LensCrafters 2009 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.> 90 | ANNUAL REPORT 2009

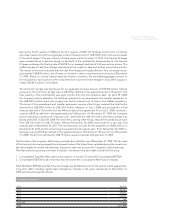

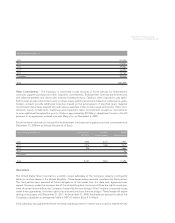

Contributions - The expected contributions for 2010 are expected to be immaterial for both the Company

and aggregate employee participants.

For 2009, a 10.5% (11.0% for 2008) increase in the cost of covered health care benefi ts was assumed. This

rate was assumed to decrease gradually to 5% for 2020 and remain at that level thereafter. The health

care cost trend rate assumption could have a signifi cant effect on the amounts reported. A 1% increase or

decrease in the health care trend rate would not have a material impact on the consolidated fi nancial state-

ments. The weighted-average discount rate used in determining the accumulated postretirement benefi t

obligation was 6.15% at December 31, 2009 and 6.3% at December 31, 2008.

The weighted-average discount rate used in determining the net periodic benefi t cost for 2009 and 2008,

was 6.3%, and 6.5%, respectively.

11.STOCK OPTION AND INCENTIVE PLANS

Stock Option Plan

Beginning in April 1998, certain offi cers and other key employees of the Company and its subsidiaries were

granted stock options of Luxottica Group S.p.A. under the Company’s stock option plans (the "plans"). The

aggregate number of shares permitted to be granted under these plans to the employees is 24,714,600.

The Company believes that the granting of options to these key employees strengthens their loyalty and

recognizes their contribution to the Group’s success. These options become exercisable in either three

equal annual installments, two equal annual installments in the second and third years of the three-year

vesting period or 100 percent vesting on the third anniversary of the date of grant. Certain options may

contain accelerated vesting terms if there is a change in ownership (as defi ned in the plans).

On May 7, 2009, the Board of Directors authorized the reassignment of new options to employees who

were then benefi ciaries of the Company’s 2006 and 2007 ordinary plans, which, considering market condi-

tions and the fi nancial crisis, had an exercise price that was undermining the performance incentives that

typically form the foundation of these plans. The new options’ exercise price was consistent with the market

values of Luxottica shares being equal to the greater of the stock price on the grant date of the new op-

tions or the previous 30 day average. In connection with the reassignment of options, the employees who

surrendered their options, received new options to purchase the same number of Luxottica Group ordinary

shares that were subject to the options he or she previously held for a total amount of 2,885,000 options.

For the new options assigned to the US benefi ciaries of the 2006 and 2007 plans, the Company recognized

an incremental fair value per share of Euro 2.16 and Euro 2.20 respectively. For the new options assigned

to the non-US benefi ciaries of the 2006 and 2007 plans, the Company recognized an incremental fair value

per share of Euro 2.68 and Euro 2.77 respectively.

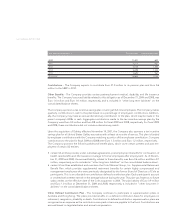

The Company adopted, ASC 718, Stock Compensation (formerly SFAS No. 123(R), Share-Based Payment)

as of January 1, 2006, and at such point began expensing stock options over their requisite service period

based on their fair value as of the date of grant. For the years ended December 31, 2009, 2008 and 2007,

Euro 8.5 million, Euro 7.5 million and Euro 7.8 million, respectively, of compensation expense has been

recorded for these plans.

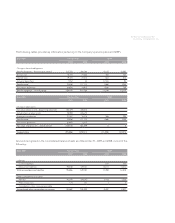

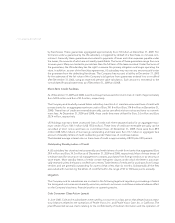

A summary of option activity under the plans as of December 31, 2009, and changes during the year then

ended is as follows: