Lenovo 2012 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2012 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180

|

|

2011/12 Annual Report Lenovo Group Limited

136

NOTES TO THE FINANCIAL STATEMENTS

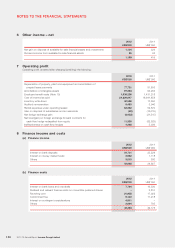

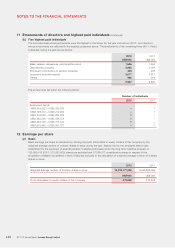

6 Other income – net

2012 2011

US$’000 US$’000

Net gain on disposal of available-for-sale financial assets and investments 1,104 326

Dividend income from available-for-sale financial assets 95 93

1,199 419

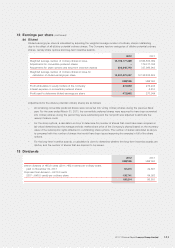

7 Operating profit

Operating profit is stated after charging/(crediting) the following:

2012 2011

US$’000 US$’000

Depreciation of property, plant and equipment and amortization of

prepaid lease payments 77,721 81,856

Amortization of intangible assets 97,684 94,284

Employee benefit costs (Note 10) 1,938,256 1,431,218

Cost of inventories sold 24,229,947 18,641,858

Inventory write-down 30,588 17,290

Auditor’s remuneration 5,483 3,940

Rental expenses under operating leases 63,252 52,670

Gain on disposal of subsidiaries and an associate (50) (13,015)

Net foreign exchange gain (4,653) (21,515)

Net loss/(gain) on foreign exchange forward contracts for

cash flow hedge reclassified from equity 11,338 (82,528)

Ineffectiveness on cash flow hedges 4,495 5,036

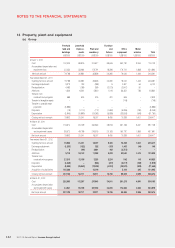

8 Finance income and costs

(a) Finance income

2012 2011

US$’000 US$’000

Interest on bank deposits 34,731 23,229

Interest on money market funds 2,952 1,118

Others 5,010 580

42,693 24,927

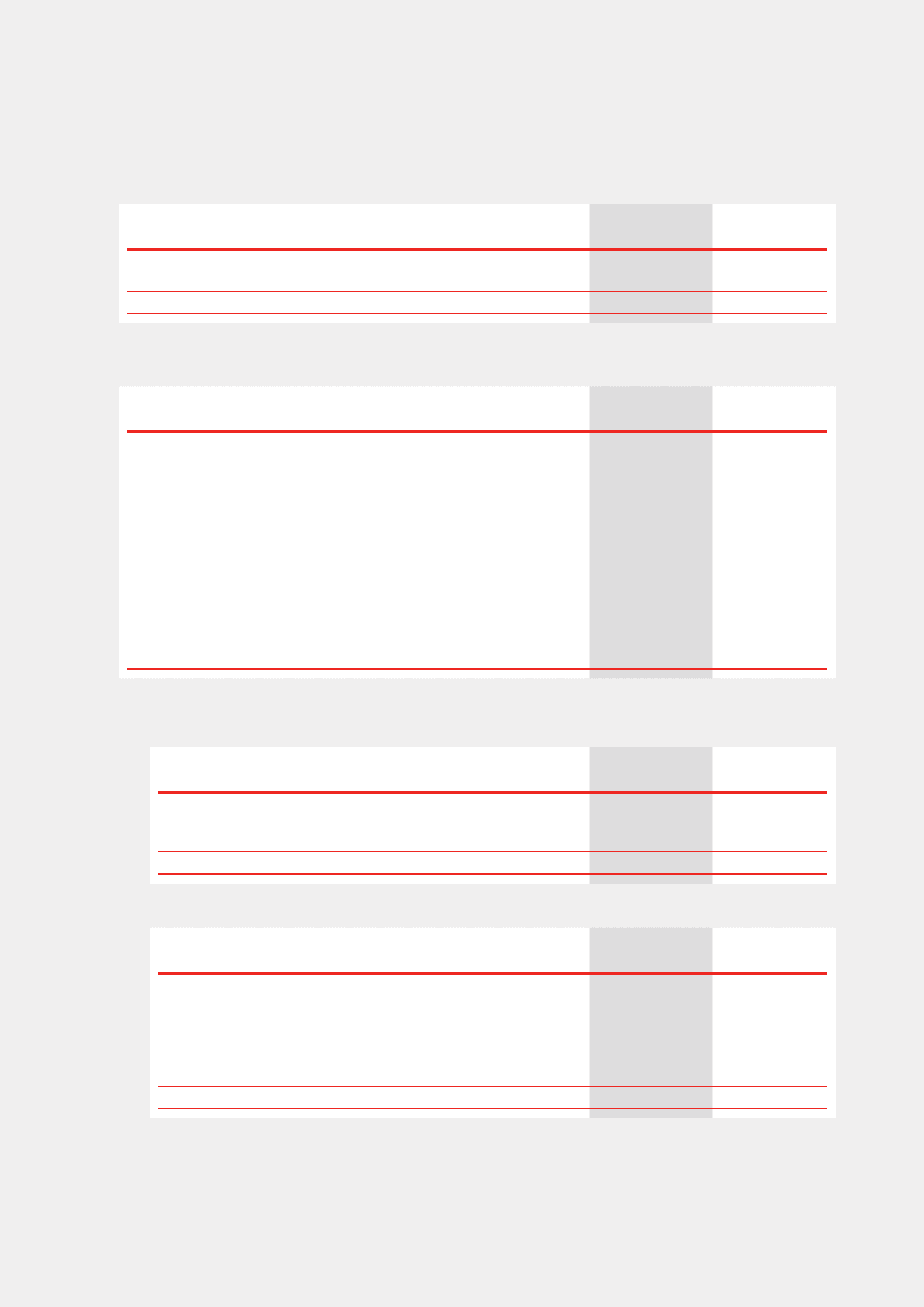

(b) Finance costs

2012 2011

US$’000 US$’000

Interest on bank loans and overdrafts 7,794 16,330

Dividend and relevant finance costs on convertible preferred shares –3,810

Factoring cost 21,955 17,022

Commitment fee 6,130 11,218

Interest on contingent considerations 4,911 –

Others 2,694 795

43,484 49,175