LensCrafters 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 68 | ANNUAL REPORT 2009

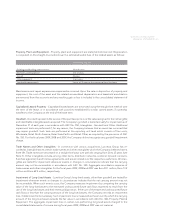

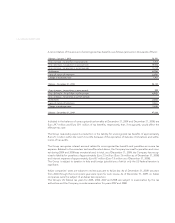

2. RELATED PARTY TRANSACTIONS

Stock Incentive Plan - On September 14, 2004, the Company announced that its majority shareholder,

Mr. Leonardo Del Vecchio, had allocated shares held through La Leonardo Finanziaria S.r.l. (subsequently

merged into Delfi n S.àr.l.), a holding company of the Del Vecchio family, representing at that time 2.11

percent (or 9.6 million shares) of the Company’s authorized and issued share capital, to a stock option plan

for top management of the Company. The stock options to be issued under the stock option plan vested

upon the meeting of certain economic objectives as of June 30, 2006 and, as such, the holders of these

options became entitled to exercise such options beginning on that date until their termination in 2014. In

2009 and 2008, no options from this grant were exercised. In 2007, 400,000 options were exercised.

As of December 31, 2009, total receivables and payables from/to other related parties amounted to Euro

2.5 million and Euro 0.5 million, respectively (Euro 3.6 million and Euro 0.9 million as of December 31, 2008).

The transactions related to the above receivables were immaterial in amount and/or signifi cance to the

Company.

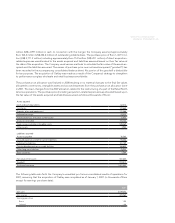

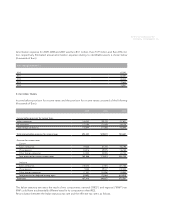

3. INVENTORIES - NET

Inventories - net consisted of the following (thousands of Euro):

2009 2008

Raw materials and packaging 112,760 112,693

Work in process 52,368 48,013

Finished goods 442,813 475,369

Less: Inventory obsolescence reserves (81,393) (65,088)

Total 526,548 570,987

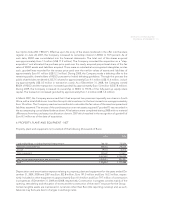

4. SALE OF THINGS REMEMBERED NOTE

On September 29, 2006, the Company sold its Things Remembered ("TR") specialty gifts retail business

to a private equity consortium for net cash consideration of Euro 128.0 million (US$ 162.1 million including

costs of US$ 5.3 million) and a promissory note (the "TR Note") with a principal amount of Euro 20.6 million

(US$ 26.1 million). During 2008, the Company sold the TR Note without recourse to an independent third

party for approximately Euro 1.0 million. The loss on the sale of the note of Euro 22.8 million including Euro

0.4 million previously recorded in accumulated other comprehensive income (loss) was included in other

expense, net in the consolidated statements of income.

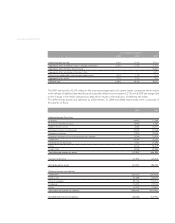

5. ACQUISITIONS AND INVESTMENTS

Acquisitions and investments:

a) Oakley

On June 20, 2007, the Company and Oakley entered into a defi nitive merger agreement with the unanimous

approval of the Boards of Directors of both companies. On November 14, 2007, the merger was consum-

mated, the Company acquired all the outstanding common stock of Oakley which became a wholly-owned

subsidiary of the Company and Oakley’s results of operations began to be included in the consolidated

statements of income of the Company. The aggregate consideration paid by the Company to the former

shareholders, option holders, and holders of other equity rights of Oakley was approximately Euro 1,425.6