Lenovo 2012 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2012 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011/12 Annual Report Lenovo Group Limited

124

NOTES TO THE FINANCIAL STATEMENTS

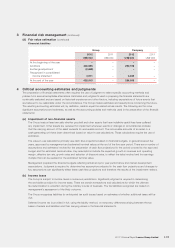

2 Significant accounting policies (continued)

(y) Related party transactions (continued)

(ii) An entity is related to the Group if any of the following conditions applies:

– The entity and the Group are members of the same group (which means that each parent, subsidiary and

fellow subsidiary is related to the others).

– One entity is an associate or joint venture of the other entity (or an associate or joint venture of a member of

a group of which the other entity is a member).

– Both entities are joint ventures of the same third party.

– One entity is a joint venture of a third entity and the other entity is an associate of the third party.

– The entity is a post-employment benefit plan for the benefit of employees of either the Group or an entity

related to the Group.

– The entity is controlled or jointly controlled by a person identified in (i) above.

– A person, or a close member of that person’s family, who has control or joint control over the Group has

significant influence over the entity or is a member of the key management personnel of the entity (or of a

parent of the entity).

(z) Dividend distribution

Dividend distribution to the Company’s shareholders is recognized as a liability in the Group’s and Company’s financial

statements in the period in which the dividends are approved by the Company’s shareholders in case of final dividend

and by the Company’s directors in case of interim dividend.

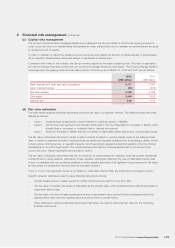

3 Financial risk management

The Group’s activities expose it to a variety of financial risks, such as market risk (including foreign currency risk and cash flow

interest rate risk), credit risk, and liquidity risk. The Group’s overall risk management program focuses on the unpredictability

of financial markets and seeks to minimize potential adverse effects on the Group’s financial performance. The Group uses

derivative financial instruments to hedge certain risk exposures. Risk management is carried out by the centralized treasury

department(“GroupTreasury”).

(a) Financial risk factors

(i) Foreign currency risk

The Group operates internationally and is exposed to foreign currency risk arising from various currency exposures,

primarily with respect to United States dollar, Australian dollar, Canadian dollar, Euro, Japanese Yen, Pound Sterling

and Renminbi. Foreign currency risk arises from future commercial transactions, recognized assets and liabilities

and net investment in foreign operations denominated in a currency that is not the group companies’ functional

currencies.

Management has set up a policy to require group companies to manage their foreign currency risk against their

functional currency. The Group’s forward foreign currency contracts are either used to hedge a percentage of

anticipated cash flows (mainly export sales and purchase of inventories) which are highly probable, or used as fair

value hedges for the identified assets and liabilities.

For segment reporting purposes, external hedge contracts on assets, liabilities or future transactions are

designated to each operating segment, as appropriate.

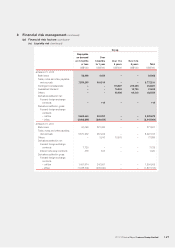

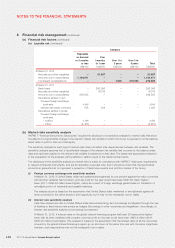

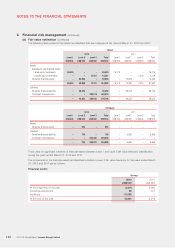

The following tables detail the Group’s and the Company’s exposure at the balance sheet date to currency risk

arising from recognized assets or liabilities denominated in a currency other than the functional currency of the

entity to which they relate, except for the currency risk between United States dollar and Hong Kong dollar given

the two currencies are under the linked exchange rate system. For presentation purposes, the amounts of the

exposure are shown in United States dollars, translated using the spot rate at the balance sheet date. Differences

resulting from the translation of the financial statements of foreign operations into the Group’s presentation

currency are excluded.