Lenovo 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011/12 Annual Report Lenovo Group Limited

110

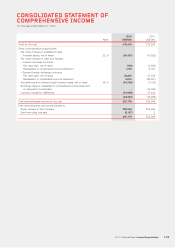

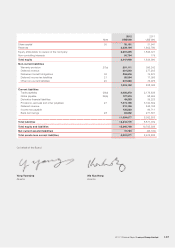

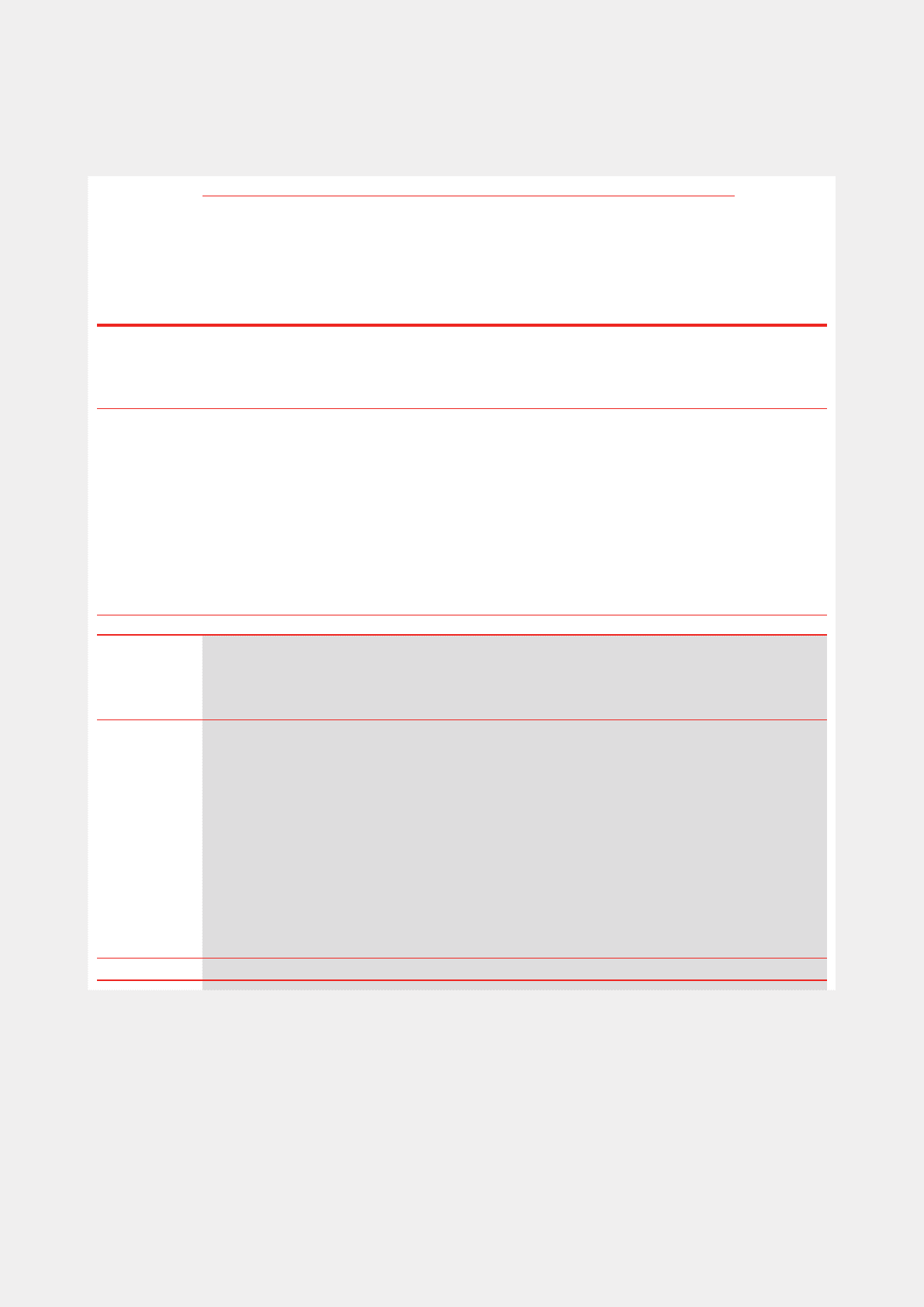

CONSOLIDATED STATEMENT OF CHANGES IN EqUITY

For the year ended March 31, 2012

Attributable to equity holders of the Company

Share

capital

Share

premium

Convertible

rights in

respect of

convertible

preferred

shares and

warrants

Investment

revaluation

reserve

Share

redemption

reserve

Employee

share

trusts

Share-based

compensation

reserve

Hedging

reserve

Exchange

reserve

Other

reserve

Retained

earnings

Non-

controlling

interests Total

US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000

At April 1, 2010 31,388 1,341,118 2,836 72,366 497 (111,054) 76,054 6,069 (35,969) 34,430 188,106 177 1,606,018

Profit for the year – – – – – – – – – – 273,234 2273,236

Other comprehensive

(loss)/income – – – (15,892) – – – (24,652) 34,446 –(7,190) –(13,288)

Total comprehensive

(loss)/income for the year – – – (15,892) – – – (24,652) 34,446 –266,044 2259,948

Transfer to statutory reserve – – – – – – – – – 23,806 (23,806) – –

Conversion of Series A

cumulative convertible

preferred shares 891 98,073 (2,836) – – – – – – – – – 96,128

Exercise of share options 168 24,948 – – – – – – – – – – 25,116

Repurchase of shares (506) (86,610) – – 506 – – – – – – – (86,610)

Vesting of shares under

long-term incentive program – – – – – 34,944 (54,149) – – – – – (19,205)

Share-based compensation – – – – – – 41,375 – – – – – 41,375

Dividends paid – – – – – – – – – – (87,870) –(87,870)

At March 31, 2011 31,941 1,377,529 –56,474 1,003 (76,110) 63,280 (18,583) (1,523) 58,236 342,474 179 1,834,900

At April 1, 2011 31,941 1,377,529 –56,474 1,003 (76,110) 63,280 (18,583) (1,523) 58,236 342,474 179 1,834,900

Profit for the year – – – – – – – – – – 472,992 2,424 475,416

Other comprehensive

(loss)/income – – – (36,337) – – – 33,890 (46,725) –(34,454) (4,611) (88,237)

Total comprehensive

(loss)/income for the year – – – (36,337) – – – 33,890 (46,725) –438,538 (2,187) 387,179

Consideration for acquisition

(Note 37(a)(i)) – – – – – – – – – 36,555 – – 36,555

Acquisition of subsidiaries – – – – – – – – – – – 88,742 88,742

Transfer to statutory reserve – – – – – – – – – 6,057 (6,057) – –

Issue of ordinary shares 1,088 196,206 – – – – – – – – – – 197,294

Exercise of share options 102 10,787 – – – – – – – – – – 10,889

Vesting of shares under

long-term incentive program – – – – – 48,252 (76,620) – – – – – (28,368)

Share-based compensation – – – – – – 66,418 – – – – – 66,418

Dividends paid – – – – – – – – – – (114,687) –(114,687)

Guaranteed dividend (Note 29) – – – – – – – – – – (30,953) –(30,953)

At March 31, 2012 33,131 1,584,522 –20,137 1,003 (27,858) 53,078 15,307 (48,248) 100,848 629,315 86,734 2,447,969