LensCrafters 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 94 | ANNUAL REPORT 2009

12. SHAREHOLDERS' EQUITY

In October 2009 and May 2008, the Company’s Shareholders Meetings approved cash dividends of Euro

100.8 million and 223.6 million, respectively. These amounts became payable in November 2009 and May

2008, respectively. Italian law requires that fi ve percent of net income be retained as a legal reserve until

this reserve is equal to one-fi fth of the issued share capital. As such, this legal reserve is not available for

dividends to the shareholders. Legal reserves of the Italian entities included in retained earnings were Euro

5.6 million and Euro 5.6 million at December 31, 2009 and 2008, respectively.

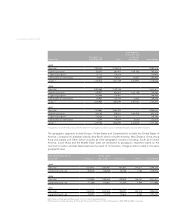

Luxottica Group’s legal reserve roll-forward for fi scal period 2007-2009 is detailed as follows (thousands of

Euro):

January 1, 2007 5,513

Increase in fi scal year 2007 23

December 31, 2007 5,536

Increase in fi scal year 2008 18

December 31, 2008 5,554

Increase in fi scal year 2009 7

December 31, 2009 5,561

Previously the Board of Directors authorized US Holdings to repurchase through the open market up to

21,500,000 ADRs of Luxottica Group S.p.A., representing at that time approximately 4.7 percent of the

authorized and issued share capital. As of December 31, 2004, both repurchase programs expired and US

Holdings purchased 6,434,786 ADRs (1,911,700 in 2002 and 4,523,786 in 2003) at an aggregate purchase

price of Euro 70.0 million (US$73.8 million translated at the exchange rate at the time of the transactions).

On November 13, 2009, the share buyback program approved at the stockholders’ meeting on May 13,

2008 expired. The 2008 program provided for the buyback of a maximum of 18,500,000 of the Company’s

ordinary shares for a period of 18 months. Under the 2008 program, launched on September 21, 2009, the

Company purchased an aggregate amount of 1,325,916 ordinary shares on the Milan Stock Exchange’s

Mercato Telematico Azionario (MTA) at an average unit price of Euro 17.13, for an aggregate amount of

Euro 22,714,251.

On November 13, 2009, the Company announced the launch on November 16, 2009 of the new share buy-

back program approved at the stockholders’ meeting on October 29, 2009, which, like the 2008 program, is

intended to provide the Company with treasury shares to effi ciently manage its share capital and to imple-

ment its Performance Shares Plan. The 2009 program provides for the buyback of a maximum of 18,500,000

of the Company’s ordinary shares. Under the 2009 program the Company purchased an aggregate amount

of 1,352,154 ordinary shares on the MTA at an average unit price of Euro 17.13, for an aggregate amount

of Euro 23,166,430.

In parallel with the purchases of shares by the Company, Arnette Optic Illusions, Inc. ("Arnette") sold on

the MTA 2,764,824 Luxottica Group shares at an average unit price of Euro 17.25, for an aggregate amount

of Euro 47,683,618. Arnette intends to sell the remaining 3,669,962 Luxottica Group shares it still owned as

of December 31, 2009.

The shares still owned by Arnette and by the Company are classifi ed as treasury shares in the Company’s

consolidated fi nancial statements. The market value of these shares based on the share price as listed on

the Milan Stock Exchange at December 31, 2009, is approximately Euro 115.1 million.