LensCrafters 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

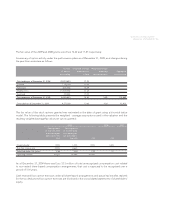

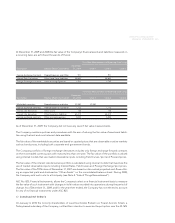

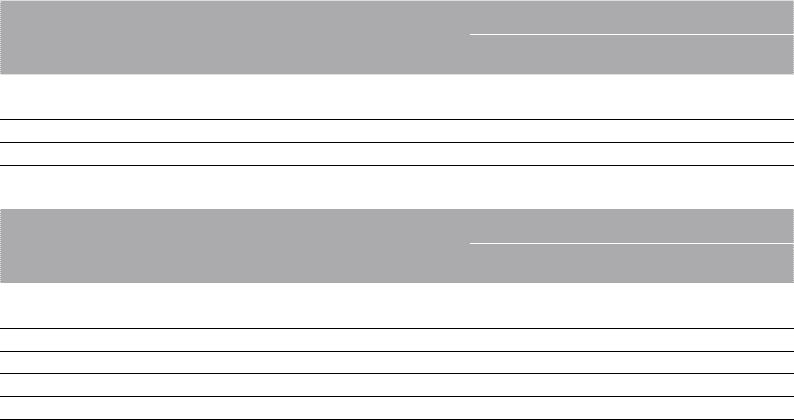

At December 31, 2009 and 2008 the fair value of the Company’s financial assets and liabilities measured on

a recurring basis are as follows (thousands of Euros):

Fair Value Measurements at Reporting Date Using

Description Balance Sheet Classification

December

31, 2009 Level 1 Level 2 Level 3

Foreign Exchange Contracts Prepaid Expenses and Other 971 971

Interest Rate Derivatives Other Long Term Liabilities 48,642 48,642

Foreign Exchange Contracts Other Accrued Expenses 3,705 3,705

Fair Value Measurements at Reporting Date Using

Description Balance Sheet Classification

December

31, 2008 Level 1 Level 2 Level 3

Marketable securities Prepaid expenses and other 23,550 23,550

Foreign exchange contracts Prepaid expenses and other 7,712 7,712

Interest rate derivatives Other assets 138 138

Interest rate derivatives Other long-term liabilities 64,213 64,213

Foreign exchange contracts Other accrued expenses 5,022 5,022

As of December 31, 2009, the Company did not have any Level 3 fair value measurements.

The Company maintains policies and procedures with the aim of valuing the fair value of assets and liabili-

ties using the best and most relevant data available.

The fair value of the marketable securities are based on quoted prices that are observable in active markets

such as bond prices, including both corporate and government bonds.

The Company portfolio of foreign exchange derivatives includes only foreign exchange forward contracts

on the most traded currency pairs with maturity less than one year. The fair value of the portfolio is valued

using internal models that use market observable inputs including Yield Curves, Spot and Forward prices.

The fair value of the interest rate derivatives portfolio is calculated using internal models that maximize the

use of market observable inputs including Interest Rates, Yield Curves and Foreign Exchange Spot prices.

The fair value of the TR Note as of December 31, 2007 was based on discounted projected cash flows utiliz-

ing an expected yield and disclosed as "Other Assets" on the consolidated balance sheet. During 2008,

the Company sold such note to a third party (see Note 4 "Sale of Things Remembered").

ASC No. 825, Financial Instruments, allows the Company to elect on a financial instrument basis to measure

the fair value of such instrument with changes in its fair value recorded into operations during the period of

change. As of December 31, 2009, and for the year then ended, the Company has not elected to account

for any of its financial instruments under ASC 825.

17. SUBSEQUENT EVENTS

On January 4, 2010 the minority shareholders of Luxottica Gözlük Endüstri ve Ticaret Anonim Sirketi, a

Turkey-based subsidiary of the Company, notified their intention to exercise the put option over the 35.16%

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 103 <