Lenovo 2012 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2012 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011/12 Annual Report Lenovo Group Limited 147

17 Intangible assets (continued)

(c) Impairment tests for goodwill and intangible assets with indefinite useful lives

During the year, the Group underwent an organizational structure change under which Latin America previously a

reportablesegmentmergedwiththeRestofEmergingMarketssegment(“REM”),formingaCGU.Theintangibleassets

havebeenreallocatedtotheCGUaffectedusingarelativevalueapproachinaccordancewithHKAS36“Impairmentof

assets”.

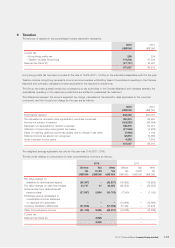

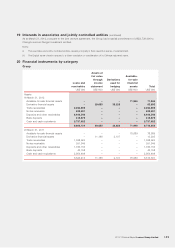

The carrying amounts of goodwill and trademarks and trade names with indefinite useful lives are presented below:

2012 2011

Goodwill

Trademarks and

trade names Goodwill

Trademarks and

trade names

US$ million US$ million US$ million US$ million

China 1,101 209 1,065 209

REM * 167 64 143 55

Latin America – – 24 9

North America 160 58 161 58

West Europe (ii) 242 110 84 35

Japan, Australia, New Zealand (i) 611 14 69 14

2,281 455 1,546 380

* Includes Africa, Asia Pacific, Central/Eastern Europe, Hong Kong, India, Korea, Middle East, Pakistan, Russia, Taiwan, Turkey and

Latin America (previously a stand-alone CGU).

(i) OnJuly1,2011,theGroupcompletedtheestablishmentofajointventurewithNECCorporation(“NEC”)undera

business combination agreement dated January 27, 2011 (Note 37). The corresponding goodwill is calculated at

US$549 million. The goodwill is attributable to the significant synergies expected to arise in connection with the

Group’s commitment to its core personal computer business and NEC’s market leadership in Japan. The entire

amount of goodwill has been allocated to the Japan, Australia, New Zealand market segment.

(ii) OnJuly29,2011,theGroupcompletedtheacquisitionofMedionAG(“Medion”)underabusinesscombination

agreement dated June 1, 2011 (Note 37). The goodwill arising from this acquisition is calculated at US$179

million. The goodwill is primarily attributable to the significant synergies expected to arise in connection with the

Group’s strategic objectives and the development of customer-focused products to capitalize on the entertainment

electronics and service business growth in Europe. The entire amount of goodwill has been allocated to the West

Europe market segment.

The Group completed its annual impairment test for goodwill allocated to the Group’s various CGUs by comparing their

recoverable amounts to their carrying amounts as at the reporting date. The recoverable amount of a CGU is determined

based on value in use. These assessments use pre-tax cash flow projections based on financial budgets approved by

management covering a 5-year period with a terminal value related to the future cash flow of the CGU beyond the five-

year period extrapolated using the estimated growth rates stated below. The estimated growth rates adopted do not

exceed the long-term average growth rates for the businesses in which the CGU operates.

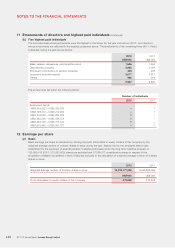

Future cash flows are discounted at the rate of 11% (2011: 11%) across all CGUs. The estimated growth rates used for

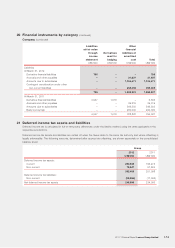

value-in-use calculations are as follows:

2012 2011

China 11.5% 21.3%

REM 7.3% 6.2%

Latin America N/A 5.0%

North America 1.0% (0.3%)

West Europe (1.9%) 5.4%

Japan, Australia, New Zealand 0.2% (4.0%)

Management determined budgeted gross margins based on past performance and its expectations for the market

development. The weighted average growth rates used are consistent with the forecasts included in industry reports.

The discount rates are pre-tax and reflect specific risks relating to the relevant segments.

The directors are of the view that there was no evidence of impairment of goodwill and trademarks and trade names as

at March 31, 2012 arising from the review (2011: Nil).