LensCrafters 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 67 <

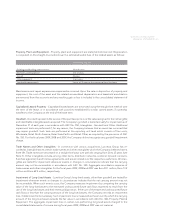

Recent Accounting Pronouncements

In January 2010, the FASB issued ASU 2010-6, Improving Disclosures About Fair Value Measurements,

which requires reporting entities to make new disclosures about recurring or nonrecurring fair-value meas-

urements including signifi cant transfers into and out of Level 1 and Level 2 fair-value measurements and

information on purchases, sales, issuances, and settlements on a gross basis in the reconciliation of Level

3 fair-value measurements. ASU 2010-6 is effective for annual reporting periods beginning after December

15, 2009, except for Level 3 reconciliation disclosures which are effective for annual periods beginning after

December 15, 2010. The Company does not expect the adoption of ASU 2010-6 to have a material impact

on the consolidated fi nancial statements.

The FASB issued FASB ASC effective for fi nancial statements issued after September 15, 2009. The ASC is

an aggregation of previously issued guidance reorganized into subject areas. All other literature or guid-

ance not included in the codifi cation becomes "non-authoritative". Upon adoption, the Company did not

have non-authoritative adjustments. Subsequent revisions to the codifi cation will be incorporated through

Accounting Standards Updates ("ASU").

In September 2009, the FASB issued ASU 2009-12 "Fair Value Measurements and Disclosures of (Topic

820) - Investments in Certain Entities that Calculate Net Asset Value per Share (or its equivalent)" which

provides guidance on measuring fair value of certain alternative investments including proper disclosure.

If the investment qualifi es, the Company may use the net asset value as an estimate of its fair value. The

Company adopted this standard in the fourth quarter of 2009 and the adoption did not have a material

impact on the consolidated fi nancial statements.

In August 2009, FASB issued ASU 2009-05 "Fair Value Measurements and Disclosures of (Topic 820) - Measuring

Liabilities at Fair Value" which provides clarifi cation for the fair value measurements of certain liabilities and ac-

ceptable techniques to do so. It also confi rmed that certain of these techniques should be considered as Level

1 fair value measurements. The guidance is effective in the fi rst reporting period beginning after issuance.

In December 2009, the FASB issued Accounting Standards Update ("ASU") 2009-17, which codifi es SFAS

No. 167, Amendment to FASB interpretation No. 46 (R), issued in June 2009. ASU 2009-17 requires a quali-

tative approach to identify a controlling fi nancial interest in a variable interest entities ("VIE"), and requires

ongoing assessment to whether an entity is a VIE and whether an interest in a VIE makes the holder the

primary benefi ciary of the VIE. ASU 2009-17 is effective for annual reporting periods beginning after No-

vember 15, 2009. The Company does not expect the adoption of ASU 2009-17 to have a material impact

on the consolidated fi nancial statements.

In December 2008, the FASB issued ASC No. 715, Retirement Benefi ts Topic (formerly FSP 132(R)-1, Em-

ployer’s Disclosures About Postretirement Benefi t Plan Assets), which requires enhanced disclosures on

plan assets, including fair value measurements and categories of assets, investment policies and strategies,

and disclosures on concentration of risks. The enhanced disclosures are provided in Note 10. The disclo-

sure requirements are not required for earlier periods that are presented for comparative purposes.

In December 2007, an update was made to ASC No. 810, Consolidation, (formerly FASB Statement No.

160) establishing new accounting and reporting standards for noncontrolling interests (formerly known as

"minority interests") in a subsidiary and, when applicable, how to account for the deconsolidation of such

subsidiary. The key differences include that non-controlling interests will be recorded as a component of

equity, the consolidated income statements and statements of comprehensive income will be adjusted

to include the non-controlling interest and certain disclosures have been updated. Beginning January 1,

2009, Luxottica applied the new guidance to its accounting for noncontrolling interests and its fi nancial

statement disclosures. The provisions of the new guidance have been applied to all periods presented in

the accompanying consolidated fi nancial statements.