Lenovo 2012 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2012 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011/12 Annual Report Lenovo Group Limited 171

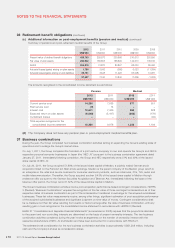

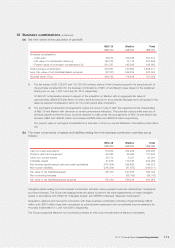

37 Business combinations (continued)

(a) Set forth below is the calculation of goodwill:

NEC JV Medion Total

US$’000 US$’000 US$’000

Purchase consideration:

– Cash paid 58,274 479,338 537,612

– Fair value of consideration shares (i) 160,730 73,119 233,849

– Present value of contingent considerations (ii) 251,557 185,393 436,950

Total purchase consideration 470,561 737,850 1,208,411

Less: Fair value of net (liabilities)/assets acquired (78,181) 559,234 481,053

Goodwill (Note 17(c)) 548,742 178,616 727,358

(i) The fair values of 281,129,381 and 115,120,635 ordinary shares of the Company issued/to be issued as part of

the purchase consideration for the business combinations of NEC JV and Medion were based on the published

share price on July 1, 2011 and July 29, 2011 respectively.

57,560,317 consideration shares in respect of the acquisition of Medion with an aggregate fair value of

approximately US$36,555,000 (Note 31) which serve as security for any potential damages are to be issued to the

seller as deferred consideration within an 18-month period after completion.

(ii) The contingent consideration arrangements require the Group to pay in cash the respective former shareholders

of NEC JV and Medion with reference to certain performance indicators. The potential undiscounted amounts of

all future payments that the Group could be required to make under the arrangements of NEC JV and Medion are

between US$0 and US$325 million and between EUR89 million and EUR372 million respectively.

The present value of contingent considerations is included in other non-current liabilities in the balance sheet (Note

29).

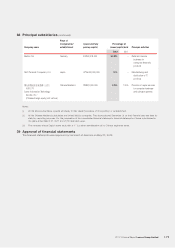

(b) The major components of assets and liabilities arising from the business combination activities are as

follows:

NEC JV Medion Total

US$’000 US$’000 US$’000

Cash and cash equivalents 110,832 254,464 365,296

Property, plant and equipment 65,480 55,925 121,405

Other non-current assets 35,174 5,327 40,501

Intangible assets 31,976 170,106 202,082

Net working capital except cash and cash equivalents (103,304) 249,826 146,522

Non-current liabilities (218,339) (87,672) (306,011)

Fair value of net (liabilities)/assets (78,181) 647,976 569,795

Non-controlling interests –(88,742) (88,742)

Fair value of net (liabilities)/assets acquired (78,181) 559,234 481,053

Intangible assets arising from the business combination activities mainly represent customer relationships, trademarks

and brand licenses. The Group has engaged external valuers to perform fair value assessments on these intangible

assetsinaccordancewithHKAS38“IntangibleAssets”andHKFRS3(Revised)“BusinessCombination”.

Acquisition-related costs incurred in connection with these business combination activities of approximately US$12

million and US$11 million have been recognized as administrative expenses in the consolidated income statement for

the years ended March 31, 2011 and 2012 respectively.

The Group recognizes Medion’s non-controlling interests at their proportionate share of Medion’s net assets.