Lenovo 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION & ANALYSIS

2011/12 Annual Report Lenovo Group Limited

26

Inventories

Inventories of the Group maintained at a stable level over the year. The significant increase at March 31, 2012 when

compared to last year represents the inventories brought in by the NEC JV and Medion of US$352 million.

Trade receivables and Notes receivable

Trade receivables and notes receivable increased in line with the increase in activities during the year. The new customers

brought in from the formation of the NEC JV and the acquisition of Medion increased the trade receivables of the Group

by US$723 million.

Deposits, prepayments and other receivables

Majority of other receivables of the Group are amounts due from subcontractors for part components sold in the ordinary

course of business. The 43% increase when compared to the last year is partly due to the new receivable balances from

subcontractors of US$204 million brought in by the NEC JV.

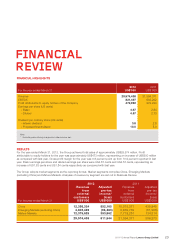

Non-current liabilities 2012 2011

Warranty provision 291,111 395,242

Deferred revenue 381,593 277,205

Retirement benefit obligations 204,818 74,870

Deferred income tax liabilities 83,594 17,093

Other non-current liabilities 641,986 73,976

1,603,102 838,386

Warranty provision

The Group records warranty liabilities at the time of sale for the estimated costs that will be incurred under its basic

limited warranty. The specific warranty terms and conditions vary depending upon the product and the country in which it

was sold, but generally includes technical support, repair parts and labor associated with warranty repair and service

actions. The period ranges from one to three years. The aggregate current and non-current amounts of warranty

provision increased by 46% when compared with last year. The increase is partly attributable to the increase business

activities of the year, and the amounts brought in from the formation of the NEC JV and the acquisition of Medion totaling

US$158 million. The Group reevaluates its estimates on a quarterly basis to assess the adequacy of its recorded warranty

liabilities and adjusts the amounts as necessary.

Retirement benefit obligations

The Group operates various pension schemes. The schemes are generally funded through payments to insurance

companies or trustee-administered funds, determined by periodic actuarial calculations. The Group has both defined

benefit and defined contribution plans. During the year, upon formation of the NEC JV, the Group assumed the cash

balance pension liability and end-of-employment benefit obligation for all employees from the then NEC personal

computer division and pension commitment for the two Medion’s management board members, totaling US$116 million.

Other non-current liabilities

Other non-current liabilities mainly represent the present value of the contingent consideration payable of US$429 million

in connection with the arrangements with the respective former shareholders of NEC JV and Medion with reference to

certain performance indicators.