LensCrafters 2009 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2009 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 122 | ANNUAL REPORT 2009

The Company recognizes that the usefulness of free cash fl ow as an evaluative tool may have certain limita-

tions, including:

• the manner in which the Company calculates free cash flow may differ from that of other companies,

which limits its usefulness as a comparative measure;

• free cash flow does not represent the total increase or decrease in the net debt balance for the period

since it excludes, among other things, cash used for funding discretionary investments and to pursue

strategic opportunities during the period and any impact of the exchange rate changes;

• free cash flow can be subject to adjustment at the Company’s discretion if the Company takes steps or

adopts policies that increase or diminish its current liabilities and/or changes to working capital; and

• free cash flow includes amounts that are used to cover mandatory debt service and other non-dis-

cretionary requirements and therefore does not represent the residual cash flow available solely for

discretionary expenditures.

The Company compensates for the foregoing limitations by using free cash fl ow as one of several compara-

tive tools, together with US GAAP measurements, to assist in the evaluation of our operating performance.

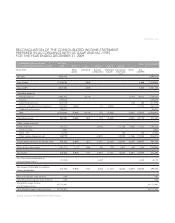

See the following table for a reconciliation of free cash fl ow to EBITDA and the table on the earlier page

for a reconciliation of EBITDA to net income, which is the most directly comparable US GAAP fi nancial

measure.

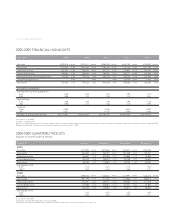

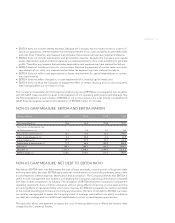

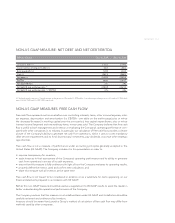

US GAAP MEASURE: FREE CASH FLOW

(Millions of Euro) FY09

EBITDA (1) 869.1

working capital 181.5

Capex (200.4)

Operating cash fl ow 850.2

Financial charges (2) (84.7)

Taxes (70.8)

Extraordinary charges (3) (3.3)

Free cash fl ow 691.4

(1) EBITDA is not a US GAAP measure; please see table on the earlier page for a reconciliation of EBITDA to net income.

(2) Equals interest income minus interest expense.

(3) Equals extraordinary income minus extraordinary expense.