Lenovo 2012 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2012 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011/12 Annual Report Lenovo Group Limited 159

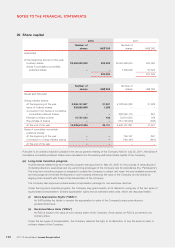

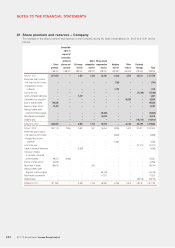

30 Share capital (continued)

(a) Long-term incentive program (continued)

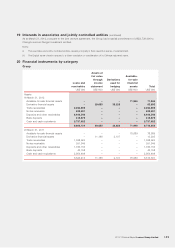

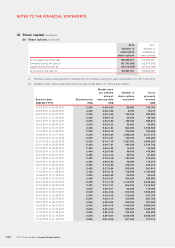

Movements in the number of units of award granted during the year and their related weighted average fair values are

as follows:

Number of units

SARs RSUs

Outstanding at April 1, 2010 337,853,379 224,709,428

Granted during the year 69,595,347 61,441,432

Vested during the year (133,727,293) (83,219,962)

Lapsed/cancelled during the year (9,828,947) (13,100,058)

Outstanding at March 31, 2011 263,892,486 189,830,840

Outstanding at April 1, 2011 263,892,486 189,830,840

Granted during the year 65,914,897 81,294,699

Vested during the year (119,792,862) (71,466,078)

Lapsed/cancelled during the year (37,920,363) (23,595,385)

Outstanding at March 31, 2012 172,094,158 176,064,076

Average fair value per unit (HK$)

– At March 31, 2011 1.53 3.47

– At March 31, 2012 3.49 4.89

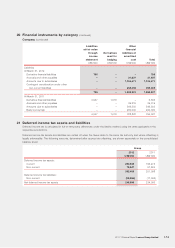

The fair values of the SARs awarded under the long-term incentive program were calculated by applying a Black-

Scholes pricing model. For the year ended March 31, 2012, the model inputs were the fair value (i.e. market value)

of the Company’s shares at the grant date, taking into account the expected volatility of 55.23 percent (2011: 64.39

percent), expected dividends during the vesting periods of 1.84 percent (2011: 1.58 percent), contractual life of 4.75

years (2011: 4.75 years), and a risk-free interest rate of 0.57 percent (2011: 1.45 percent).

The remaining vesting periods of the awards under the long-term incentive program as at March 31, 2012 ranged from

0.08 to 3.92 years (2011: 0.08 to 3.92 years).

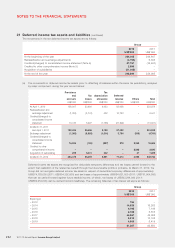

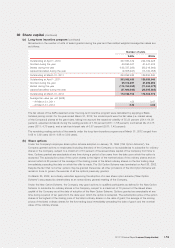

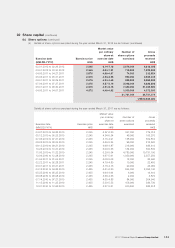

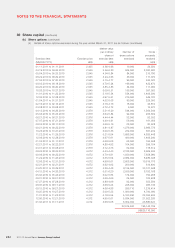

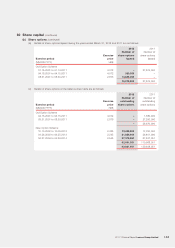

(b) Share options

UndertheCompany’semployeeshareoptionschemeadoptedonJanuary18,1994(“OldOptionScheme”),the

Company granted options to employees (including directors) of the Company or its subsidiaries to subscribe for ordinary

shares in the Company, subject to a maximum of 10 percent of the issued share capital of the Company from time to

time. Options granted are exercisable at any time during a period of ten years from the date upon which the option is

accepted. The subscription price of the option shares is the higher of the nominal value of the ordinary shares and an

amount which is 80 percent of the average of the closing prices of the listed ordinary shares on the five trading days

immediately preceding the date on which the offer is made. The Old Option Scheme was terminated on April 26, 2002.

Despite the fact that no further options may be granted thereunder, all other provisions of the Old Option Scheme will

remain in force to govern the exercise of all the options previously granted.

OnMarch25,2002,anordinaryresolutionapprovingtheadoptionofanewshareoptionscheme(“NewOption

Scheme”)waspassedbyshareholdersatanextraordinarygeneralmeetingoftheCompany.

Under the New Option Scheme, the Company may grant options to qualified participants as defined in the New Option

Scheme to subscribe for ordinary shares in the Company, subject to a maximum of 10 percent of the issued share

capital of the Company as at the date of adoption of the New Option Scheme. Options granted are exercisable at any

time during a period of ten years from the date upon which the option is accepted. The subscription price of the option

shares is the highest of the closing price of the listed ordinary shares on the date of grant; the average of the closing

prices of the listed ordinary shares for the five trading days immediately preceding the date of grant; and the nominal

value of the ordinary shares.