Lenovo 2012 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2012 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011/12 Annual Report Lenovo Group Limited

126

NOTES TO THE FINANCIAL STATEMENTS

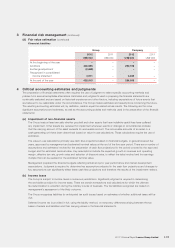

3 Financial risk management (continued)

(a) Financial risk factors (continued)

(ii) Cash flow interest rate risk

The Group’s substantial long-term borrowings are denominated in United States dollar. Borrowings denominated

in other currencies are insignificant. It is the Group’s policy to mitigate interest rate risk through the use of

appropriate interest rate hedging instruments. Generally, the Group manages its cash flow interest rate risk by

using floating-to-fixed interest rate swaps. Such interest rate swaps have the economic effect of converting

borrowings from floating rates to fixed rates. Under the interest rate swaps, the Group agrees with other parties to

exchange, at specified intervals (primarily quarterly), the difference between fixed contract rates and floating-rate

interest amounts calculated by reference to the agreed notional amounts.

The Group operates a global channel financing program. The Group is exposed to fluctuation of interest rates of all

the currencies covered by the global channel financing program.

(iii) Credit risk

Credit risk is managed on a group basis. Credit risk arises from cash and cash equivalents, derivative financial

instruments and deposits with banks and financial institutions, as well as credit exposures to customers, including

outstanding receivables and committed transactions.

For banks and other financial institutions, the Group controls its credit risk through monitoring their credit rating

and setting approved counterparty credit limits that are regularly reviewed.

The Group has no significant concentration of customer credit risk. The Group has a credit policy in place and

exposures to these credit risks are monitored on an ongoing basis.

No credit limits were exceeded by any customers during the reporting period, and management does not expect

any losses from non-performance by these counterparties.

(iv) Liquidity risk

Cash flow forecasting of the Group is performed by Group Treasury. It monitors rolling forecasts of the Group’s

liquidity requirements to ensure it has sufficient cash to meet operational needs while maintaining sufficient

headroom on its undrawn committed borrowing facilities (Note 28) at all times so that the Group does not breach

borrowing limits or covenants (where applicable) on any of its borrowing facilities. Such forecasting takes into

consideration the Group’s debt financing plans, covenant compliance, compliance with internal balance sheet ratio

targets and, if applicable external regulatory or legal requirements, for example, currency restrictions.

Surplus cash held by the operating entities over and above balances required for working capital management

are transferred to Group Treasury. Group Treasury invests surplus cash in interest bearing current accounts, time

deposits, money market deposits and marketable securities, choosing instruments with appropriate maturities or

sufficient liquidity to provide sufficient headroom as determined by the above-mentioned forecasts, At the balance

sheet date, the Group held money market funds of US$1,076,456,000 (2011: US$732,181,000) (Note 25).

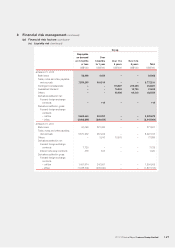

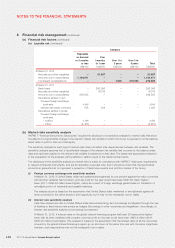

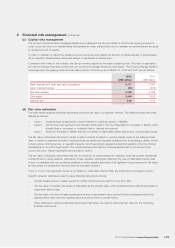

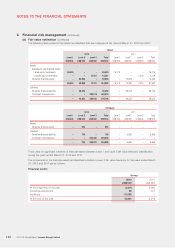

The tables below analyze the Group’s and the Company’s non-derivative financial liabilities and derivative financial

liabilities into relevant maturity groupings based on the remaining periods at the balance sheet date to the

contractual maturity dates. Derivative financial liabilities are included in the analysis if their contractual maturities

are essential for an understanding of the timing of the cash flows. The amounts disclosed in the tables are the

contractual undiscounted cash outflows/(inflows).