Lenovo 2012 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2012 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION & ANALYSIS

2011/12 Annual Report Lenovo Group Limited

16

During the fiscal year, Lenovo continued to outperform in

the market and further extended its leadership in China

through its solid strategic execution to protect mature

cities; and at the same time, attack emerging smaller cities

and rural areas where demand is stronger due to low PC

penetration. Lenovo’s unit shipments growth in China was

25 percent year-on-year for the fiscal year and market share

increased by 3.2 percentage point year-on-year to an all-

time high of 32.0 percent, according to industry estimates.

Leveraging its position as the country’s PC market leader

with a strong consumer presence, Lenovo continued to

expand its MIDH business in China by rolling out a wide

range of new smartphones and tablets products. Lenovo’s

smartphone market share in China reached 9.5 percent

in the fiscal quarter four and its tablet products had a

dominant position of about 50 percent of the Android

market in China. These new MIDH products achieved

a strong start, laying a solid foundation for the Group’s

initiatives to tap the growth opportunity in China’s mobile

internet arena.

Operating profit in China grew to US$552 million during the

fiscal year, and operating margin was up 0.1 percentage

point year-on-year to 4.5 percent, even as the Group

continued to invest in its mobile internet business during

the year. Operating margin for China PC business was 5.6

percent, up from 4.9 percent in the previous fiscal year.

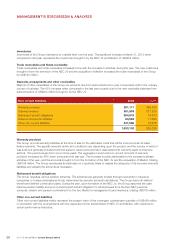

Emerging Markets (excluding China)

Emerging Markets (excluding China) accounted for 16

percent of the Group’s total revenue.

The Group’s strong growth momentum continued in

Emerging Markets (excluding China) during the fiscal year.

Lenovo successfully expanded its business scale in the

geography through continued improvement in distribution

channels, product portfolio, and investments in branding

and marketing. The Group’s unit shipments grew 38

percent year-on-year for the fiscal year, which was about

4 times the overall market growth of 10 percent. Lenovo’s

market share increased by 1.5 percentage point year-on-

year to record-high of 7.2 percent, according to industry

estimates. Strong unit shipments growth and share gains

were recorded across all key regions. The Group has

achieved milestone achievements in some key markets. In

India, Lenovo has become the number one PC vendor in

the fiscal quarter four with 10th straight quarters of faster

than market growth closing off the fiscal year 11/12 with a

market share of 13 percent. The Group has also become

the number three PC vendor in Russia in the fiscal quarter

four. The Group will continue to attack in markets with less

than 10 percent market share; once 10 percent market

share is hit in the markets, the Group will balance further

share growth with improved profitability; and if the Group

achieves market leadership, Lenovo will seek to maximize

profitability.

Operating loss in Emerging Markets (excluding China)

recorded US$94 million during the fiscal year, against an

operating loss of US$62 million recorded in the previous

fiscal year.

Mature Markets

Mature Markets accounted for 42 percent of the Group’s

total revenue.

The Group continued to record strong performance in

shipments and improved profitability in Mature Markets

during the fiscal year. The Group’s unit shipments in Mature

Market grew 53 percent, against overall market decline of

5 percent. According to preliminary industry estimates, its

market share reached a record high level of 8.7 percent

during the fiscal year, and record-high 10.1 percent market

share in the fiscal quarter four, the first time its mature

market share to reach double-digit level.

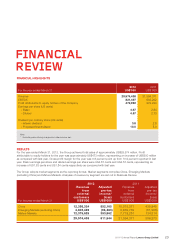

EM

Russia

MEA

LAS

India

HTK

EET

Brazil

ASEAN 7.4% (+0.8)

3.7%

6.8%

6.0%

7.4%

4.8%

9.6%

7.2%

13.0%

(+0.6)

(+0.8)

(+1.1)

(+2.2)

(+1.1)

(+1.4)

(+1.5)

(+3.8)

LENOVO SHARE GAINS IN

ALL EMERGING MARKET REGIONS IN FY12