LensCrafters 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.> 92 | ANNUAL REPORT 2009

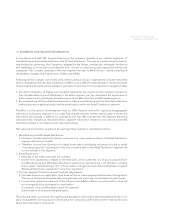

ures were met over the period ending December 2006. For the years ended December 31, 2009, 2008 and

2007 Euro 0.0 million, Euro 0.0 million and Euro 0.2 million, respectively, of compensation expense has

been recorded for this plan.

In September 2004, the Company’s Chairman and majority shareholder, Mr. Leonardo Del Vecchio, al-

located shares held through La Leonardo Finanziaria S.r.l., an Italian holding company of the Del Vecchio

family, representing, at that time, 2.11 percent (or 9.6 million shares) of the Company’s currently authorized

and issued share capital, to a stock option plan for top management of the Company at an exercise price

of Euro 13.67 per share. The stock options to be issued under the stock option plan vested upon meeting

certain economic objectives in June 2006.

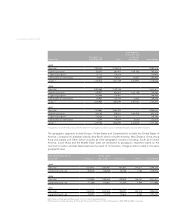

In July 2006, under a Company performance plan, the Company granted options to acquire an aggregate

of 13,000,000 shares of the Company to certain top management positions throughout the Company which

vest and become exercisable as certain fi nancial performance measures are met. On May 7, 2009, the

Board of Directors authorized the reassignment of new options to employees who were then benefi ciaries

of the above Company performance plan, which, considering market conditions and the fi nancial crisis,

had an exercise price that was undermining the performance incentives that typically form the foundation

of these plans. The new options’ exercise price was consistent with the market values of Luxottica shares,

being equal to the greater of the stock price on the grant date of the new options or the previous 30 day

average. In connection with the reassignment of options the employees who surrendered their options, re-

ceived new options to purchase the same number of Luxottica Group ordinary shares that were subject to

the options he or she previously held pursuant to the above-mentioned grant, reduced by 50%, for a total

amount of 5,700,000 options. Upon vesting, the employee will be able to exercise such options until they

expire in 2018. Currently it is expected that these performance conditions will be met. If these performance

measures are not expected to be met, no additional compensation costs will be recognized and previous

compensation costs recognized will be reversed. For the years ended December 31, 2009, 2008 and 2007,

Euro 3.4 million, Euro 3.0 million and Euro 34.1 million, respectively, of compensation expense has been

recorded for these plans.

There were no performance grants issued in 2007. The weighted average grant-date fair value of options

granted during the year 2009 was Euro 5.07.

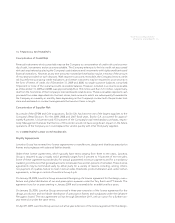

In May 2008, a Performance Shares Plan for top managers within the Group as identifi ed by the Board of Di-

rectors of the Group (the "Board") (the "2008 PSP") was adopted. The 2008 PSP is intended to strengthen

the loyalty of the Group’s key employees and to recognize their contribution to the Group’s success on a

medium-to long-term basis. The benefi ciaries of the 2008 PSP are granted the right to receive ordinary

shares, without consideration, at the end of the three-year vesting period, and subject to achievement

of certain fi nancial target as defi ned by the Board. The 2008 PSP has a term of fi ve years, during which

time the Board may resolve to issue different grants to the 2008 PSP’s benefi ciaries. The 2008 PSP covers

a maximum of 6,500,000 ordinary shares. Each annual grant will not exceed 2,000,000 ordinary shares. On

May 13, 2008, the Board granted 1,003,000 rights to receive ordinary shares. The rights can be increased

up to 1,203,600 provided that at the end of the three year period (2008/2010) the performance targets

as defi ned by the plan will be achieved. Management believes that, based on the current estimates, the

Group performance targets as defi ned by the plan will not be achieved. Accordingly, no compensation

expense has been recorded in 2009 and 2008 for this plan.

Pursuant to the PSP plan adopted in 2008, on May 7, 2009, the Board of Directors granted certain of our

key employees 1,435,000 rights to receive ordinary shares ("PSP 2009"). The rights can be increased up to

1,793,750 provided that at the end of the three year period (2009/2011), the performance targets as defi ned

by the plan will be achieved. For the year ended December 31, 2009, Euro 4.4 million of compensation

expense has been recorded for this plan.