LensCrafters 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 77 <

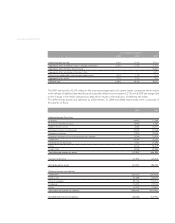

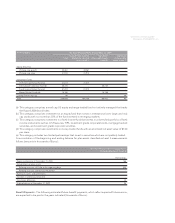

9. LONG-TERM DEBT

Long-term debt consists of the following:

(Euro 000) December 31,

2009 2008

Luxottica Group S.p.A. credit agreement

with various fi nancial institutions (a) 550,000 400,000

Senior unsecured guaranteed notes (b) 199,501 213,196

Credit agreement with various fi nancial institutions (c) 751,765 1,001,403

Other loans with banks and other third parties, interest

at various rates, payable in installments through 2014 (d) 4,180 4,314

Credit agreement with various fi nancial institution

for Oakley Acquisition (e) 1,064,052 1,185,482

Capital lease obligations, payable in installments through 2010 970 1,107

Total 2,570,469 2,805,502

Current maturities 166,279 286,213

Long-term debt 2,404,189 2,519,289

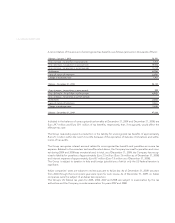

(a) In September 2003, the Company acquired its ownership interest of OPSM for an aggregate of AUD

442.7 million (Euro 253.7 million), including acquisition expenses. The purchase price was paid for with

the proceeds of a credit facility with Banca Intesa S.p.A. of Euro 200 million, in addition to other short-

term lines available. The credit facility included a Euro 150 million term loan, which required repayment

of equal semi-annual installments of principal of Euro 30 million starting on September 30, 2006 until

the final maturity date. Interest accrued on the term loan at EURIBOR (as defined in the agreement)

plus 0.55 percent. The revolving loan provided borrowing availability of up to Euro 50 million; amounts

borrowed under the revolving portion could be borrowed and repaid until final maturity. Interest ac-

crued on the revolving loan at EURIBOR (as defined in the agreement) plus 0.55 percent. The Company

could select interest periods of one, two or three months. The final maturity of the credit facility was

September 30, 2008, the credit facility was re-paid in full. The credit facility contains certain financial

and operating covenants. The Company was in compliance with those covenants during 2008, prior to

the final maturity date.

In June 2005, the Company entered into four interest rate swap transactions with various banks with

an aggregate initial notional amount of Euro 120 million which decreased by Euro 30 million every six

months starting on March 30, 2007. These swaps expired on September 30, 2008. The ineffectiveness of

cash flow hedges was tested at the inception date and throughout the year. The results of the tests in-

dicated that the cash flow hedges were highly effective prior to the swap expiration date of September

2008.

In December 2005, the Company entered into an unsecured credit facility with Banca Popolare di Ve-

rona e Novara Soc. Coop. a R.L (LLC). The 18-month credit facility consisted of a revolving loan that

provided borrowing availability of up to Euro 100.0 million. Amounts borrowed under the revolving por-

tion could be borrowed and repaid until final maturity. The final maturity of the credit facility was June

1, 2007. The Company repaid the outstanding amount on the maturity date with the proceeds of a new

unsecured credit facility with Banca Popolare di Verona e Novara Soc. Coop. a R.L. The new 18-month