Lenovo 2012 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2012 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180

|

|

2011/12 Annual Report Lenovo Group Limited 151

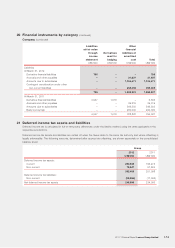

20 Financial instruments by category (continued)

Company (continued)

Liabilities

at fair value

through

income

statement

Derivatives

used for

hedging

Other

financial

liabilities at

amortized

cost Total

US$’000 US$’000 US$’000 US$’000

Liabilities

At March 31, 2012

Derivative financial liabilities 796 – – 796

Accruals and other payables – – 31,637 31,637

Amounts due to subsidiaries – – 1,104,471 1,104,471

Contingent consideration under other

non-current liabilities – – 256,093 256,093

796 –1,392,201 1,392,997

At March 31, 2011

Derivative financial liabilities 4,547 1,018 –5,565

Accruals and other payables – – 39,319 39,319

Amounts due to subsidiaries – – 549,503 549,503

Bank borrowings – – 200,000 200,000

4,547 1,018 788,822 794,387

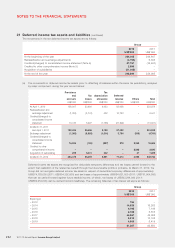

21 Deferred income tax assets and liabilities

Deferred income tax is calculated in full on temporary differences under the liability method using the rates applicable in the

respective jurisdictions.

Deferred income tax assets and liabilities are netted off when the taxes relate to the same tax authority and where offsetting is

legally enforceable. The following amounts, determined after appropriate offsetting, are shown separately on the consolidated

balance sheet:

Group

2012 2011

US$’000 US$’000

Deferred income tax assets:

Current 252,946 193,274

Non-current 79,547 57,824

332,493 251,098

Deferred income tax liabilities:

Non-current (83,594) (17,093)

Net deferred income tax assets 248,899 234,005