Lenovo 2012 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2012 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011/12 Annual Report Lenovo Group Limited 157

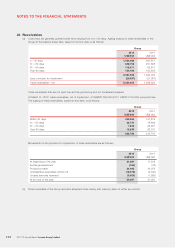

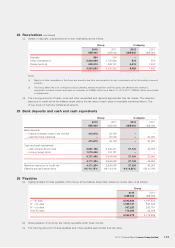

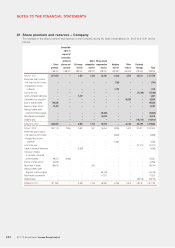

28 Bank borrowings

Group Company

2012 2011 2012 2011

US$’000 US$’000 US$’000 US$’000

Term loans (i) –200,000 –200,000

Short-term loans (ii) 62,952 71,561 ––

62,952 271,561 –200,000

Notes:

(i) Term loans have been settled in March 2012.

(ii) Majority of the short-term loans are denominated in United States dollar.

The exposure of all the bank borrowings of the Group and the Company to interest rate changes and the contractual repricing

dates at the end of the reporting period are within one year.

The carrying amounts of bank borrowings approximate their fair value as the impact of discounting is not significant.

Total bank facilities of the Group are as follows:

Total facilities Utilized amounts

2012 2011 2012 2011

US$’000 US$’000 US$’000 US$’000

Revolving loans 800,000 800,000 ––

Term loans –300,000 –200,000

Short-term loans 521,000 475,000 62,952 71,561

Foreign exchange contracts 5,759,000 4,764,000 4,720,000 3,190,000

Other trade finance facilities 362,000 331,000 220,000 201,000

7,442,000 6,670,000 5,002,952 3,662,561

All the bank borrowings are unsecured and the effective annual interest rates at March 31, 2012 are as follows:

United States dollar Other currencies

2012 2011 2012 2011

Term loans –3.5% ––

Short-term loans 3.5%-5.45% 1.5%-2.4% 5% 1.5%-14.1%

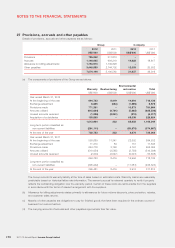

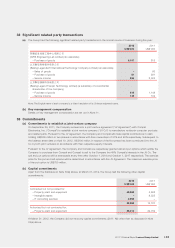

29 Other non-current liabilities

Group Company

2012 2011 2012 2011

US$’000 US$’000 US$’000 US$’000

Contingent considerations (Note 37) 428,915 –256,093 –

Guaranteed dividend to non-controlling

shareholders of Medion (Note) 31,015 –––

Environmental restoration (Note 27) 83,876 11,081 ––

Others 98,180 62,895 725 –

641,986 73,976 256,818 –

Note:

FollowingtheacquisitionofMediononJuly29,2011asdisclosedinNote37,LenovoGermanyHoldingGmbH(“LenovoGermany”),anindirect

wholly-owned subsidiary of the Company and the immediate holding company of Medion entered into a domination and profit and loss transfer

agreement(the“DominationAgreement”)withMediononOctober25,2011.PursuanttotheDominationAgreement,LenovoGermanyhas

guaranteed to the non-controlling shareholders of Medion an annual guaranteed pre-tax dividend for each fiscal year amounting to EUR0.82 per

share. The Domination Agreement became effective on January 3, 2012 and is terminable by either Lenovo Germany or Medion after March 31,

2017. Accordingly, a non-current liability in respect of future guaranteed dividend has been recognized. The corresponding amount stated at its

discounted value on the date of acquisition of Medion was charged to retained earnings in equity.