LensCrafters 2009 Annual Report Download - page 104

Download and view the complete annual report

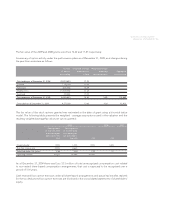

Please find page 104 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.> 102 | ANNUAL REPORT 2009

Texas LensCrafters Class Action Lawsuit

In May 2008, two individual optometrists commenced an action against LensCrafters, Inc. (now Luxottica

Retail North America Inc.) and Luxottica Group S.p.A. in the United States District Court for the Eastern

District of Texas, alleging violations of the Texas Optometry Act ("TOA") and the Texas Deceptive Trade

Practices Act, and tortious interference with customer relations. The suit alleges that LensCrafters has

attempted to control the optometrists’ professional judgment and that certain terms of the optometrists’

sub-lease agreements with LensCrafters violate the TOA. The suit seeks recovery of a civil penalty of up to

US$ 1,000 for each day of a violation of the TOA, injunctive relief, punitive damages, and attorneys’ fees

and costs. In August 2008, plaintiffs filed a first amended complaint, adding claims for fraudulent induce-

ment and breach of contract. In October 2008, plaintiffs filed a second amended complaint seeking to

certify the case as a class action on behalf of all current and former LensCrafters’ sub-lease optometrists.

Luxottica Group S.p.A. filed a motion to dismiss for lack of personal jurisdiction in October 2008. The court

did not address that motion. The case was transferred to the Western District of Texas, Austin Division, in

January 2009, pursuant to the defendants’ motion to transfer venue. On January 11, 2010, plaintiffs filed a

motion requesting that the court permit the case to proceed as a class action on behalf of all optometrists

who sublease from Lenscrafters in Texas.

On February 8, 2010, the parties reached an agreement to settle the litigation on confidential terms. On

March 8, 2010, the court dismissed the case with prejudice. Amounts paid to settle this litigation will not

be material. Costs associated with the litigation for the years ended December 31, 2009 and 2008 were not

material.

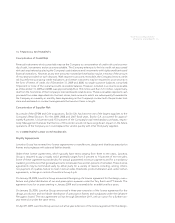

Other

The Company is a defendant in various other lawsuits arising in the ordinary course of business. It is the

opinion of the management of the Company that it has meritorious defenses against all such outstanding

claims, which the Company will vigorously pursue, and that the outcome of such claims, individually or in

the aggregate, will not have a material adverse effect on the Company’s consolidated financial position or

results of operations.

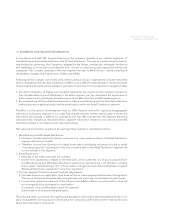

16. FAIR VALUES

Certain assets and liabilities of the Company are recorded at fair value on a recurring basis while others are

recorded at fair value based on specific events. ASC No. 820, Fair Value Measurements and Disclosures,

specifies a hierarchy of valuation techniques consisting of three levels:

• Level1-Inputsarequotedpricesinanactivemarketforidenticalassetsorliabilities

• Level2-Inputsarequotedforsimilarassetsorliabilitiesinanactivemarket,quotedpricesforidenti-

cal or similar assets and liabilities in markets that are not active, inputs other than quoted prices that

are observable (for example interest rates and yield curves observable at common quoted intervals) or

market-corroborated inputs

• Level3-Unobservableinputsusedwhenobservableinputsarenotavailableinsituationswherethereis

little, if any market activity for the asset or liability