LensCrafters 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.> 82 | ANNUAL REPORT 2009

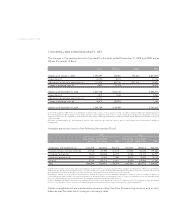

10. EMPLOYEE BENEFITS

Liability for Termination Indemnities

With regards to staff leaving indemnities ("TFR"), Italian law provides for severance payments to employ-

ees upon dismissal, resignation, retirement or other termination of employment. TFR, through December

31, 2006, was considered an unfunded defi ned benefi t plan. Therefore, through December 31, 2006, the

Company accounted for the defi ned benefi t plan in accordance with EITF 88-1, "Determination of Vested

Benefi t Obligation for a Defi ned Benefi t Pension Plan" which is now included in ASC No. 715, using the

option to record the vested benefi t obligation, which is the actuarial present value of the vested benefi ts

to which the employee would be entitled if the employee retired, resigned or were terminated as of the

date of the fi nancial statements.

Effective January 1, 2007, the TFR system was reformed, and under the new law, employees are given the

ability to choose where the TFR compensation is invested, whereas such compensation otherwise would

be directed to the National Social Security Institute or Pension Funds. As a result, contributions under the

reformed TFR system are accounted for as a defi ned contribution plan. The liability accrued until Decem-

ber 31, 2006 continues to be considered a defi ned benefi t plan, therefore each year, the Company adjusts

its accrual based upon headcount and infl ation, excluding changes in compensation level.

There are also some termination indemnities in other countries which are provided through payroll tax and

other social contributions in accordance with local statutory requirements. The related charges to earnings

for the years ended December 31, 2009, 2008 and 2007 were Euro 17.7 million, Euro 17.9 million and Euro

15.4 million, respectively.

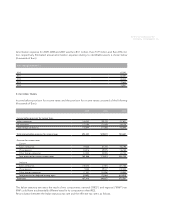

Qualifi ed Pension Plans - During fi scal years 2009, 2008, and 2007, the Company continued to sponsor a

qualifi ed noncontributory defi ned benefi t pension plan, the Luxottica Group Pension Plan ("Lux Plan"),

which provides for the payment of benefi ts to eligible past and present employees of the Company upon

retirement. Pension benefi ts are accrued based on length of service and annual compensation under a

cash balance formula.

Nonqualifi ed Pension Plans and Agreements - The Company also maintains a nonqualifi ed, unfunded

supplemental executive retirement plan ("SERP") for participants of its qualifi ed pension plan to provide

benefi ts in excess of amounts permitted under the provisions of prevailing tax law. The pension liability and

expense associated with this plan are accrued using the same actuarial methods and assumptions as those

used for the qualifi ed pension plan.

The Company sponsors for certain US entities a Supplemental Pension Plan. This plan is a nonqualifi ed

unfunded SERP for certain participants of certain US entities pension plan who were designated by the

Board of Directors of those US entities on the recommendation of former chief executive offi cer of those

US entities at such time. This plan provides benefi ts in excess of amounts permitted under the provisions

of the prevailing tax law. The pension liability and expense associated with this plan are accrued using the

same actuarial methods and assumptions as those used for the qualifi ed pension plan.

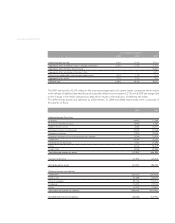

As required by ASC 715-30-35-62 (formerly FASB Statement No. 158), during fi scal 2008 the Company

adopted a December 31 measurement date for the pension and SERP plans. In accordance with such

standard, the Company elected to use prior year measurements to calculate the effect of adoption. As a

result of this change in measurement date, the adjustment to retained earnings net of tax related to the

pension and SERP plans was a decrease of Euro 2.9 million and Euro 0.2 million, respectively. The impact

on accumulated other comprehensive income net of tax related to the pension and SERP plans was an

increase of Euro 0.2 million and Euro 0.0 million, respectively.