LensCrafters 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.> 106 | ANNUAL REPORT 2009

subject to corporation tax and resident in countries that are members of the European Union (the "EU") or

participants in the European Economic Area (the "EEA") and are included in the list provided for by Italian

Ministerial Decree, September 4, 1996 (as amended and supplemented) (the "Decree"), are entitled to

reduced tax rate of 1.375% on distributions of profi ts for the tax years ending after December 31, 2007; and

(ii) pension funds established in a EU or EEA country included in the list provided for by the Decree, are

entitled to reduced tax rate of 11 percent on profi ts distributed on or after July 29, 2009.

The substitute tax regime does not apply if ordinary shares representing a "non-qualifi ed" interest in Lux-

ottica Group are held by an Italian resident shareholder in a discretionary investment portfolio managed

by an authorized professional intermediary, and the shareholder elects to be taxed at a fl at rate of 12.5

percent on the appreciation of the investment portfolio accrued at year-end (which appreciation includes

any dividends), pursuant to the so-called discretionary investment portfolio regime - regime del risparmio

gestito.

TAX REGIME - HOLDERS OF ADSs

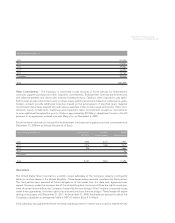

Dividends paid to benefi cial owners who are not Italian residents and do not have a permanent establish-

ment in Italy to which the ADSs are effectively connected are generally subject to a 27.0 percent substitute

tax rate. Accordingly, the amount of the dividend paid to Deutsche Bank Trust Company Americas, as

depositary of the Ordinary Shares and the issuer of the ADSs, through Deutsche Bank S.p.A., as custodian

under the Deposit Agreement, will be subject to such Italian substitute tax. Therefore, the amount of the

dividends that the holders of ADS will initially receive will be net of such Italian substitute tax.

All owners of ADSs will be given the opportunity to submit to Deutsche Bank Trust Company Americas,

in accordance with the procedure set forth by it, the documentation attesting to (i) their residence for tax

purposes in Italy or in countries which have entered into anti-double taxation treaties with the Republic of

Italy, pursuant to which reduced/NIL tax rates may become directly applicable; (ii) their status as companies

or entities subject to corporation tax and resident in a country that is a member of the EU or participants in

the EEA and are included in the list provided for by the Decree, and as such entitled to a reduced tax rate of

1.375 percent on distributions of profi ts of the tax years ending after December 31, 2007; or (iii) their status

as pensions funds established in an EU or EEA country and included in the list provided for by the Decree

and as such entitled to a reduced tax rate of 11 percent on profi ts distributed on or after July 29, 2009.

Concurrently with the delivery of the Proxy Statement, the Depositary has mailed to all ADS holders a

document and necessary forms setting forth the detailed procedure to be used by ADS holders for the

purpose of obtaining the direct application of the reduced tax rate under an applicable tax treaty or under

the Italian domestic law.

As soon as the required documentation is delivered by Deutsche Bank Trust Company Americas to Deut-

sche Bank S.p.A., such bank shall endeavor to effect repayment of the entire 27.0 percent withheld or the

balance between the 27.0 percent withheld at the time of payment and the rate actually applicable to

the non-Italian resident ADS holder under a tax treaty or under the Italian domestic law, as the case may

be. By way of example, Italy and the United States (as well as many other countries) are parties to a tax

treaty pursuant to which the rate of the tax applicable to dividends paid by an Italian resident company to

a US resident entitled to the benefi ts under the treaty may, in certain cases, be reduced to 15.0 percent.

Therefore, US resident ADS holders entitled to the 15.0 percent rate provided by the currently applicable

Italy-United States tax treaty have the opportunity of being repaid a further 12.0 percent of the gross

dividend, that is the difference between the 27.0 percent withheld at the time of payment of the dividend

and the 15.0 percent substitute tax provided for by the Italy-United States tax treaty.