LensCrafters 2009 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 93 <

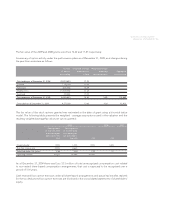

The fair value of the 2009 and 2008 grants were Euro 14.22 and 17.67 respectively.

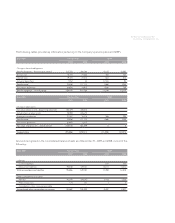

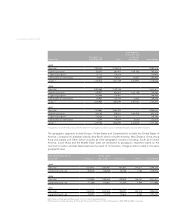

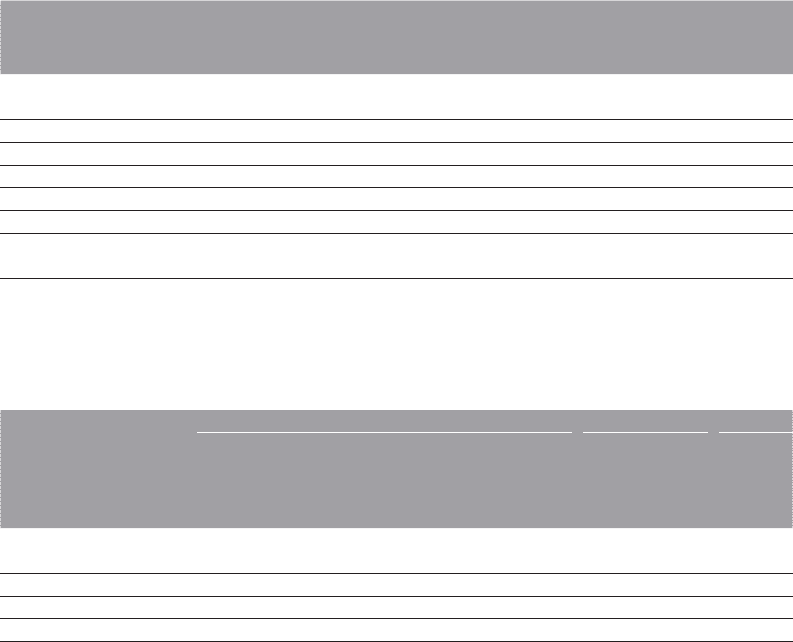

A summary of option activity under the performance plans as of December 31, 2009, and changes during

the year then ended are as follows:

Number

of options

outstanding

Weighted average

exercise price

in Euro

Weighted average

remaining

contractual term

Aggregate

intrinsic value

Outstanding as of December 31, 2008 23,753,600 17.10

Granted 7,135,000 11.08

Forfeitures (478,000) 18.49

Modifi cations (11,400,000) 21.28

Exercised (75,000) 13.33

Outstanding as of December 31, 2009 18,935,600 12.30 5.49 113,689

Exercisable as of December 31, 2009 9,575,000 13.66 4.56 42,920

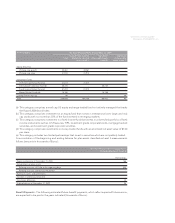

The fair value of the stock options granted was estimated at the date of grant using a binomial lattice

model. The following table presents the weighted - average assumptions used in the valuation and the

resulting weighted average fair value per option granted:

2009 2008 2007

Reassignment

of the STR 2006

plan employees

domiciled in the

USA

Reassignment

of the STR 2006

plan employees

not domiciled in

the USA PSP PSP

Dividend yield 1.43% 1.43% 1.43% 1.65% -

Risk-free interest rate 2.90% 2.66% -

Expected option life (years) 5.65 5.65 3.00 2.1 -

Expected volatility 35.52% 35.59% 43.03% -

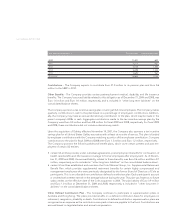

As of December 31, 2009 there was Euro 33.3 million of total unrecognized compensation cost related

to non-vested share-based compensation arrangements; that cost is expected to be recognized over a

period of 3.01 years.

Cash received from option exercises under all share-based arrangements and actual tax benefi ts realized

for the tax deductions from option exercises are disclosed in the consolidated statements of shareholders’

equity.