LensCrafters 2009 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNEXES | 119 <

• EBITDA does not include interest expense. Because the Company has borrowed money in order to fi-

nance our operations, interest expense is a necessary element of our costs and ability to generate profits

and cash flows. Therefore, any measure that excludes interest expense may have material limitations;

• EBITDA does not include depreciation and amortization expense. Because the Company uses capital

assets, depreciation and amortization expense is a necessary element of our costs and ability to generate

profits. Therefore, any measure that excludes depreciation and expense may have material limitations;

• EBITDA does not include provision for income taxes. Because the payment of income taxes is a neces-

sary element of our costs, any measure that excludes tax expense may have material limitations;

• EBITDA does not reflect cash expenditures or future requirements for capital expenditures or contrac-

tual commitments;

• EBITDA does not reflect changes in, or cash requirements for, working capital needs; and

• EBITDA does not allow the Company to analyze the effect of certain recurring and non-recurring items

that materially affect our net income or loss.

The Company compensates for the foregoing limitations by using EBITDA as a comparative tool, together

with US GAAP measurements, to assist in the evaluation of our operating performance and leverage. See

the following table for a reconciliation of EBITDA to net income, which is the most directly comparable US

GAAP fi nancial measure, as well as the calculation of EBITDA margin on net sales.

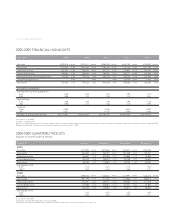

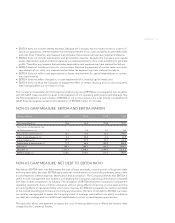

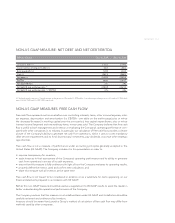

NON-US GAAP MEASURE: EBITDA AND EBITDA MARGIN

(Millions of Euro) 4Q09 4Q08 FY09 FY08

Net income/(loss) (+) 35.6 38.8 314.8 379.7

Net income attributable to non-

controlling interests (+) 1.1 2.6 12.1 15.5

Provision for income taxes (+) 18.1 10.4 167.4 194.7

Other (income)/expense (+) 2.3 33.8 4.2 37.9

Interest expense (+) 19.7 31.9 84.7 122.0

Depreciation & amortization (+) 71.3 68.6 285.9 264.9

EBITDA (=) 148.2 186.1 869.1 1,014.7

Net sales (/) 1,157.1 1,236.5 5,094.3 5,201.6

EBITDA margin (=) 12.8% 15.0% 17.1% 19.5%

NON-US GAAP MEASURE: NET DEBT TO EBITDA RATIO

Net debt to EBITDA ratio: net debt means the sum of bank overdrafts, current portion of long-term debt

and long-term debt, less cash. EBITDA represents net income before non-controlling interests, taxes, other

income/expense, interest expense, depreciation and amortization. The Company believes that EBITDA is

useful to both management and investors in evaluating the Company’s operating performance compared

with that of other companies in its industry. The calculation of EBITDA allows the Company to compare the

operating results with those of other companies without giving effect to fi nancing, income taxes and the

accounting effects of capital spending, which items may vary for different companies for reasons unrelated

to the overall operating performance of a Company’s business. The ratio of net debt to EBITDA is a meas-

ure used by management to assess the Company’s level of leverage, which affects our ability to refi nance

our debt as it matures and incur additional indebtedness to invest in new business opportunities.

The ratio also allows management to assess the cost of existing debt since it affects the interest rates

charged by the Company’s lenders.