LensCrafters 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 69 <

million (US$ 2,091 million) in cash. In connection with the merger, the Company assumed approximately

Euro 166.6 million (US$ 244.4 million) of outstanding indebtedness. The purchase price of Euro 1,441.5 mil-

lion (US$ 2,111.2 million) including approximately Euro 15.9 million (US$ 20.1 million) of direct acquisition-

related expenses was allocated to the assets acquired and liabilities assumed based on their fair value at

the date of the acquisition. The Company used various methods to calculate the fair value of the assets ac-

quired and the liabilities assumed. The excess of purchase price over net assets acquired ("goodwill") has

been recorded in the accompanying consolidated balance sheet. No portion of this goodwill is deductible

for tax purposes. The acquisition of Oakley was made as a result of the Company’s strategy to strengthen

its performance sunglass wholesale and retail businesses worldwide.

The purchase price allocation was finalized in 2008 resulting in no material changes to the final fair values

allocated to inventories, intangible assets and accrued expenses from the purchase price allocation done

in 2007. The main changes from the 2007 allocation related to the restructuring of a part of the Retail North

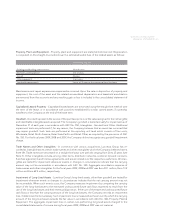

America operations. The purchase price (including acquisition-related expenses) was allocated based upon

the fair value of the assets acquired and liabilities assumed as follows (thousands of Euro):

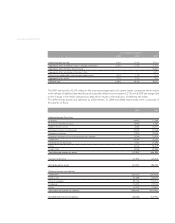

Assets aquired

Cash and cash equivalents 62,310

Inventories 122,668

Property, plant and equipment 131,466

Deferred tax assets 43,425

Prepaid expenses and other current assets 10,850

Accounts receivable 104,740

Trade names and other intangible assets 538,469

Other assets 3,985

Liabilities assumed

Accounts payable 36,560

Accrued expenses and other current liabilities 93,586

Deferred tax liabilities 181,789

Outstanding borrowings on credit facilities 166,850

Other long term liabilities 25,904

Bank overdrafts 5,584

Fair value of net assets 507,640

Goodwill 933,813

Total purchase price 1,441,453

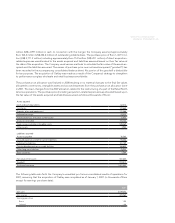

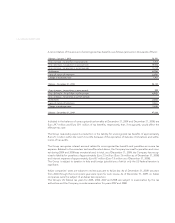

The following table sets forth the Company’s unaudited pro forma consolidated results of operations for

2007, assuming that the acquisition of Oakley was completed as of January 1, 2007 (in thousands of Euro

except for earnings per share data):

2007

Net sales 5,539,000

Net income 470,363

Earnings per share

Basic 1.04

Diluted 1.04