Lenovo 2012 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2012 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011/12 Annual Report Lenovo Group Limited

148

NOTES TO THE FINANCIAL STATEMENTS

17 Intangible assets (continued)

(c) Impairment tests for goodwill and intangible assets with indefinite useful lives (continued)

The Group has performed a sensitivity analysis on key assumptions used for the annual impairment test for goodwill.

Except for JANZ in 2012 and REM in 2011, a reasonably possible change in key assumptions used in the impairment

test for goodwill would not cause any CGU’s carrying amount to exceed its respective recoverable amount. As at March

31, 2012, the recoverable amount for JANZ calculated based on value in use exceeded carrying value by US$149

million. Had JANZ’s forecasted operating margin been 0.65 percentage point lower than management’s estimates, the

JANZ’s remaining headroom would be removed.

As at March 31, 2011, the recoverable amount for REM calculated based on value in use exceeded carrying value

by US$375 million. Had REM’s forecasted operating margin been 1.5 percentage points lower than management’s

estimates, the REM’s remaining headroom would be removed.

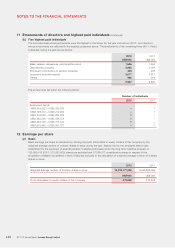

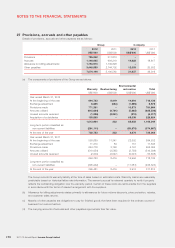

18 Subsidiaries

(a) Investments in subsidiaries

Company

2012 2011

US$’000 US$’000

Unlisted investments, at cost 2,472,880 1,929,073

A summary of the principal subsidiaries of the Company is set out in Note 38.

(b) Amounts due from/to subsidiaries

The amounts are interest-free, unsecured and have no fixed terms of repayment.

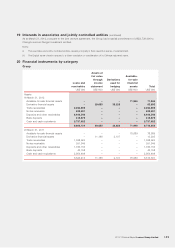

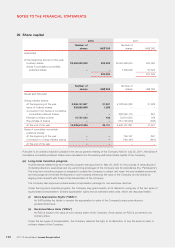

19 Interests in associates and jointly controlled entities

Group

2012 2011

US$’000 US$’000

Share of net assets

– Associates 677 914

– Jointly controlled entities 2,733 –

3,410 914

The following is a list of the principal associate and jointly controlled entities as at March 31, 2012:

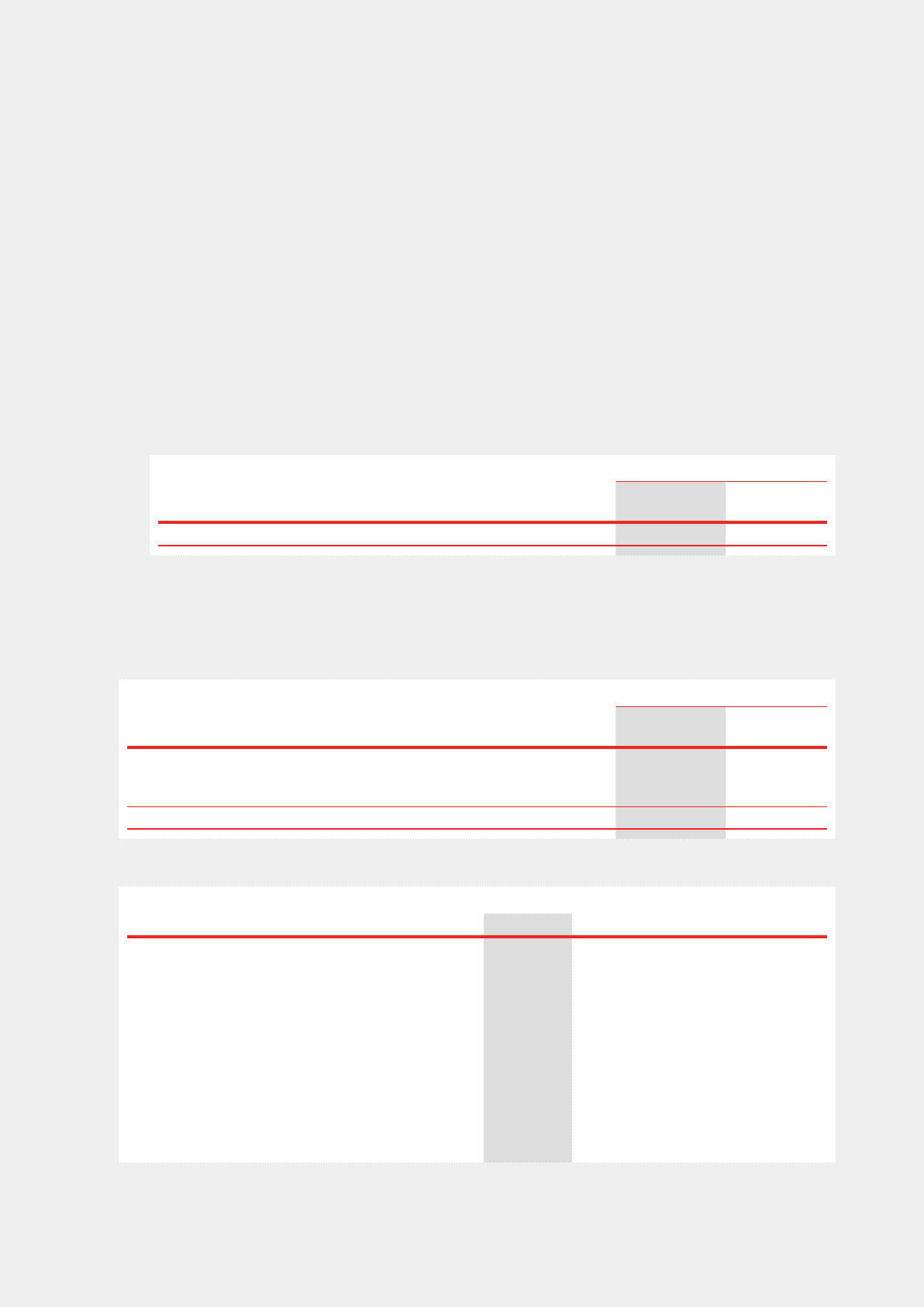

Company name

Place of

establishment

Interest held indirectly

Principal activities2012 2011

Associate

閃聯信息技術工程中心有限公司

(IGRS Engineering Lab Limited)

Chinese Mainland 23% 23% Distribution and development

of IT technology

Jointly controlled entities

成都聯創融錦投資有限責任公司 Chinese Mainland 49% –Property development

(Chengdu Lenovo Rongjin

Investment Limited)

上海視雲網絡科技有限公司

(Shanghai Shiyun Network

Technology Limited)

Chinese Mainland 49% –Distribution and development

of IT technology and

software