LensCrafters 2009 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Please note that in order for ADS holder to take advantage of the accelerated tax refund (Quick Refund),

the certifi cation by the respective Tax Authority must be dated before May 27, 2010 (the dividend payment

date in Euro) and Deutsche Bank Trust Company Americas or Deutsche Bank S.p.A. should receive the

certifi cation on or before September 20, 2010 for Deutsche Bank Trust Company Americas or September

29, 2010 for Deutsche Bank S.p.A.

The Company recommends to all ADS holders who are interested in taking advantage of such an oppor-

tunity to request more detailed information as to the exact procedure to be followed from Deutsche Bank

Trust Company Americas (ADR Department, telephone +1-800-876-0959; fax +1-866-888-1120, attn. Gina

Seroda) or directly from the Company’s headquarters in Italy (Investor Relations Department, tel. +39 02

86334718; fax +39 02 86334092).

ADS holders are further advised that once the amounts withheld are paid to the Italian tax authority, the

ADS holders who are entitled to a reduced tax rate may only apply to the Italian tax authority to receive

the reimbursement of the excess tax applied to the dividends received from the Company. Such procedure

customarily takes years before the reimbursement is actually made. Therefore, the above-mentioned pro-

cedure for direct application of the reduced withholding rate was established by the Company in the best

interest of its stockholders.

STATEMENT OF THE OFFICER RESPONSIBLE FOR PREPARING

THE COMPANY’S FINANCIAL REPORTS

The offi cer responsible for preparing the Company’s fi nancial reports, Enrico Cavatorta, declares, pursu-

ant to Article 154-bis, Section 4, of the Consolidated Law on Finance, that the accounting information

contained in this report is consistent with the data in the supporting documents, books of accounts and

other accounting records.

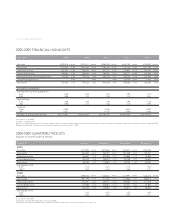

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 107 <