Lenovo 2012 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2012 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011/12 Annual Report Lenovo Group Limited

166

NOTES TO THE FINANCIAL STATEMENTS

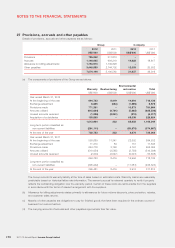

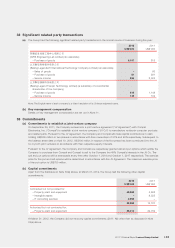

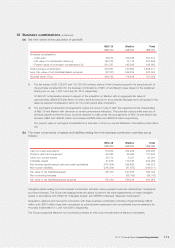

33 Commitments (continued)

(c) Commitments under operating leases

The future aggregate minimum lease payments in respect of land and buildings under non-cancelable operating leases

of the Group are as follows:

2012 2011

US$’000 US$’000

Not later than one year 51,473 36,267

Later than one year but not later than five years 95,452 94,409

Later than five years 38,056 44,268

184,981 174,944

At March 31, 2012, the Company did not have any operating lease commitments (2011: Nil).

34 Contingent liabilities

(a) The Group, in the ordinary course of its business, is involved in various claims, suits, investigations, and legal

proceedings that arise from time to time. Although the Group does not expect that the outcome in any of these other

legal proceedings, individually or collectively, will have a material adverse effect on its financial position or results of

operations, litigation is inherently unpredictable. Therefore, the Group could incur judgments or enter into settlements of

claims that could adversely affect its operating results or cash flows in a particular period.

(b) The Company has executed guarantees with respect to bank facilities made available to its subsidiaries. At March 31,

2012, such facilities granted and utilized amounted to approximately US$2,985,823,000 and US$1,414,442,000 (2011:

US$2,146,903,000 and US$1,249,895,000) respectively.

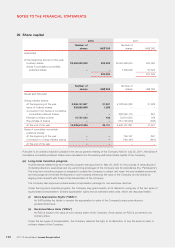

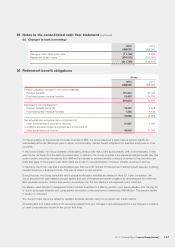

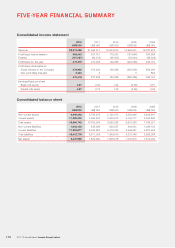

35 Notes to the consolidated cash flow statement

(a) Reconciliation of profit before taxation to net cash generated from operations

2012 2011

US$’000 US$’000

Profit before taxation 582,443 357,751

Share of losses of associates and jointly controlled entities 851 225

Finance income (42,693) (24,927)

Finance costs 43,484 49,176

Depreciation of property, plant and equipment and

amortization of prepaid lease payments 77,721 81,856

Amortization of intangible assets and share-based compensation 164,102 135,659

Loss/(gain) on disposal of property, plant and equipment 1,505 (191)

Loss on disposal of construction-in-progress 61,415

Loss/(gain) on disposal of intangible assets 1,113 (14)

Gain on disposal of subsidiaries and an associate (50) (13,015)

Dividend income (95) (93)

Gain on disposal of financial instruments (7,274) (326)

(Increase)/decrease in inventories (13,587) 75,185

Increase in trade receivables, notes receivable, deposits,

prepayments and other receivables (1,322,485) (1,238,985)

Increase in trade payables, notes payable, provisions,

accruals and other payables 2,724,863 1,761,769

Effect of foreign exchange rate changes (83,139) (96,388)

Net cash generated from operations 2,126,765 1,089,097