statements No.157 and No. 159 including amend-

ments and interpretations) in two steps: effective January 1, 2008 for all fi nancial instruments and non-fi nancial

instruments that are accounted for at fair value on a recurring basis, and effective January 1, 2009 for all other

non-fi nancial instruments (see Note 16). ASC No. 825 allows the Company to elect and record at fair value

many fi nancial assets and liabilities and certain other items with the change being recorded in earnings. This

can be done on an instrument by instrument basis in most circumstances, is irrevocable after elected for that

instrument and must be applied to the entire instrument. The adoption of both of these standards did not

have a material effect on the consolidated fi nancial statements. See Note 16.

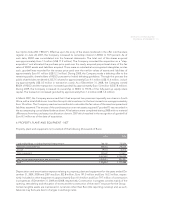

Reclassifi cations - The presentation of certain prior year information has been reclassifi ed to conform to the

current presentation. In particular the Group made the following reclassifi cations:

1. Euro 16.9 million have been reclassified from "Other long term liabilities" into "Other" within "Accrued

expenses in current liabilities";

2. Euro 6.3 million have been reclassified from "Selling and Advertising" into "Cost of Sales";

3. Euro 30.6 million have been reclassified from "Selling and Advertising expenses" into "General and

Administrative expenses".