Lenovo 2012 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2012 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011/12 Annual Report Lenovo Group Limited 141

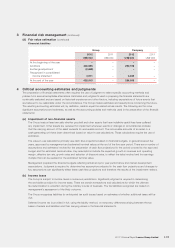

12 Earnings per share (continued)

(b) Diluted

Diluted earnings per share is calculated by adjusting the weighted average number of ordinary shares outstanding

due to the effect of all dilutive potential ordinary shares. The Company has two categories of dilutive potential ordinary

shares, namely share options and long-term incentive awards.

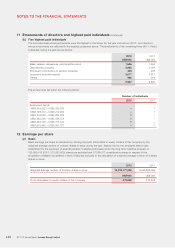

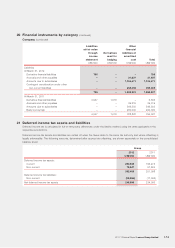

2012 2011

Weighted average number of ordinary shares in issue 10,133,177,289 9,634,806,069

Adjustments for convertible preferred shares –176,317,792

Adjustments for share options and long-term incentive awards 208,243,718 337,099,963

Weighted average number of ordinary shares in issue for

calculation of diluted earnings per share 10,341,421,007 10,148,223,824

US$’000 US$’000

Profit attributable to equity holders of the Company 472,992 273,234

Interest expense on convertible preferred shares –3,810

Profit used to determine diluted earnings per share 472,992 277,044

Adjustments for the dilutive potential ordinary shares are as follows:

– All remaining convertible preferred shares were converted into voting ordinary shares during the previous fiscal

year. For the year ended March 31, 2011, the convertible preferred shares were assumed to have been converted

into ordinary shares during the period they were outstanding and the net profit was adjusted to eliminate the

relevant finance costs.

– For the share options, a calculation is done to determine the number of shares that could have been acquired at

fair value (determined as the average periodic market share price of the Company’s shares) based on the monetary

value of the subscription rights attached to outstanding share options. The number of shares calculated as above

is compared with the number of shares that would have been issued assuming the exercise in full of the share

options.

– For the long-term incentive awards, a calculation is done to determine whether the long-term incentive awards are

dilutive, and the number of shares that are deemed to be issued.

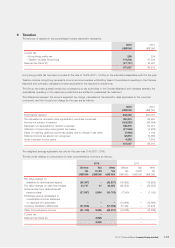

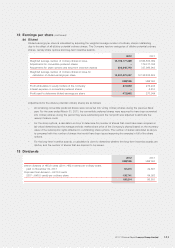

13 Dividends

2012 2011

US$’000 US$’000

Interim dividend of HK3.8 cents (2011: HK2.6 cents) per ordinary share,

paid on November 30, 2011 50,473 32,581

Proposed final dividend – HK10.0 cents

(2011: HK5.0 cents) per ordinary share 132,741 64,020

183,214 96,601